California has a large solar market, and the US states plan to convert to 100% clean energy by 2045. Thanks to California's sunny climate, many residents are investing in solar panels with a battery storage pack to reduce their monthly electricity bills and carbon emissions. If you are planning to go solar in California, there are many solar incentives available to lower the upfront cost of installation. For more savings, you can combine the California solar incentives with the 30% federal tax credit.

Jackery Solar Generators are available in many sizes and capacities to charge most household appliances for long hours. When you purchase the large Jackery Solar Generator 3000 Pro or Jackery Solar Generator 2000 Plus Kit (4kWh), you are entitled to receive a tax rebate of nearly $839.7 - $1,139.7. In this ultimate guide, we will reveal different California solar incentives and how you can apply for these plans to reduce the solar panel installation cost.

California Solar Incentives in 2024

California residents can save thousands of dollars in their lifetime with a solar system. However, the high upfront cost can be a challenge for many. For this reason, California offers many solar incentives to reduce the initial investment costs.

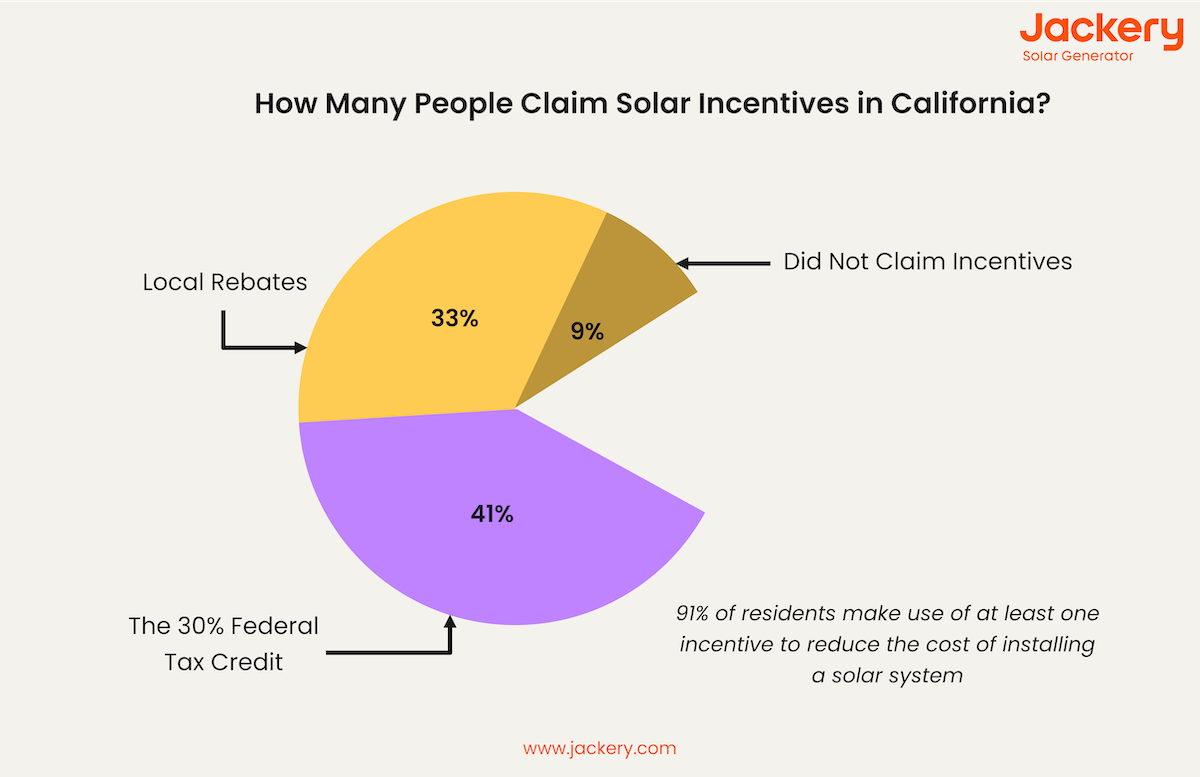

Around 91% of residents have used at least one incentive to reduce the off-grid solar system cost. Of the total number of people who applied for solar incentives, 41% claimed the 30% federal tax credit, 33% claimed local rebates, and 9% did not claim their incentives. Federal tax credits are one of the popular choices, followed by local rebates.

Here is a table comparing different solar incentives in California, including their definitions, eligibility, and savings.

|

California Solar Incentives |

What Is It? |

Who Can Claim? |

When Can I Get It? |

How Much Can It Save? |

|

Federal Solar Tax Credit (ITC) |

It lowers the cost of solar panel systems by 30%. |

Low-income residents in California. |

One-time : Once you qualify for the rebate, you will receive money. |

$4367, though it might vary. |

|

Self-Generation Incentive Program (SGIP) |

It offers up to $200 - $1000 per kWh for solar panels with battery storage. |

All customers of investor-owned utilities. |

One-time : Residents who install solar panels with a battery storage system. |

$200 per kWh generated by the solar panel system. |

|

Solar Energy System Property Tax Exclusion |

It is a property tax exclusion on the added home value due to rooftop solar systems. |

California residents. |

Annually : No increased taxes because of solar panel installation. |

Varies depending on the home size and cost of solar panel installation. |

|

Property Assessed Clean Energy (PACE) Program |

It allows you to finance the solar system typically with no money upfront and usually includes a low-interest rate. |

Homeowners in California. |

One-time Loan : The financing for solar panels is paid through property taxes. |

Varies depending on the loan. |

|

Inflation Reduction Act (IRA) |

All qualified residents can earn up to 30% against the cost of the solar panel system. |

Qualified residents in California. |

Varies depending on the solar panel size. |

30% of the cost of the solar panel system. |

|

Single-Family Affordable Solar Housing (SASH) Program |

It provides $3 per watt for systems up to 5 kW to low-income households and disadvantaged communities. |

Single families residing in California. |

One-time : You will get $3 per watt after qualifying. |

Nearly $15,000 |

|

Local Incentives |

Depending on the utility company, the additional rebates may lower the cost of the system. |

Varies depending on the local incentive type. |

It varies by program. |

Nearly $500, though it will depend on the program type. |

|

Net Metering |

It allows you to earn energy credits when you exchange energy. |

All customers of investor-owned utilities, such as PG&E, SoCal Ed, and SDG&E. |

Ongoing : You receive credits as you supply electricity back to the grid. |

Varies depending on the credit rate, system size, and energy needs. |

Federal Solar Tax Credit (ITC)

California residents can earn 30% of the total installation cost with the Federal Solar Tax Credit. You must legally own the solar panel system to qualify for the tax rebate. For example, if you are spending $10,000 on a solar panel system, you would earn an ITC of $3000.

However, the 30% solar tax credit will last through 2032 under the current law. From 2033, the tax credit will drop to 26% and then to 22% in 2034. Unless the federal government renews, the solar tax credit will end by 2035. In order to apply, consider downloading and filling out IRS Form 5695 for residential energy credits.

Self-Generation Incentive Program (SGIP)

The Self-Generation Incentive Program (SGIP) offered by the California Public Utilities Commission provides many rebates to residents for investing in solar panels and battery storage systems. You are entitled to receive anywhere between $150 - $1000 per kWh of battery storage system installed. However, the rebate amount will depend on the local utility company and battery storage capacity. There are mainly two incentive tiers :

Small Residential Storage : Homeowners installing battery storage systems smaller than 10 kW on their property are eligible to earn $150 - $2000 per kWh of battery storage.

Residential Storage Equity : SGIP also has an equity budget, where money is set aside for solar batteries installed in low-income or disadvantaged areas. The rebate offered is $850 per kWh for the installed system.

You need to contact the Program Administration for your utility to apply for incentives in your area.

Solar Energy System Property Tax Exclusion

California has a property tax exclusion for solar panel systems installed before 2025. The exclusion applies to solar panels, lithium-ion batteries, and many solar heating systems. Solar incentives are available to homeowners or builders intending to sell the property and homeowners living on their property. It is automatically applied when you get a building permit.

If you own a $7,00,000 home in California and the rate is 0.7%, you would pay $4900 in property taxes per year. If you install a solar panel and battery storage for $30,000, the property taxes and assessed home value would stay the same. If there is no tax exclusion, a $30,000 home value increase would generally represent a $210 property tax increase.

Property Assessed Clean Energy (PACE) Program

California is one of the states that offers Property-Assessed Clean Energy (PACE) financing programs to homeowners. You can install a solar panel system, and the financing program will pay you for it over 10 to 20 years.

Most of these programs include low interest since the debt is tied to the property and not you. With PACE financing, you make payments in addition to the property tax bill. If you sell your home before paying back the loan, it automatically transfers to the new homeowners.

Inflation Reduction Act (IRA)

The Inflation Reduction Act (IRA) allows qualified homeowners with home solar systems to receive a tax credit of up to 30% against the cost of the complete systems. To claim IRA rebates, you can complete IRS Form 5695 and include it with your tax return for the year you installed your solar system.

Single-Family Affordable Solar Housing (SASH) Program

The DAC-SASH program offers solar incentives for low-income households in disadvantaged communities. It typically provides $8.5 million in incentives daily to California households. The average cost of installing a solar system in California is $2.51 per watt, and the program offers an incentive of nearly $3 per watt. In other words, the DAC-SASH incentive covers the total cost of the solar panel system. The DAC-SASH program is managed by the GRID Alternatives in California and will remain available till 2030.

California Local Incentives

The cities, municipalities, and towns in California also offer many solar incentives to residents who invest in solar energy projects. Let's explain some of the California local incentives :

CleanPowerSF Solar Inverter Replacement Program : The CleanPowerSF and San Francisco Public Utilities Commission run this program to help residents replace their old, damaged solar incentives. The program is available only to existing GoSolarSF customers with solar installations that are 10 years old. You can receive nearly $3000 to cover the replacement cost.

Lancaster Energy Power Choice : California homeowners who are customers of Lancaster Energy can take advantage of this program. Californians who cannot afford solar panels or do not want to pay an upfront installation cost can get them installed for free by Tesla with the Power Choice program. Tesla will install the Tesla Powerwall Battery and rooftop panels for free, and customers will pay for energy usage and storage with their electric bills.

San Diego Green Building Incentive Program : If you install residential solar panels in the city of San Diego, the program will waive the building permit and plan check fees. This will help residents reduce their average electric bill and switch to clean energy.

Silicon Valley Power Low Income Solar Grant Program : The publicly owned Silicon Valley Power serves Santa Clara and provides grants for solar panels. Customers enrolled in the Financial Rate Assistance Program can earn $3.50 per watt for solar systems up to 3 kW.

SoCalGas Solar Thermal Water Heating System Rebate : SoCalGas customers in southern and central California can earn a rebate of $2500 - $4000 on qualifying solar water heaters. The program can be availed of when installing an Energy Star-certified water heater and solar system. However, the solar system must have a Solar Uniform Energy Factor of 1.8 or higher.

If you want to claim local incentives, your solar installer must apply for local, federal, and statewide renewable energy incentives. You can also check local utility and government websites to see additional solar incentives in your city or county.

California Net Metering

Net metering, or net energy metering (NEM), is one of the most important incentives in the US. The California government enacted NEM 3.0 on April 14, 2024. You can sell excess solar energy to local electric companies in return for electricity bills. However, the export tariffs with NEM 3.0 you receive for the surplus solar energy are lower than the electricity prices you usually pay.

As a quick example, let's compare net metering vs solar batteries. Let's consider a residential home solar panel system that generates 10,000 kWh of energy every year. We assume that your household appliances use 5000 kWh of energy, and the remaining 5000 kWh is sent to the local utility grid.

The average electric rate in California is 29.99 cents per kWh. Since the tariffs of NEM 3.0 are around 75% less than the retail prices, we assume the solar export price is 7.50 cents per kWh. In this case, you would save nearly $1500 in electricity bills per year by using 5000 kWh to charge household appliances. On the other hand, you would get $375 for exporting the remaining 5000 kWh.

If you have a battery bank or power station, you can store excess solar energy and save money on electricity bills. If you want to enroll in net metering, your solar installer must submit an interconnection application to the utility company. Once you receive approval, the installer will connect the solar system to the grid, and you can start earning from net metering.

Are There Solar Incentive Scams in California?

The popularity of solar panels in California is increasing — and so are the solar incentive scams. Here, we will include some solar incentive scams in California :

Posing as a Utility Representative or Government

In California, many people receive fake phone calls offering a free energy audit of their homes. After the sales team completes the audit, they try to sell you solar panels under the guise that the state mandates them. It's best to do some research to ensure the company is trustworthy and legitimate.

Offering Unrealistically Low Prices

There are some solar companies that try to hook you with incredibly low prices that seem too good to be true. In order to avoid getting caught in the sales trap, you must research the average solar panel installation cost in the city.

Promoting the Leasing of Panels

Some leasing company owners suggest homeowners lease solar panels instead of buying them. This is because most California solar incentives require residents to own solar panels. If you buy solar panels, you get long-term benefits, including a reduction in the average kWh cost per hour.

High-Pressure Sales Tactics

Sometimes, solar companies use high-pressure sales tactics to get you to make a snap decision. A contractor who asks you to make an instant upfront payment is most likely a scam. A legitimate solar contractor will give you time to think and understand what you are buying.

No Delivery

Sometimes, scammers promise everything and deliver little to nothing in results. They will seem like good people willing to improve your life. But, in reality, they are scammers who will not show up during the installation time.

Promising Huge Government Tax Credits

The scammers promise huge federal tax credits if you purchase a solar panel system for your home. While there are many federal tax credits available, they are not huge amounts like the company promises.

Not Having a Signed Contract

A legitimate solar company will offer a free estimate of what you should expect to pay after the solar installation is completed. There are some shady companies that will want you to start work before all the contracts are signed. If this happens, you will probably end up paying more than the original estimate.

Is Solar Worth It in California?

California has year-round sunshine, which makes solar panel installation worthy of investment. Solar incentives and programs encourage the adoption of clean energy among homeowners. There are many benefits of going solar in California, including :

High Power Bill Savings : The average electricity bills in California are typically high. Though you will have to pay a high upfront cost for installing solar panels, they can help you reduce monthly bills.

Local Incentives for Energy Storage : Pairing solar panels and home batteries to create a reliable power supply. California offers many local solar incentives for battery systems with its programs, like the Self-Generation Incentive Program (SGIP).

Security from Power Outages : California residents often have to deal with blackouts and power outages. Wildfires are common in California and are responsible for knocking down the power lines and causing outages. A solar panel and battery backup can keep household appliances in use during emergencies.

The average cost of installing solar panels in California is $12,550 for an average-sized 5 kilowatt (kW) system or $2.51 per watt.

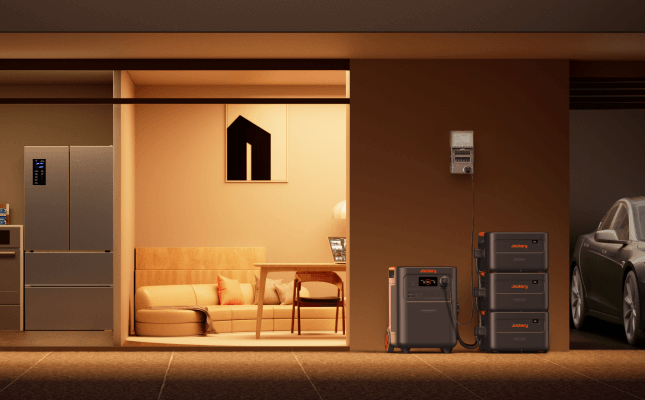

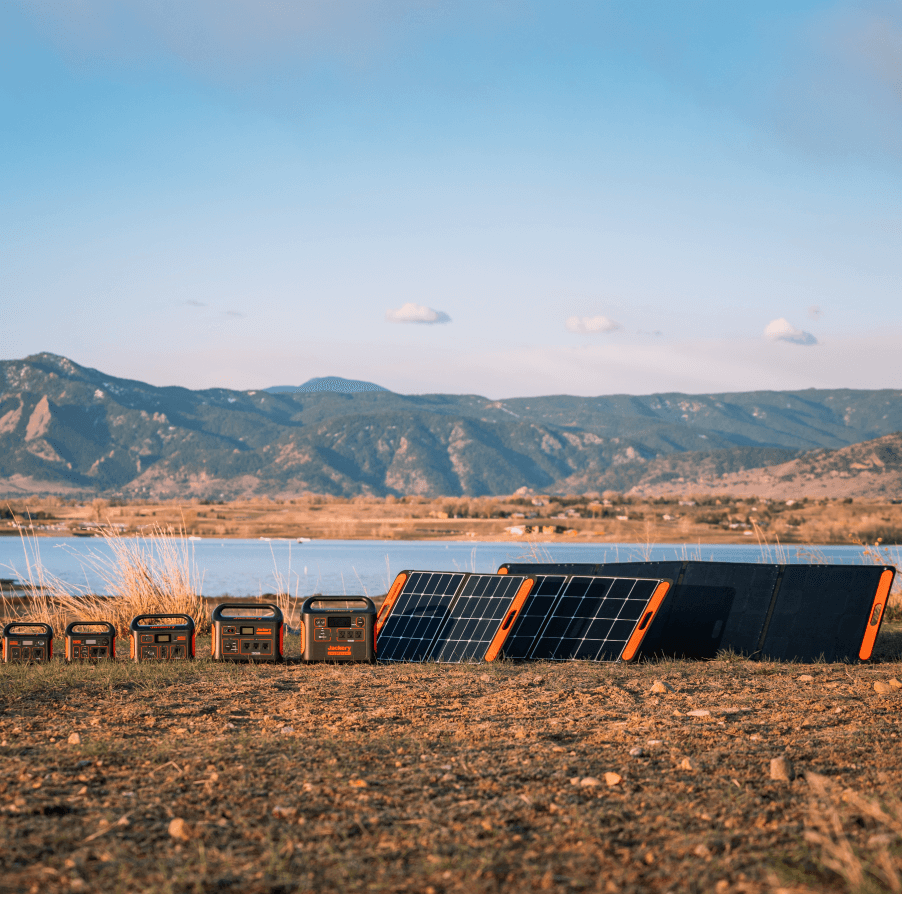

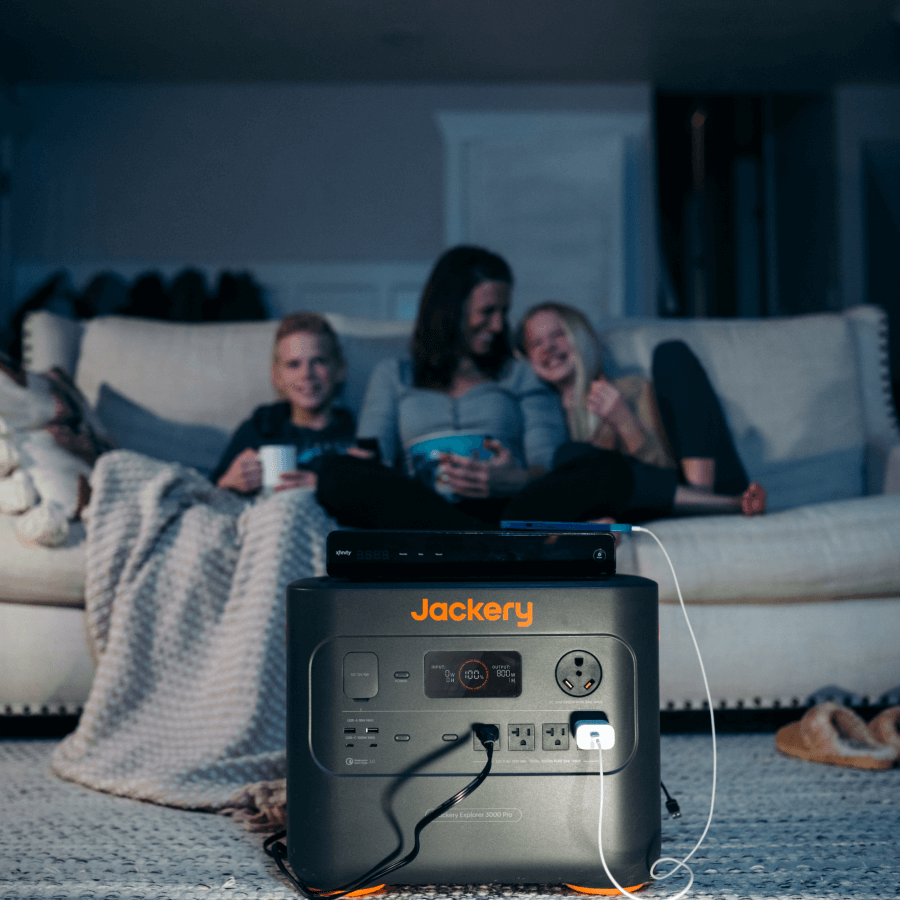

Jackery Solar Generators in Tax Rebates

Jackery is a well-known brand that manufactures solar panels, battery backups, and solar generators. The Jackery Solar Generators combine battery backups called Jackery Explorer Portable Power Stations, which can be recharged with the Jackery SolarSaga Solar Panels. You can then plug household appliances into the power station to charge them.

If you invest in the Jackery Solar Generators, you can claim a tax rebate through a federal solar tax credit (ITC) or an annual residential clean energy tax credit. All you need to do is fill out Form 5695 to earn tax rebates of around $839.7 - $1139.7 to reduce the upfront cost of investing in a solar system. Here are the popular solar generator options offered by Jackery, which can charge most household appliances for hours.

Jackery Solar Generator 3000 Pro

The large Jackery Solar Generator 3000 Pro has an NMC battery that can charge 99% of household appliances, such as air conditioners, space heaters, LED lights, etc. You'll receive nearly $839.7 in tax rebates, though it will depend on how much you qualify. The Jackery Explorer 3000 Pro Portable Power Station can be plugged into 6*Jackery SolarSaga 200W Solar Panels to charge the battery backup in only 3.5 hours.

Customer Review

"Works great so far with home charge and solar charge. Will be hooking it up to my pop-up camper next week. Great size, quiet and good app so far." — James Matthews.

Jackery Solar Generator 2000 Plus Kit (4kWh)

The Jackery Solar Generator 2000 Plus Kit (4kWh) comes with three components, including 1*Jackery Explorer 2000 Plus Portable Power Station, 1*Jackery Battery Pack 2000 Plus, and 2*Jackery SolarSaga 200W Solar Panels. The solar generator supports 99% of household appliances for long hours to reduce the monthly electricity bills. The Jackery Explorer 2000 Plus Portable Power Station can be recharged in 2 hours using 6*Jackery SolarSaga 200W Solar Panels.

Customer Review

"After a boatload of research, I recently purchased the Jackery 2000 Plus system, with two 200-watt solar arrays. I'll be using this unit both in our 22' RV (30 amp) and when living off the grid in our larger 5th wheel in the summer months." — Randall MacPherson.

|

|

Solar Generator 3000 Pro |

Solar Generator 2000 Plus Kit (4kWh) |

|

Capacity |

3024 Wh |

2-24 kWh |

|

Battery Cell |

NMC |

LiFePO4 |

|

Cycle Life |

2000 cycles to 70%+ capacity |

4000 cycles to 70%+ capacity |

|

Recharging Methods |

Solar Recharging: 3.5 H (6*Jackery SolarSaga 200W Solar Panels) Car Recharging: 35 H Wall Recharging: 2.4 H |

Solar Recharging: 2 H (6*Jackery SolarSaga 200W Solar Panels) Car Recharging: 25 H Wall Recharging: 2 H |

|

Output Ports |

AC Output (x1): 120 V~ 60 Hz 25 A Max AC Output (x3): 120 V~ 60 Hz 20 A Maximum USB-C Output (x2): 100 W Maximum, 5 V⎓3 A, 9 V⎓3 A, 12 V⎓3 A, 15 V⎓3 A, 20 V⎓5 A |

AC Output (×4) 120 V~ 60 Hz, 20 A Maximum AC Output (×1) 120 V~ 60 Hz, 25 A Maximum USB-A Output (x2): Quick Charge 3.0, 18 W Maximum USB-C Output (x2): 100 W Maximum, (5 V, 9 V, 12 V, 15 V, 20 V up to 5 A) |

|

Working Hours |

Air Fryer (1000 W): 2.5 H Portable Air Conditioner (1000 W): 2.5 H Dishwasher (1050 W): 2.4 H Kettle (850 W): 3 H Electric Oven (800 W): 3.2 H |

Air Fryer (1000 W): 3.4 H Portable Air Conditioner (1000 W): 3.4 H Dishwasher (1050 W): 3.3 H Kettle (850 W): 4 H Electric Oven (800 W): 4.3 H |

|

How Much It Can Save with Tax Rebates |

$839.7 (Though this is an estimated value) |

$1139.7 (Though this is an estimated value) |

California Solar Incentives FAQs

Does California offer any incentives for solar?

Yes, California offers many incentives to reduce the overall costs of going solar, including rebates on purchasing solar batteries, property tax exclusion, and net metering.

Will California really pay for solar panels?

Yes, solar incentives like the California Public Utilities Commission's Self-Generation Incentive Program (SGIP) make installing solar panels quite affordable. The rebate amount will depend on the local utility company and battery storage capacity.

Does California have a solar property tax exemption?

According to Section 73 of the state revenue and taxation code, eligible residents get a property tax exclusion for new solar installations. Your property taxes will not rise if you install a solar system on the property. Though the tax exclusion was about to expire in 2016, it is now extended till January 2025.

What is the average cost to install solar panels in California?

The average cost to install a solar panel system in California is nearly $2.51 per watt or $12,550 for a 5 kW panel system. This is typically less than the national average of $2.85 per watt or $17,100.

How long does it take for solar panels to pay for themselves in California?

On average, solar panels in California pay for themselves in 6.4 years. However, many factors can influence the total cost, such as the amount of sunlight received, electricity costs, tax breaks received, and more.

Final Thoughts

Installing a solar panel system can be pretty expensive. However, there are many California solar incentives and rebates to reduce the overall cost of the installation. If you want to go solar, it's time to act! The Jackery Solar Generators are reliable and efficient solutions that charge 99% of household appliances for long hours. For example, investing in the Jackery Solar Generator 2000 Plus Kit (4kWh) allows you to receive $1139.7 in tax rebates. This helps you reduce the initial investment cost and switch to clean energy.

Resources

- DAC-SASH | GRID Alternatives

- Attachment 2: SGIP Equity Resiliency Eligibility Matrix - Residential Customers

- Participating in the Self-Generation Incentive Program (SGIP)

- DSIRE

- Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics | Department of Energy

- Net Metering | SEIA

- California State Board of Equalization

- Net-Energy Metering 3.0(NEM 3.0)

![[Add - on] Jackery Manual Transfer Switch for Explorer 5000 Plus - Jackery](http://www.jackery.com/cdn/shop/files/add-on-jackery-manual-transfer-switch-for-explorer-5000-plus-9017324.png?v=1754016782&width=170)

![Guide To California Solar Incentives, Rebates, & Tax Credits [2024]](http://www.jackery.com/cdn/shop/articles/guide-to-california-solar-incentives-rebates-tax-credits-2024-2991899.jpg?v=1754018059)

Leave a comment