Texas is a great place to switch solar, all thanks to several solar incentives, rebates, and tax credits available. On top of that, the cost of solar panel installation in Texas is lower in the state compared to the national average. You'll get more profit from solar energy as the state receives more than 200 days of sun every year. If you are planning to go solar in 2024, it is essential to check various Texas solar incentives that can help you reduce the overall cost.

Jackery Solar Generators are reliable charging solutions equipped with LiFePO4 or NMC batteries. They can help you charge most of the heavy-duty household appliances when living off the grid or during extended power outages. When you invest in Jackery Solar Generator 3000 Pro or Jackery Solar Generator 2000 Plus, you can receive a tax rebate of around $839.7 - $1139.7 — though it may vary depending on certain factors.

Texas Solar Incentives in 2024

The average off-grid solar system cost in Texas is typically lower than the national average. For example, a 6 kW solar system might cost around $16,300 before the 30% federal tax credit. However, the cost might vary depending on the size of the solar system, shape and slant of the roof, and brand of solar panels.

There are other Texas solar incentives available to reduce the upfront cost of panels. Most solar incentives in Texas come from local governments or energy companies to dramatically reduce costs. Here is a table that compares different solar incentives with their eligibility, savings, and more!

|

Texas Solar Incentives |

What Is It? |

Who Can Claim? |

When Can I Get It? |

How Much Can It Save? |

|

Federal Solar Tax Credit (ITC) |

Qualified customers receive a 30% tax credit for solar panels and battery storage installation. |

All Americans. |

One-time. |

On average, you save $3,570. However, the exact rebate will depend on the solar panel size. |

|

Solar Energy System Property Tax Exemption |

Residents installing solar panels will get a 100% tax exemption on the increased tax due to solar panel installation. |

Residents in Texas. |

Ongoing. |

You save 100% tax exemption on increased property tax. |

|

Inflation Reduction Act (IRA) |

Qualified homeowners can save 30% of their cost of solar panel systems. |

Qualified residents in Texas. |

One-time. |

You save a 30% tax deduction for installing solar panels with battery storage. |

|

TXU Energy Home Solar Buyback Plan |

Homeowners receive bill credits for the excess solar power the panels generate. |

Homeowners who install Sunrun solar panels. |

Ongoing. |

You get monthly energy credits or a reduction in electricity bills. |

|

Local Incentives |

Local companies offer tax rebates for solar panel installations. |

Customers of participating local utility companies. |

Varies depending on the chosen local program. |

Varies depending on the chosen local program. |

|

Net Metering |

Residents receive bill credits or money in exchange for surplus solar energy. |

Customers of participating utility companies. |

Ongoing. |

Varies by utility. |

Federal Solar Tax Credits (ITC)

The Federal Solar Tax Credit (ITC) is a popular nationwide solar incentive established by the federal government. When a homeowner invests in a solar panel system, they can claim a tax credit of 30% of their system cost. For example, if they buy a 10 kW system for $30,000, your tax credit would be $3000.

As it is a tax credit and not a refund or rebate, you can claim the credit in the year you install your solar system. In order to claim the incentive, all you need to do is apply the claim to your federal income tax burden. You can also combine this benefit with other local programs and state tax incentives to reduce the cost of home solar systems.

Solar Energy System Property Tax Exemption

Texas also offers a solar property tax exemption program to ensure you can save money while installing solar panels. When you install solar panels at home, it generally increases your home value. Under the Solar Energy System Property Tax Exemption, the increased home value is exempt from 100% of the resulting property tax increase. That means your home value will go up after installing the panels, but your property taxes won't. For example, if you are installing a $24,000 solar system, your property tax exemption would be $403 per year.

Inflation Reduction Act (IRA)

IRA Residential Clean Energy Property Credit (25D) offers a 30% tax deduction to homeowners installing solar panels and home battery storage. However, this credit percentage will phase down after 2033, and you'll receive only a 26% tax credit. You will then receive a 22% tax deduction in 2034, which will be eliminated by the end of the year.

TXU Energy Home Solar Buyback Plan

The TXU Energy Home Solar Buyback Plan helps you save the maximum value out of your Sunrun solar panels. When you return energy to the electricity grid, you will get paid in automatic bill credits. These credits can be used to offset monthly energy charges.

If the charges remain unused, they will be banked up to a certain amount and automatically applied to future electricity bills. To claim the Solar Buyback Plan, install a smart meter to track surplus energy generation and sign an interconnection agreement with ERCOT. You will receive the credits within a few days of the billing cycle.

Texas Local Incentives

Beyond the state-level solar incentives in Texas, the cities, municipalities, and towns offer many local incentives to residents who are investing in solar panels. Here are some of the popular options available :

American Electric Power SMART Source Solar PV Program

American Electric Power serves major parts of south and west Texas. It runs a SMART Source Solar PV Program that offers financial incentives to AEP Texas customers. The rebate amount will generally depend on the size of the solar panels installed. For example, if you install 3 kW—5 kW solar systems, you can claim $1500. AEP pays $2250 for 5 kW to 7.5 kW solar systems.

A solar system above 7.5 kW can offer financial incentives of up to $3000. Central Texas residents can receive $3,81,195, whereas around $1,72,425 is provided to non-residents. However, the North Texas residents receive $1,85,898 upon installation of solar panels. One important thing to remember is that only solar installation companies enrolled in the SMART Source Solar PV Program can apply for and receive the financial incentives offered.

Austin Energy Solar Photovoltaic Rebates & Incentives

Austin Energy offers a hefty discount of $2500 rebate to homeowners for installing a new solar panel. However, you must own (not lease) the solar energy system providing at least 3 kW of power. Additionally, you must complete the solar education course to earn the rebate.

Before you apply for the rebate, you need to complete the course and a short quiz. In order to start the rebate application, you must prepare your electric utility account number, address, ZIP code, and contact information. The Participating Contractor will complete the rebate application process on your behalf.

SMTX Solar PV Rebate

San Marcos's municipal utility provides rebates for different renewable energy systems, including solar panels. If you install new solar panels, you can receive $1 per watt up to a maximum of $2500. However, your system must provide at least 1 kW of power to qualify for the Texas solar incentives. To claim the rebate, you must install the panels with a minimum 20-year warranty by a certified installer.

Oncor Solar Energy Residential Rebate

Oncor, one of the biggest electrical utilities in Texas, provides homeowners with a rebate on solar PV panels. However, Oncor rebates are only available to solar panel installations with battery storage.

The qualified solar panel system size is between 3 kW and 15 kW. The incentive will depend on direction, tilt, panel type, and size. Once the installation is complete, your installer will submit the application to Oncor. The company will then issue the agreement and offer permission to operate.

CPS Energy Solar Water Heater Rebate

Instead of solar panels, the CPS Energy Solar Water Heater Rebate offers financial incentives for investing in solar water heaters. With the CPS Energy rebate and federal tax credits, you can reduce the overall upfront cost of the investments.

The rebate amount can be calculated by multiplying the annual energy savings in kWh and $0.60, but the maximum is $2000. You'll need to complete the application work before the installation. Once the post-inspection is completed, the rebate amount will be credited to the account.

Sunset Valley Solar Rebate Program

Sunset Valley, located southwest of Austin, offers some financial incentives to its residents. The customers of Austin Energy who are installing solar panels get an additional rebate on top of $2500. Qualified homeowners will get an extra $1 per solar panel wattage up to $3000. The incentives are available on a first-come, first-served basis.

Texas Net Metering

Net metering is a billing type or structure that helps people earn credits for excess energy generated by solar panels fed back to the utility grid. Due to the deregulated energy market, Texas offers a unique approach to net metering. While Texas does not have a statewide net metering policy, some utility companies, like El Paso Electric, Green Mountain Energy, and CPS Energy, offer net metering programs.

In Texas, you can either look for a municipal electric company offering net metering or a Retail Electric Provider that will purchase your extra solar power at a price lower than the retail electricity rate. Every kilowatt-hour (kWh) of electricity not consumed by your household is sent to the utility grid and deducted as energy credit from the next power bill. Since different companies manage net metering programs, the incentives and technical requirements might vary.

The buyback plans provided by the deregulated utilities compensate for net generation at the energy credit rate. The retail electric provider pays the homeowner the retail rate for the electricity at the time of use. This is similar to net metering. However, rather than using a retail rate on a monthly basis, it is applied at the time of use. You must contact the utility provider to enroll in net metering in Texas.

Are There Any Energy Storage Incentives in Texas?

No, Texas does not offer homeowners any state-specific energy storage incentives. However, some utility companies offer specific programs. Batteries above 3 kWh are eligible for the 30% federal tax credit.

Batteries are great for protecting from extended blackouts, increasing energy independence, and avoiding paying peak electricity pricing in Texas. If your utility company does not provide net metering, consider installing a battery with solar panels to save more on electricity bills.

Is Solar Worth It in Texas?

Yes, Texas has abundant sunshine to increase the productivity of solar panels. Many companies operating in Texas offer solar incentive programs, which can be combined with the federal tax credit to reduce the upfront cost of solar panel installation. If you are still unsure if solar is worth it in Texas, it's best to check your monthly electricity bills. If you consistently pay more, switching to solar energy could be financially beneficial. Here are some benefits of going solar in Texas :

Financial Savings : With so many Texas solar incentives available, the solar panel installation cost is much more manageable. Solar power panels and battery storage systems can help you reduce — or even eliminate — the average electric bill in Texas.

Energy Independence : When you power household appliances with the help of solar energy, it allows you to practice off-grid living and protect from power crises.

Environmental Impact : Electricity generated by natural gas and coal is harmful to the environment, whereas solar energy is a green, renewable source. Switching to solar energy can reduce one's carbon footprint, and one can even share excess solar power with utility companies.

Jackery Solar Generators in Tax Rebates

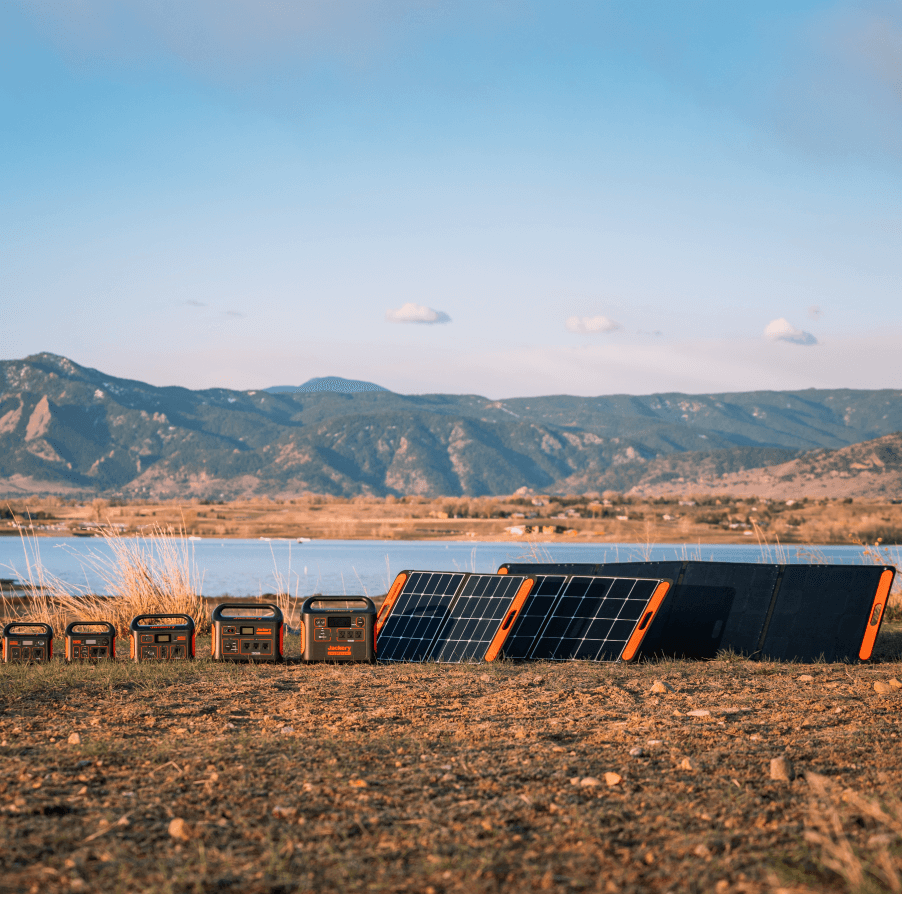

Jackery is a leading manufacturer and seller of efficient solar generators, portable power stations, and solar panels. The Jackery Solar Generators combine Jackery Explorer Portable Power Stations and foldable Jackery SolarSaga Solar Panels. These are reliable charging solutions that can power most heavy-duty appliances for long hours, helping you stay protected from power outages and blackouts.

If you invest in solar generators, you may qualify for an annual residential clean energy tax credit to help you save 30% of the costs of a new solar panel system. Jackery Solar Generators offers rebates depending on the size of solar generator you choose. In order to claim the federal solar tax credit, all you need to do is fill out Form 5695. Here are the popular Jackery Solar Generators ideal for home emergencies and extended blackouts.

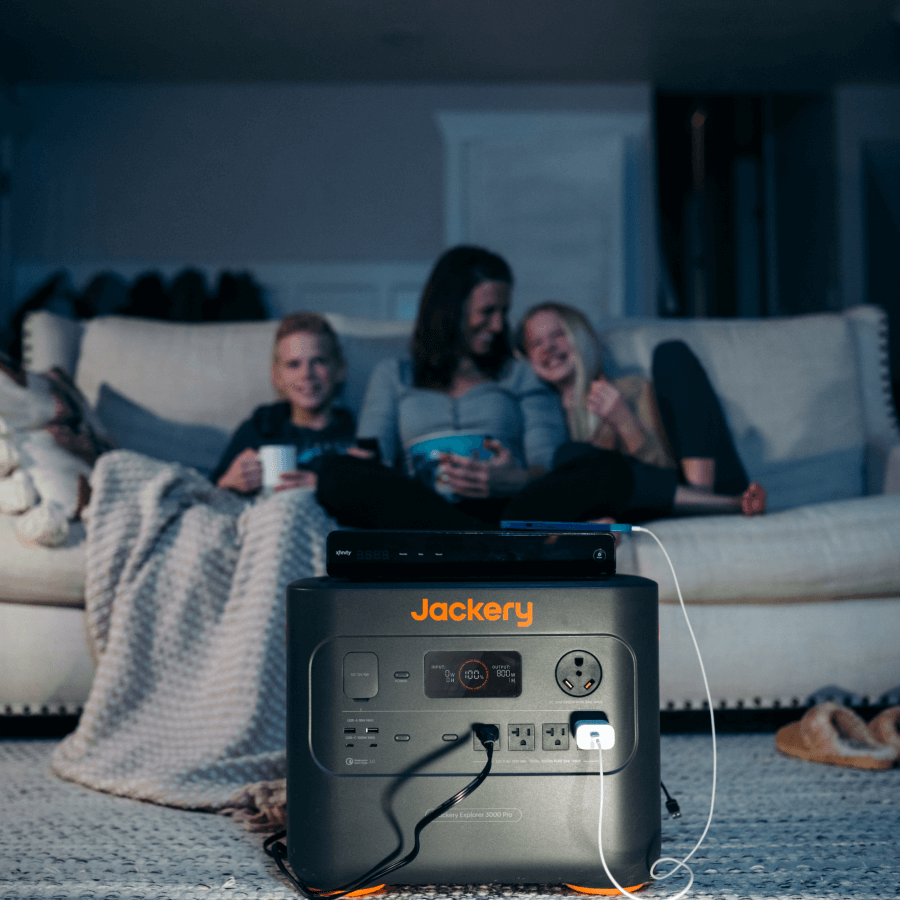

Jackery Solar Generator 3000 Pro

The large Jackery Solar Generator 3000 Pro features a stable NMC battery that can charge most household appliances, such as air conditioners, refrigerators, space heaters, LED lights, etc. Eligible people who invest in the Jackery Solar Generator 3000 Pro might earn a tax rebate of up to $839.7. You can recharge the Jackery Explorer 3000 Pro Portable Power Station in only 3.5 hours by connecting it with 6*Jackery SolarSaga 200W Solar Panels.

Customer Review

"It worked really well all night. Long on a heater to keep the cold out when the electricity went out." — Alicia.

Jackery Solar Generator 2000 Plus Kit (4kWh)

The Jackery Solar Generator 2000 Plus Kit (4kWh) is another reliable charging solution for large households and apartments. Investing in the portable solar generator will help you earn nearly $1139.7 in tax rebates. The Jackery Explorer 2000 Plus Portable Power Station can be recharged in under 2 hours by connecting it with 6*Jackery SolarSaga 200W Solar Panels. It is ideal for extended home emergencies, power outages, etc.

Customer Review

"I like the idea that if I need more power in the future, I can purchase another battery pack. The wheels on the generator are great as 64 lbs is easier to pull/push instead of carrying it." — Larry Gee.

|

|

Solar Generator 3000 Pro |

Solar Generator 2000 Plus Kit (4kWh) |

|

Capacity |

3024 Wh |

2-24 kWh |

|

Battery Cell |

NMC |

LiFePO4 |

|

Cycle Life |

2000 cycles to 70%+ capacity |

4000 cycles to 70%+ capacity |

|

Recharging Methods |

Solar Recharging : 3.5 H (6*Jackery SolarSaga 200W Solar Panels) Car Recharging : 35 H Wall Recharging : 2.4 H |

Solar Recharging: 2 H (6*Jackery SolarSaga 200W Solar Panels) Car Recharging: 25 H Wall Recharging: 2 H |

|

Output Ports |

AC Output (x1) : 120 V~ 60 Hz 25 A Max AC Output (x3) : 120 V~ 60 Hz 20 A Maximum USB-C Output (x2) : 100 W Maximum, 5 V⎓3 A, 9 V⎓3 A, 12 V⎓3 A, 15 V⎓3 A, 20 V⎓5 A |

AC Output (×4) : 120 V~ 60 Hz, 20 A Maximum AC Output (×1) : 120 V~ 60 Hz, 25 A Maximum USB-A Output (x2) : Quick Charge 3.0, 18 W Maximum USB-C Output (x2) : 100 W Maximum, (5 V, 9 V, 12 V, 15 V, 20 V up to 5 A) |

|

Working Hours |

Electric Grill (1000 W) : 2.5 H Space Heater (1000 W) : 2.5 H Dishwasher (1050 W) : 2.4 H Kettle (850 W) : 3 H Microwave (800 W) : 3.2 H |

Electric Grill (1000 W) : 3.4 H Space Heater (1000 W) : 3.4 H Dishwasher (1050 W) : 3.3 H Kettle (850 W) : 4 H Microwave (800 W) : 4.3 H |

|

How Much It Can Save with Tax Rebates |

$839.7 (Though this is an estimated value) |

$1139.7 (Though this is an estimated value) |

Texas Solar Incentives FAQs

Does Texas have incentives for solar panels?

Yes, Texas offers state-level rebates and local incentives to reduce the solar system installation cost. The Federal Solar Tax Credit is one of the most valuable financial incentives for installing solar panels in Texas.

How long does it take solar to pay for itself in Texas?

In Texas, the average time solar panels take to pay for themselves is 6 - 9 years. This is much faster than in other US states because of all the sunny days of Texas and the solar incentives.

What is the solar exemption in Texas?

The solar exemption program in Texas allows residents to claim an exemption for the increased property value that arises from installing solar panels.

How many years can you claim the solar tax credit?

You can generally claim the solar tax credit once after the solar panel installation. However, if you have any unused amount remaining on the tax credit, you can carry over the tax credit for up to five years.

Can you sell solar power back to the grid in Texas?

Yes, net metering allows you to sell power back to the grid in Texas. Of course, you'll need authorization from the electricity provider and a bidirectional meter to track the energy generation.

Final Thoughts

Solar panels in Texas have a high upfront cost. However, they offer tremendous savings over the years to become energy-independent and reduce monthly electricity bills. Thanks to multiple local and state-wise Texas solar incentives, the cost of solar panel systems can be much more affordable.

If you are planning to go solar on a limited budget, you may consider Jackery Solar Generators. For example, the larger Jackery Solar Generator 3000 Pro and Jackery Solar Generator 2000 Plus (4kWh) can help you save $839.7- $1139.7 in tax rebates and even lower your electricity bills.

Resources

- Solar and Wind-Powered Energy Device Exemption and Appraisal Guidelines

- Net metering in Texas: what are your options?

- Solar Water Heater Rebates

- SAVING ENERGY ONE PANEL AT A TIME

- The Inflation Reduction Act - Texas Impact

- AEP Texas

- Solar Photovoltaic (PV) Rebate & Incentives

- Distributed Generation Rebate Program

![Guide to Texas Solar Incentives, Rebates, & Tax Credits [2024]](http://www.jackery.com/cdn/shop/articles/guide-to-texas-solar-incentives-rebates-tax-credits-2024-4911234.jpg?v=1754018087)