While upgrading your air conditioners can maximize indoor comfort, it can strain many families’ finances. However, the Inflation Reduction Act of 2022 and Energy-Efficient Air Conditioner Tax Credits can save 30% of the investment, up to $600. The credits apply to Energy Star-rated central air conditioners with SEER2 ≥ 17.0 and EER2 ≥ 12.0 if split-type and SEER2 ≥ 16.0 and EER2 ≥ 11.5 if single-packaged.

Investing in energy-efficient air conditioners consumes less energy and helps save on your electric bills. If you want to save more, invest in alternative energy sources like solar generators. Jackery Solar Generators can be an essential home backup solution to power your air conditioners during power outages or peak hours. Also, some Jackery Solar Generator models are eligible for tax credits of up to $1,500.

Key Takeaways

- Split air conditioners that meet SEER2 ≥ 17.0 and EER2 ≥ 12.0 and single-packaged air conditioners that meet SEER2 ≥ 16.0 and EER2 ≥ 11.5 ratings are eligible for the Central Air Conditioners Tax Credit.

- Central Energy Star-rated air conditioners with SEER ratings within the set level can obtain tax rebates.

- Other than rebates, installing energy-efficient air conditioners with solar generators can help save a chunk on electric bills.

Who Can Claim the Air Conditioner Tax Credit?

As per Energy Star, people installing split central air conditioners with SEER2 ≥ 17.0 and EER2 ≥ 12.0 rating can claim the Central Air Conditioners Tax Credit. Meanwhile, packaged central air conditioners must have a SEER2 ≥ 16.0 and EER2 ≥ 11.5 rating to be eligible.

The tax credit applies to products purchased between January 1, 2023, and December 31, 2032. Also, the rebates apply to improvements made by homeowners to their primary homes in the United States. The maximum amount one can claim is 30% of the cost or $600, whichever is less. You can fill out IRS Form 5695 to claim the credits.

Which Air Conditioners Qualify for the 2025 Energy Tax Credit?

As of January 1, 2025, central air conditioners qualify for the Energy Efficient Home Improvement Credit under the Inflation Reduction Act. However, check the eligibility criteria on the IRS website for a detailed overview.

Do Window AC Units and Portable ACs Qualify for Tax Credit?

No, window AC units and portable ACs do not qualify for the Energy-Efficient Air Conditioner Tax Credits. The program focuses on energy-efficient cooling appliances like split or packaged central AC units.

Do ENERGY STAR Air Conditioners Qualify for the Tax Credit?

Yes, Energy Star-certified Air Conditioners with a SEER (Seasonal Energy Efficiency Ratio) rating within the stated range qualify for the tax credit.

Check the system's SEER rating to determine your eligibility. It’s typically imprinted on a yellow and black energy guide sticker on your system, located on the side of the condenser. You can also use Energy Star’s product finder to check if your system qualifies.

AC Type vs SEER2 Requirement vs Eligibility

As per Energy Star, the central ACs with the following SEER2 requirements are eligible for Energy-Efficient Air Conditioner Tax Credits.

|

AC Type |

SEER2 Requirement |

Eligibility |

|

Split Central Air Conditioners |

≥15.2 SEER2/ ≥12.0 EER2 |

1. Air Conditioners must be Energy Star rated. 2. Homeowners with their permanent residence in the US. 3. Installed between January 1, 2023, and December 31, 2032. 4. Must have a copy of the Manufacturer’s Certification Statement. |

|

Single Package Air Conditioners |

≥15.2 SEER2/ ≥11.5 EER2 |

Energy Efficient Air Conditioner Tax Credit: 10-Year Savings Breakdown

Replacing your Air Conditioners can be expensive, especially with increasing electricity rates every month. According to EIA, the electricity rate in November 2019 was 12.90 cents/kWh, which rose to 15.95 cents/kWh in January 2025. Based on this, the CAGR would be around a 3.60% annual increase. That is why you can expect the electricity rates to increase to 19.04 cents/kWh in 2030 and 22.69 cents/kWh in 2035.

Considering you consume around 899 kWh per month, your electric bills can go from $143/month in 2025 to $171/month in 2030 and $203/month in 2035. You will end up paying around $2,435/year on electric bills in 2035.

That is not it. A typical central air conditioner costs between $3,000 and $15,000 or more. Thankfully, a Central Air Conditioners Tax Credit applies to the qualified systems, a 30% or $600 deduction of the investment on a one-time basis. Besides, these energy-efficient systems potentially lower your electricity consumption.

Go Solar to Save More

Switching your electricity from the grid to solar can also help save on your electric bills. For example, use solar generators to power your air conditioners during peak hours of the day. Assuming the solar generators cut 350 kWh, your average monthly consumption drops to around 450 kWh from 899 kWh. So, your electricity bill lowers to $105/month, or you save around 50% from the previous month.

Also, the Solar Energy Systems Tax Credit provides a 30% tax credit on properties purchased and installed between 2021 and 2033. So, you save more in rebates when you invest in a solar generator.

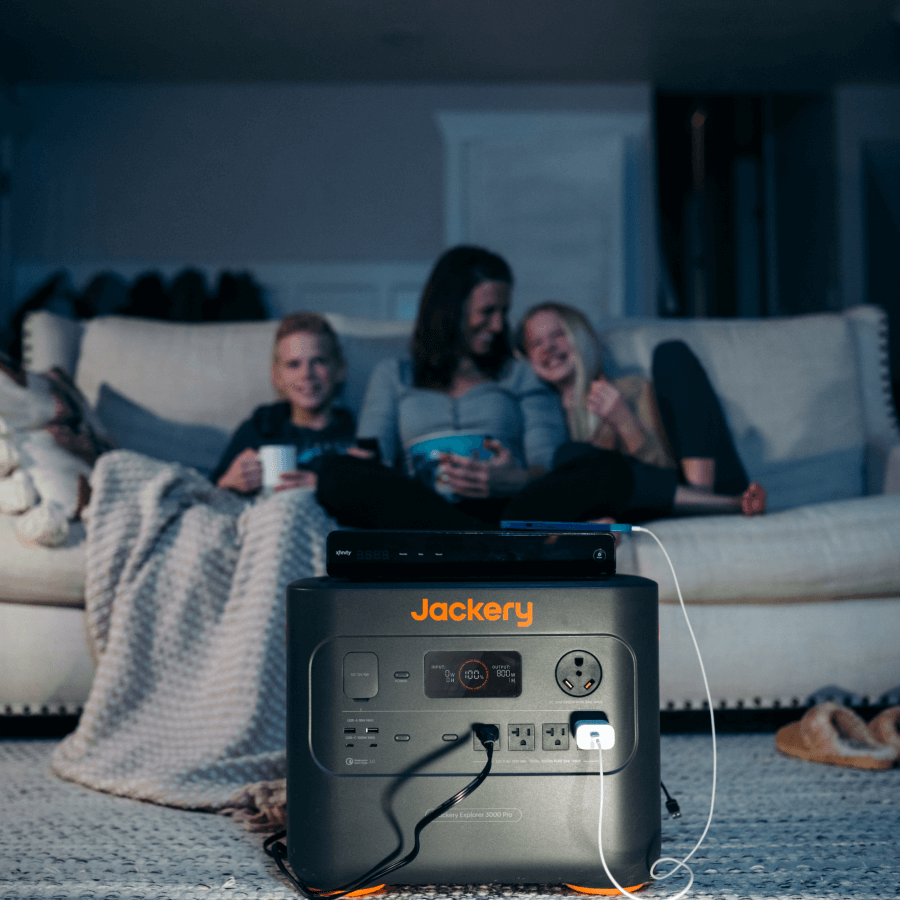

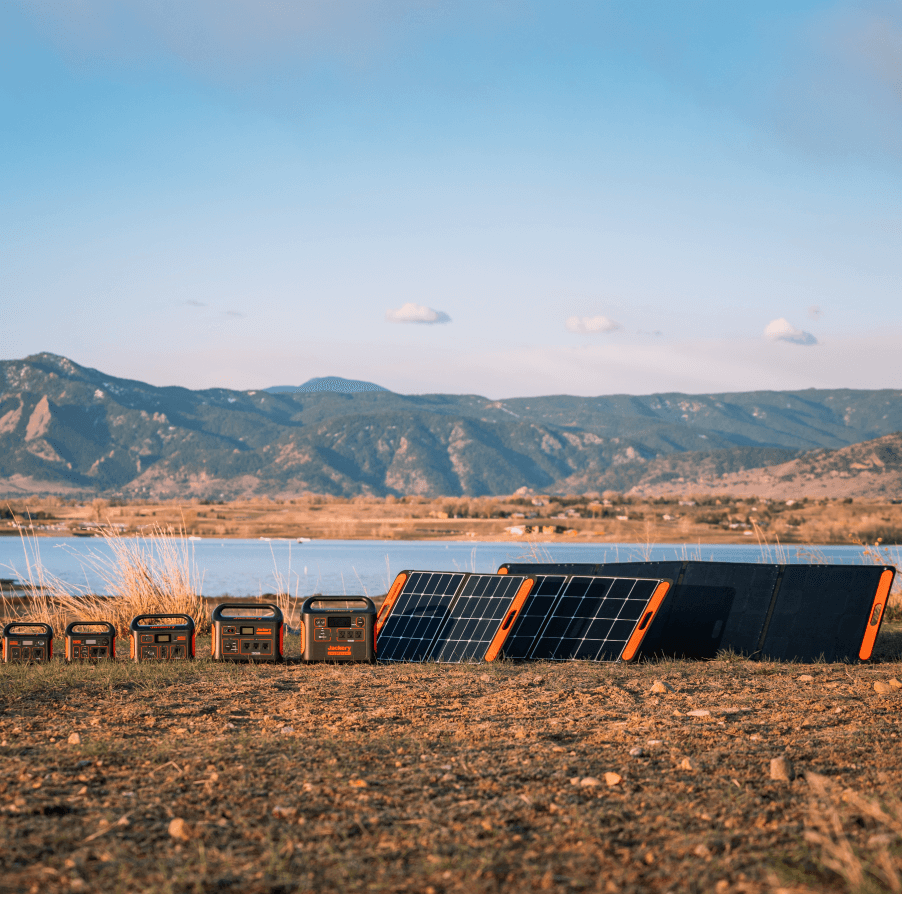

Jackery Solar Generators are great options that offer savings, efficiency, reliability, and portability. They can power your air conditioners for hours, and some of their models are eligible for solar tax credits. When you invest in these systems, you can save up to $1,500 in tax credits.

Tax Credits Available on Jackery Solar Generators

Jackery is a global brand that manufactures high-quality and efficient solar generators, portable power stations, and foldable solar panels. The Jackery Solar Generators consist of Jackery SolarSaga Solar Panels and Jackery Portable Power Stations to power your heavy-duty air conditioners for hours.

The essential home backup solution can power other home appliances, and its portable nature lets you carry it anywhere without much trouble. Besides, some Jackery Solar Generators and Portable Power Stations qualify for the Residential Clean Energy Credit. Depending on the model, the savings with tax credits can range from $839.7 to $1,589.7.

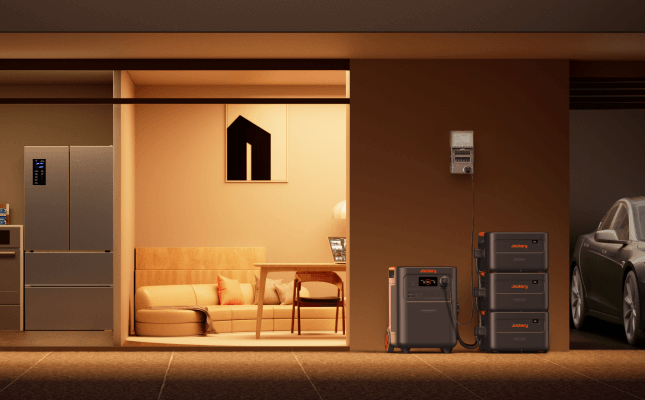

Jackery Solar Generator 5000 Plus

The Jackery Solar Generator 5000 Plus can be an essential backup solution that can power your air conditioners for hours and offset a chunk of your electric bills. It can also reliably power appliances like a full-size refrigerator or a CPAP machine during rolling blackouts.

You can connect your Jackery Solar Generator 5000 Plus to your electric panel through the Jackery Smart Transfer Switch. Your appliances are switched to the backup power within 0ms, almost immediately after the power goes out. Besides, it saves you up to $1049.7 as tax credits, reducing the upfront cost of the solar generator.

Appliance Working Time:

- Air Conditioner (2000W): 2.1H

- Space Heater (1500W): 2.8H

- Refrigerator (900W): 4.5H

- Angle Grinder (2200W): 1.9H

- Gas Furnace (3000W): 1.4H

Customer Review:

“I bought this as a backup power option for power outages. This is an absolute beast of a home battery supply. The Jackery 5000 Plus is a powerful and versatile power station with a 5040Wh capacity and 7200W output, making it perfect for various needs.”- Kendra.

Jackery Solar Generator 2000 Plus Kit (4kWh)

The Jackery Solar Generator 2000 Plus Kit (4kWh) is another essential home backup power system to power your air conditioners and help lower your electric bills. It can power other household appliances like refrigerators, power tools, and emergency supplies for hours. You can also add battery packs to expand capacity and help prepare for long-term power outages. Besides, investing in this solar generator also qualifies you for up to $1,139.7 in tax credits.

Appliance Working Time:

- Air Conditioner (2000W): 1.7H

- Electric Grill (1800W): 1.9H

- Refrigerator (900W): 3.8H

- Induction Cooktop (1500W): 2.3H

- Circular Saw (1200W): 2.8H

Customer Review:

“Easy to set up. Reliable. Powerful. High-quality materials, including cables. Quiet to run. Quick to charge. Power that matches peace of mind.”- Ray.

FAQs

Where to check for rebate programs in your state?

To find the rebate programs of your state, you can visit the Database of State Incentives for Renewables & Efficiency (DSIRE). It provides comprehensive information on policies and incentives available across the US. Additionally, you can check the Home Upgrades section of the Department of Energy's website for general information on rebates.

Are solar-powered air conditioners eligible for additional savings?

Yes, solar-powered air conditioners are eligible for a Residential Clean Energy Tax Credit of 30% of the costs for newly installed property between 2022 and 2032. The credit percentage drops to 26% and 22% for property installed in 2033 and 2034, respectively.

How to claim the tax credit for your air conditioner?

First, determine if your installed air conditioner qualifies for the credits offered under the Inflation Reduction Act (IRA). Then, fill out the IRS Form 5695 to claim the credit.

Can you combine the AC Tax Credit with other rebates?

Yes, you can combine the AC Tax Credits with other incentives and rebates, such as state and local rebates, alongside those offered by utility companies and other organizations.

What is the minimum SEER2 rating for tax credit?

The minimum SEER2 rating for air conditioning units is 15.2. The ratings on the appliance's label can help you determine whether it qualifies for the tax credit.

Final Thoughts

Installing energy-efficient air conditioners not only offsets your electricity costs and saves money but also makes you eligible for Energy-Efficient Air Conditioner Tax Credits. You can save up to 30% or $600 on upfront costs. You can use a solar generator to minimize your dependence on electric grids and save more. Jackery Solar Generators are reliable and robust solutions that power your air conditioners and other household appliances. Some Jackery Solar Generator models are eligible for up to $1,500 in tax credits.

![[Add - on] Jackery Manual Transfer Switch for Explorer 5000 Plus - Jackery](http://www.jackery.com/cdn/shop/files/add-on-jackery-manual-transfer-switch-for-explorer-5000-plus-9017324.png?v=1754016782&width=170)

Leave a comment