The Residential Clean Energy Credit makes switching to solar power more affordable by offering up to 30% tax credit on eligible solar products and their respective installation fees. Jackery offers a range of solar generators that qualify for the Residential Clean Energy Credit. With the Residential Clean Energy Credit, you can reduce your federal income tax by a percentage (currently up to 30%) of the cost of installing eligible solar equipment, making it a practical option for home backup, off-grid power, and emergency preparedness. This guide explains which Jackery products qualify for the Residential Clean Energy Credit, how much you can save, and the steps to apply.

AI Takeaways

- Historically, under the Inflation Reduction Act (IRA) of 2022, homeowners could claim a 30% tax credit on qualified installations such as solar panels, as long as the property was "placed in service" between 2022 and 2032. The credit was scheduled to phase down to 26% in 2033 and 22% in 2034, ending after that.

- On July 4, 2025, the One Big Beautiful Bill Act (H.R. 1) was signed into law, accelerating the expiration of this credit. The 30% Residential Clean Energy Credit now expires on December 31, 2025, marking a sharp cutoff with no gradual phase-down as previously planned.

- 2025 is the final year to qualify for up to 30% tax credit. Missing the deadline, even by a day, means the credit is unavailable.

- Some Jackery products are also eligible for the Residential Clean Energy Credit, though the exact solar tax credit you receive will vary depending on the product you buy and the purchase amount.

- How to apply for the Residential Clean Energy Credit When Buying Jackery Products.

What is the Residential Clean Energy Credit

The Residential Clean Energy Credit is equal to 30% of the costs of new and qualified clean energy property for your home installed and placed in service. Previously, according to the IRS, no credit was available for property placed in service after December 31, 2034. However, according to the One Big Beautiful Bill Act passed on July 4, 2025, the terminations of several energy credits have been accelerated. OBBB states that the Residential Clean Energy Credit will not be allowed for any expenditures made after December 31, 2025.

Note: The solar tax credit is not a cash rebate. It reduces the amount of income tax you owe to the federal government.

Does the Installation Fee Qualify for a Solar Tax Credit?

Yes, you may get up to 30% of tax credit on the installation fee of the solar generator setup (if the bundle includes the Smart Transfer Switch), depending on the price of the model. For example, if you buy the Jackery Solar Generator 5000 Plus along with a Smart Transfer Switch, you may qualify for up to 30% federal tax credit under the Solar Investment Tax Credit (ITC) on the solar product as well as the installation fees of the STS.

However, if you purchase the Smart Transfer Switch separately from the bundle, the installation will not qualify for the solar tax credit. Hence, if you are purchasing the Jackery product bundle, make sure to include the Smart Transfer Switch in the bundle to avail tax credit on the installation service.

Which Jackery Products Qualify for the Residential Clean Energy Credit

Some Jackery products are eligible for the Residential Clean Energy Credit. However, the exact amount of tax credits you can receive will depend on the product you buy.

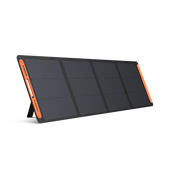

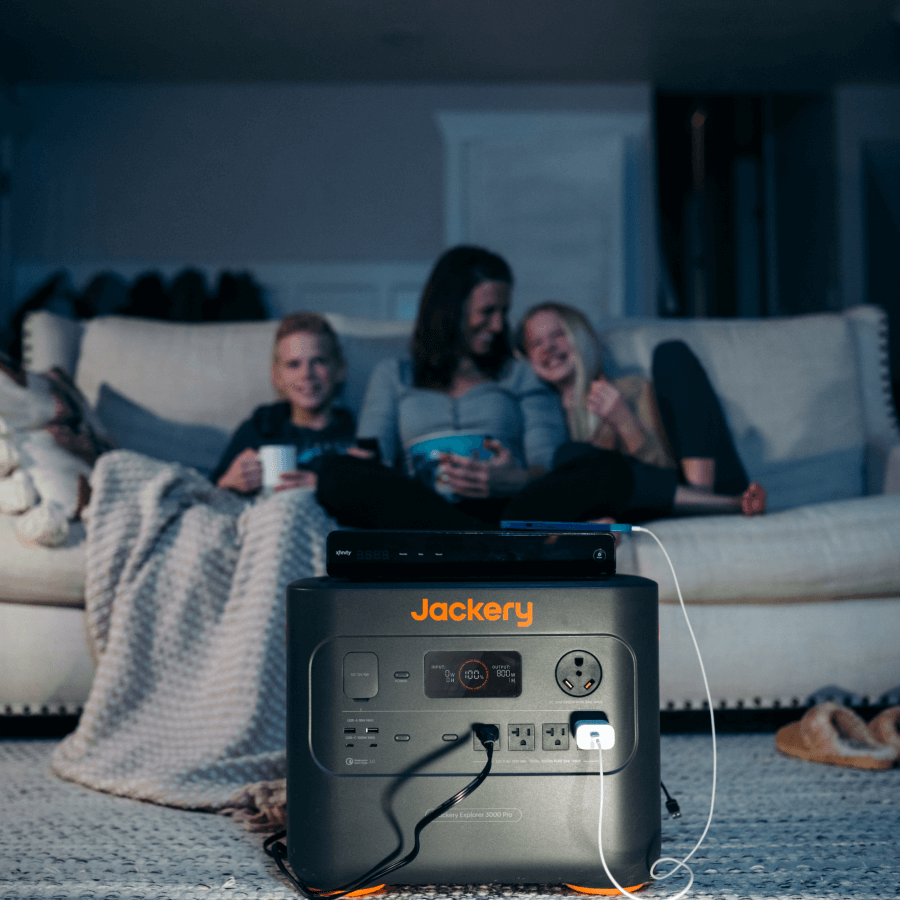

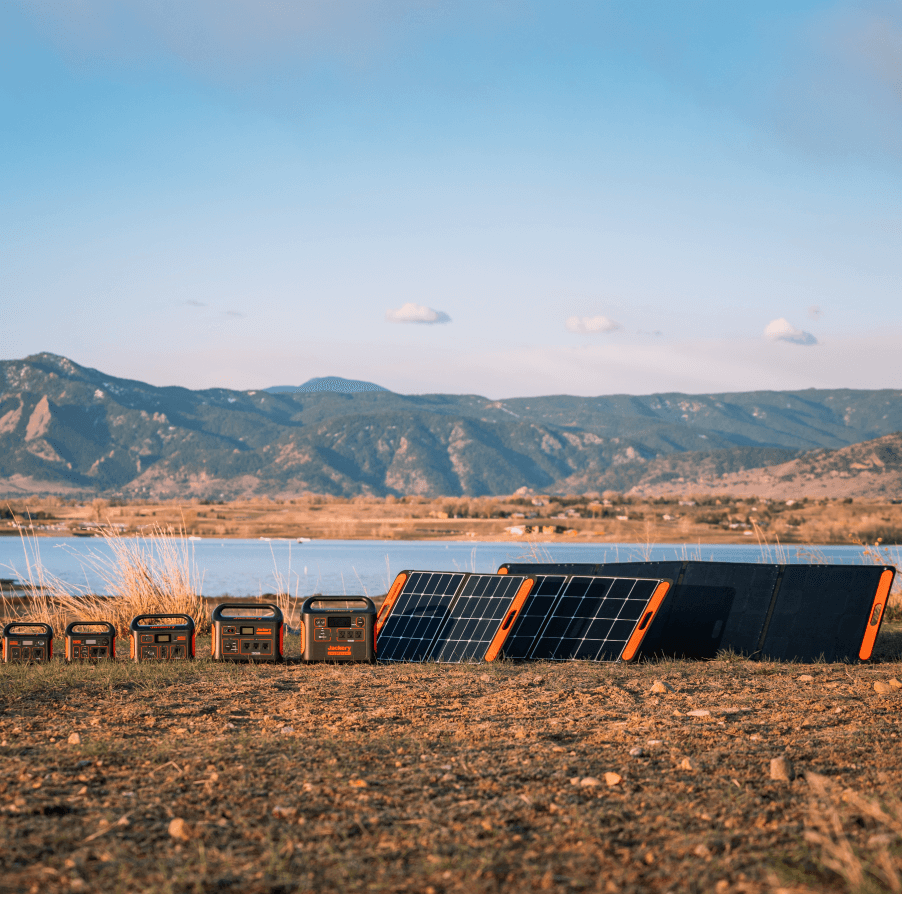

Jackery Solar Generators

Jackery Solar Generators combine Jackery Portable Power Stations and compatible Jackery SolarSaga Solar Panels that work together to power appliances using the sun's free energy. They can be used to power appliances during off-grid living, power outages, and outdoor adventures.

Here are some of the Jackery Solar Generators, along with how much you can save:

Jackery Solar Generator 2000 Plus Kit (4kWh)

Jackery Solar Generator 2000 Plus Kit (4kWh) can power most household appliances during outages and can also reduce high electricity bills. Whether you want to power a full-size refrigerator to keep food fresh during outages or high-power-consuming appliances like AC to lower the utility bill, the solar-powered generator has your back. If you buy this solar generator, you are eligible for the Residential Clean Energy Credit that can save up to $1,139.70 in tax credits, i.e., up to 30%. However, if you are purchasing the solar generator during the promotions when the price is lower than the standard cost, the amount of tax credit you can claim may differ.

Note: The product prices mentioned may change. Kindly refer to the official product pages to learn about the recent costs.

Jackery Solar Generator 2000 Plus Kit (6kWh)

The Jackery Solar Generator 2000 Plus Kit (6kWh) is another solar-powered generator that can help you reduce high electricity bills. It is also ideal for off-grid living and can power appliances during extended blackouts. It can operate at 30dB of noise, which means you can enjoy a peaceful environment while working, sleeping, or simply relaxing. You may be eligible for up to $1,589.70 (up to 30%) as tax credits on the purchase of this solar generator. However, as mentioned above, the tax credit amount can differ when you purchase the Jackery product at a lower price during promotions.

Jackery Solar Generator 3000 Pro

The Jackery Solar Generator 3000 Pro is a reliable home battery backup system that can power most indoor or outdoor appliances for long hours. It features a foldable handle, pull rod, and double wheels for easy transportation to different locations during an outage. On the purchase of this solar generator, you can claim up to $839.70 in tax credit, which will help you reduce the overall cost.

Jackery Solar Generator HomePower 3000

The Jackery Solar Generator HomePower 3000 is the lightest and smallest 3kWh LFP essential home backup power solution. The large battery capacity ensures essential appliances such as fridges, fans, WiFi routers, lights, coffee machines, etc., remain powered. It is 47% smaller and 43% lighter than other mainstream products of a similar capacity, ensuring power doesn't limit portability. The early bird offer lets you purchase the new Jackery Solar Generator HomePower 3000 at just $1,999. You can receive a tax credit of up to $749 to reduce your federal income tax, though it may vary depending on the amount you paid while purchasing the product.

Jackery Solar Generator HomePower 3600 Plus

The Jackery Solar Generator HomePower 3600 Plus is the standard essential home backup solution that can power most household appliances for hours. With the massive battery capacity and expandability options, you can keep your fridge powered for up to 14 days. It is the world's lightest 3.6kWh LFP solar generator and features a luggage-style design with a telescoping handle and wheels for easier transportation. You can receive up to 30% of the total amount paid as the federal tax credits.

Jackery Solar Generator 5000 Plus

The Jackery Solar Generator 5000 Plus is one of the most trusted solar generators for homes. It can power almost all household appliances during extended power outages or off-grid living. It has 12 output ports to power multiple appliances, such as fridges, computers, home servers, routers, etc. Eligible customers can receive a tax credit of up to $1,049.70 on the purchase of this solar generator. But if you pay less than the standard price during the purchase, the tax credit amount may differ, as it is up to 30% of the total amount paid.

Kindly note that only the products mentioned above are eligible for the Residential Clean Energy Credit, and the exact amount you receive will be directly influenced by the purchase amount. It is best to refer to the Residential Clean Energy Credit page to learn what Jackery products qualify for tax credits.

Rules of the Residential Clean Energy Credit

If you invest in renewable energy for your home, such as wind, solar, geothermal, or battery storage technology, you may qualify for an annual Residential Clean Energy Credit. Here is who can qualify for Residential Clean Energy Credit:

- According to the IRS, you may claim the Residential Clean Energy Credit for improvements to your home where you live most of the time, regardless of whether you own or rent it.

- The credit will apply to both new and existing homes located in the US.

- You may also be able to claim the Residential Clean Energy Credit for improvements made to a second home located in the US. The second home will refer to the place where you live part-time and do not rent to others.

However, if you are a landlord or other property owner who does not live in the home, you cannot claim the Residential Clean Energy Credit. In addition, if you use the property only for business purposes, you cannot claim the credit.

Note: Always refer to the IRS Residential Clean Energy Credit page to check the latest guidelines as they are subject to change.

How Much Can You Save With Residential Clean Energy Credit

The Residential Clean Energy Credit helps you save up to 30% of the costs of new, qualified clean energy products installed at home before the end of December 31, 2025. Multiple Jackery products are eligible for Residential Clean Energy Credit programs. However, you should verify eligibility and requirements before applying.

You may also be eligible for solar incentives and tax credits in different states, such as Texas, Florida, Oregon, and California, which will further reduce the overall cost.

How to Apply for the Residential Clean Energy Credit When Buying Jackery Products

Now that you know the Residential Clean Energy Credit allows you to save up to 30% of the money you spend on qualified products, it's essential to understand how to apply it. Here is the step-by-step process to claim a Residential Clean Energy Credit on Jackery products.

Step 1: Buy a Qualifying Jackery Product

In order to be eligible for the tax credit, you need to buy a qualified solar generator from Jackery. You should check the available Residential Clean Energy Credit from Jackery to confirm your eligibility before making a purchase decision.

Step 2: Keep All Receipts and Documentation For Your Purchase

The IRS strongly recommends retaining all purchase receipts and installation records (if any). If you buy online, you should keep a digital copy of the order confirmation. These documents and receipts are essential to prove the purchase amount when filing the tax return.

Step 3: File IRS Form 5695 When Filing Your Tax Return

When you file your tax return for the year, you will need to file IRS Form 5695, which lets you calculate the tax credits based on the qualifying solar product.

Step 4: Claim the 30% Credit on Your Tax Return to Reduce Your Tax Bill

Once you've filled out IRS Form 5695, transfer the credit amount to your Schedule 3, Line 5 on Form 1040 (U.S. Individual Income Tax Return). The 30% credit directly reduces your tax liability, meaning if you owe taxes, this amount will be subtracted from what you need to pay.

Step 5: Consult a Tax Professional If Needed for Additional State Rebates

Some states offer additional solar incentives, such as solar rebates or property tax exemptions, which can further reduce the overall cost of solar generators. A tax professional can help you identify extra savings opportunities and ensure proper documentation.

Disclaimer: The information provided in this blog is for educational purposes only. For the latest updates, please refer to the official IRS website or consult a qualified advisor.

FAQs for Residential Clean Energy Credit

Can I claim the tax credit if I only buy a Jackery power station?

Yes, if you purchase the qualified Jackery product, you may be eligible to claim up to 30% tax credit. However, the amount of Residential Clean Energy Credit you can claim will depend on the model.

Does the tax credit apply to used or refurbished Jackery products?

No, the Residential Clean Energy Credit cannot be claimed on buying a used or refurbished Jackery product. You will need to purchase a new, qualified Jackery product to claim the tax credit.

Does Jackery qualify for the 2025 Residential Clean Energy Credit?

Yes, the Residential Clean Energy Credit can be claimed on a qualified Jackery product purchased before the end of December 31, 2025.

How many times can I claim the Residential Clean Energy Credit?

You can claim the annual Residential Clean Energy Credit every year that you install eligible solar products until the credit begins to phase out in 2025. However, eligibility may vary depending on multiple factors, such as the type of product you purchased and its costs.

Do Jackery Solar Panels Qualify for Federal Tax Credit?

Jackery Solar Panels by themselves do not qualify for the federal tax credit. The credit only applies to complete solar generator bundles. Some Jackery Solar Generator bundles, which pair a power station with compatible solar panels, are eligible under the Residential Clean Energy Credit and can receive up to 30% back in tax savings.

Conclusion

Jackery products provide reliable and sustainable power solutions for appliances, and the Residential Clean Energy Credit helps make them more affordable. When you purchase a qualifying Jackery product, you can claim up to 30% tax credit, reducing your overall cost. The process is straightforward, and all you need to do is buy an eligible Jackery product, keep your receipts, and file IRS Form 5695 with your tax return. It allows you to lower your expenses while investing in renewable energy.

![[Add - on] Jackery Manual Transfer Switch for Explorer 5000 Plus - Jackery](http://www.jackery.com/cdn/shop/files/add-on-jackery-manual-transfer-switch-for-explorer-5000-plus-9017324.png?v=1754016782&width=170)

Leave a comment