Florida gets over 230 sunny days per year, which is why it is called the Sunshine State. This is one reason why many people use solar energy to store their energy for charging home appliances. However, installing solar panels in Florida comes with high upfront costs. Luckily, residents can reduce the high solar panel installation cost with many Florida solar incentives, including tax credits, rebates, and net metering.

Jackery Solar Generators are reliable charging solutions that can power indoor or outdoor appliances during extended power outages, blackouts, or off-grid living. Investing in solar generators will help you earn a tax rebate of around $839.7 — $1139.7, depending on how much you qualify. In this guide, we will discuss different solar incentives in Florida that can drastically lower the upfront solar panel cost.

Florida Solar Incentives 2024

Florida, famous as the Sunshine State, is an excellent state for solar energy. The solar panel costs nearly $10,000 - $15,000 — depending on the size and type of the solar panel system. Florida also offers many solar incentives, rebates, and credits to reduce solar installation costs. Here's a table comparing federal, local, and state solar incentives in Florida.

|

Florida Solar Incentives |

What Is It? |

Who Can Claim? |

When Can I Get It? |

How Much Can It Save? |

|

Federal Solar Tax Credit (ITC) |

Eligible homeowners get a non-refundable tax credit up to 30% of the total investment. |

Florida residents who own their house. |

One-time : If you qualify for the tax credit, you will receive the money back. |

You will save up to 30% of the total solar panel system cost. |

|

Solar Energy System Property Tax Exemption |

It means the value of the solar energy system is exempt from property taxes. |

All Floridians. |

Ongoing : Your solar system will be automatically excluded from the property tax value. |

Savings depend on the county's property tax rebate. |

|

Solar System Sales Tax Exemption |

Solar panels and other eligible installation equipment are exempt from the state's 6% sales tax. |

All Floridians. |

One-time : You will earn a rebate at the time of purchase. |

You can save up to 6% of your solar system costs. |

|

Solar Loans |

You will get financial assistance to purchase a new solar panel system. |

All Floridians. |

One-time : You'll get a solar loan when purchasing a new solar panel system. |

Varies depending on the size and type of solar panel system. |

|

Inflation Reduction Act (IRA) |

Qualified residents receive 30% of the cost of the solar panel system. |

Qualified purchases of solar panels. |

One-time : You will get financial assistance with your federal income tax return. |

You save up to 30% of the cost of the solar panel system. |

|

Local Incentives |

These are special financial incentives offered by the local utility companies. |

All customers of the utility company that offers the incentive. |

Varies depending on the local incentive you choose. |

Varies depending on the utility provider and the local incentive. |

|

Net Metering |

Eligible homeowners receive credits for excess energy generated by solar panels and send it to the utility company. |

All customers of utilities, such as Florida Power and Light (FPL) and Duke Energy. |

Ongoing : You receive credits and reduced energy bills as you supply the surplus energy back to the grid. |

Varies depending on some factors, such as the system size, energy needs, and credit rate. |

Federal Solar Tax Credit (ITC)

The Residential Clean Energy Credit, previously called the Federal Solar Tax Credit (ITC), can reduce the cost of a solar panel system by 30%. For example, a 5 kilowatt-hour (kW) solar panel system costs around $12,000. With the 30% Federal Solar Tax Credit (ITC), you can reduce the cost to $8400.

You can claim this incentive as a credit when filing taxes. One important thing to remember is that Florida residents who purchase solar panel systems with cash or a solar loan qualify for ITC. If you are eligible for ITC, fill out Form 5695 and submit the document when filing taxes.

The Federal Solar Tax Credit (ITC) won't last forever. The rebate percentage will reduce to 26% in 2033 and then 22% in 2034. If the federal government does not renew the credit before then, it might expire in 2034.

Solar Energy System Property Tax Exemption

Solar panels or other renewable energy investments, such as geothermal heat pumps or wind turbines, are exempt from property tax in Florida. That means even if the home value increases after installing solar panels, you won't have to pay additional property taxes.

Let's take an example to understand. Florida's average property tax is 0.98%. If the average cost of installing the solar panel system to a house in Florida is $24,000, they can save $235 per year due to property tax exemption. However, this solar incentive in Florida might expire at the end of 2037.

Solar System Sales Tax Exemption

Florida also offers a sales tax exemption for purchasing solar panels, solar water heaters, solar space heaters, etc. The state-level financial incentive is administered by the Florida Department of Revenue and has no maximum limit. The solar incentive applies to the Florida sales tax or 6% of the solar panel costs and is applied automatically during the purchase process.

For example, if you purchase a 10 kW system for $33,100, the sales tax exemption will be $1986. One thing to note is that Floridians do not pay any sales tax when investing in a solar panel system—no matter the size of the system. However, solar equipment must be certified by the Florida Solar Energy Center to claim a tax exemption.

Solar Loans

Florida also offers some solar loans for those who don't want to spend upfront money purchasing solar systems. Here are a few of them :

Florida Residential PACE Loans : Florida, similar to California, also offers property-assessed clean energy loans for installing solar panels. With PACE loans, people can install solar panels without any upfront cost. PACE loans do not require a credit check but a lien on the property.

Florida SELF Loans : The Solar and Energy Loan Fund encourages underserved communities to install solar panels. The applicant must own a residential property. They get a fixed rate of 7.99%—8.25% for loans of $3000 - $25000 over 3 to 10 years.

Clay Electric Energy Conservation Loan : These loans are available to help Florida members finance energy efficiency improvements for their homes. You can borrow $10,000 for improvements, like solar panel installation. However, you need a good payment record with Clay Electric and a credit history to qualify for the solar loan.

Inflation Reduction Act (IRA)

The Inflation Reduction Act (IRA) offers up to 30% of the cost of the solar system to eligible homeowners installing home solar panels. For example, if you buy a solar system for $15,000, you would qualify for a tax reduction of up to $4500.

The IRA credit helps reduce the upfront cost of installation and the switch to clean energy. To qualify for the rebate, you must file IRS Form 5695 with your federal income tax return in the year that you install the system.

Florida Local Incentives

Florida might have a few state-level rebates, but local utilities and cities offer many financial rebates for installing solar panels, solar water heaters, solar attic fans, and solar pool heaters. Here are a few of them :

Jacksonville Electric Authority (JEA) : The JEA offers up to $400 to its residential customers who convert from an electric water heater to solar power.

Beaches Energy Solar Water Heater Rebate : Beaches Energy serves the beach cities east of Jacksonville, Florida, and offers up to $1,250 back to its customers for energy-efficient upgrades. Customers also get up to $500 for installing solar water heaters.

Keys Energy Solar Water Heater Rebate : Keys Energy offers rebates for efficient refrigerators, dishwashers, and ceiling fans. The residential customers also get up to $450 for solar water heaters.

New Smyrna Beach Solar Attic Fan Rebate : The coastal utility of New Smyrna offers a few efficiency rebates, including rebates for solar attic fans. The qualified purchases can get up to 25% back of the solar attic fan installation.

Florida Net Metering

Net metering is another rebate program that helps Florida residents earn money using the solar system while saving on their energy bills. In the net metering program, residents can sell the surplus power generated by their solar power panels to the local utility company. You will get paid to send excess power back to the electric grid.

The two biggest utility companies—Duke Energy and Florida Power and Light (FPL)—offer net metering programs in Florida. Most Florida homeowners typically fall into Tier 1, which has a system size of 10 kW. There is no application for this tier, but higher tiers must pay a fee. For example, FPL charges a $400 fee for Tier 2 and $1000 for Tier 3.

While the Duke Energy program is available statewide, the FLP buyback program is only available in some cities, including :

- Melbourne

- Miami

- Naples

- Ocala

- Orlando

- Port St. Lucie

- Clearwater

- Daytona Beach

- Fort Lauderdale

- Fort Myers

- Gainesville

- Kissimmee

- Lake City

- Lakeland

- Augustine

- Petersburg

- Tampa

- West Palm Beach

To enroll in net metering in Florida, you must complete the application form and send it to your utility company.

Are There Any Energy Storage Incentives in Florida?

Florida currently does not provide any state-specific energy storage incentives. Some Florida cities and municipal electric utility companies (like Orlando, Lakeland, and Jacksonville) have previously offered tax credits and rebates for solar batteries. However, as of early 2024, they all appear to have expired. Florida doesn't have a viable Solar Renewable Energy Credits (SREC) market because it does not have a Renewable Portfolio Standard (RPS) or solar electricity targets.

Is Solar Worth It in Florida?

For many homeowners, going solar in Florida is well worth the investment — especially given how many sunny days the state gets. Additionally, the Florida solar incentives reduce the overall cost of solar panels. This not only helps you reduce the monthly electricity bills but also offers energy independence during power outages. Here are some benefits of going solar in Florida :

- With solar panel installation in Florida, you can save money on utility bills with financial incentives and net metering.

- Switching to clean solar energy eliminates your reliance on fossil fuels, which harm the environment.

- If you store excess energy generated by the solar panels in battery backups, it helps you power the house when the electricity goes out due to storm damage or other big events.

Jackery Solar Generators in Tax Rebates

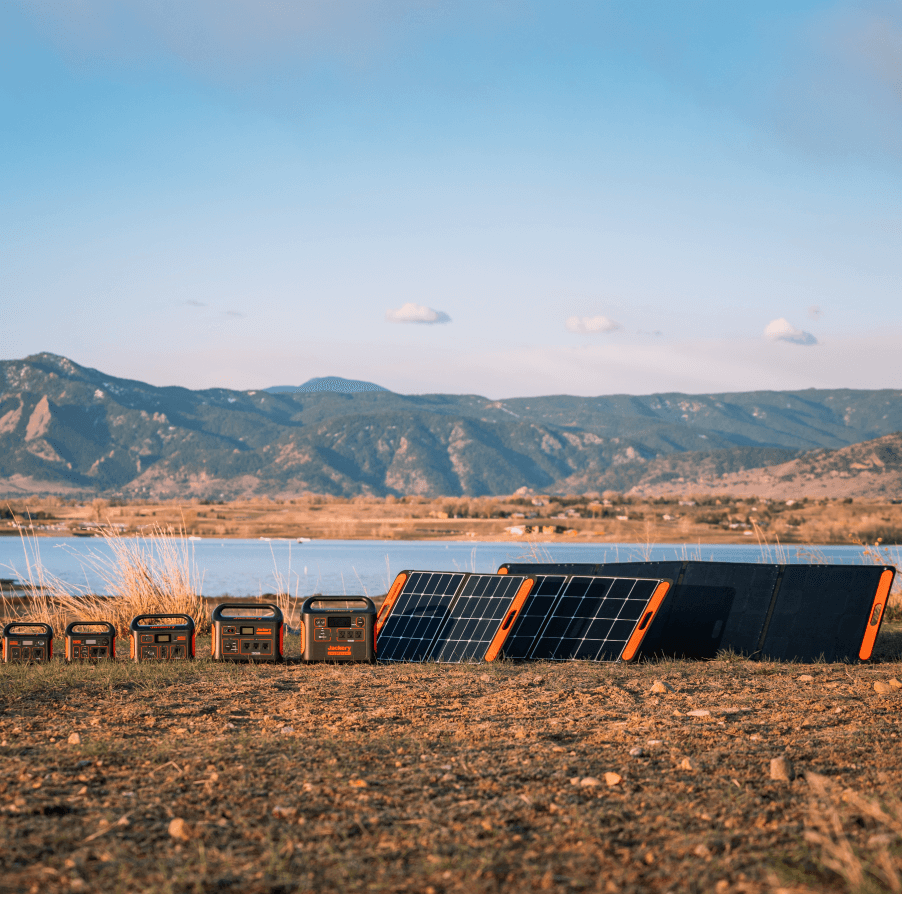

Jackery is a reputable solar brand that manufactures and sells solar generators, portable power stations, and solar panels. The Jackery Solar Generators combine efficient Jackery Explorer Portable Power Stations and portable Jackery SolarSaga Solar Panels to collect, convert, and supply electricity to indoor or outdoor appliances.

If you invest in renewable energy sources for your house, you may qualify for an annual residential clean energy tax credit. The tax rebate is equal to 30% of the costs of the new solar panel system. For example, purchasing the Jackery Solar Generators will help you earn a tax rebate of up to $839.7 — $1139.7. To claim the refund, you can fill out Form 5695 and save some upfront money on a solar generator.

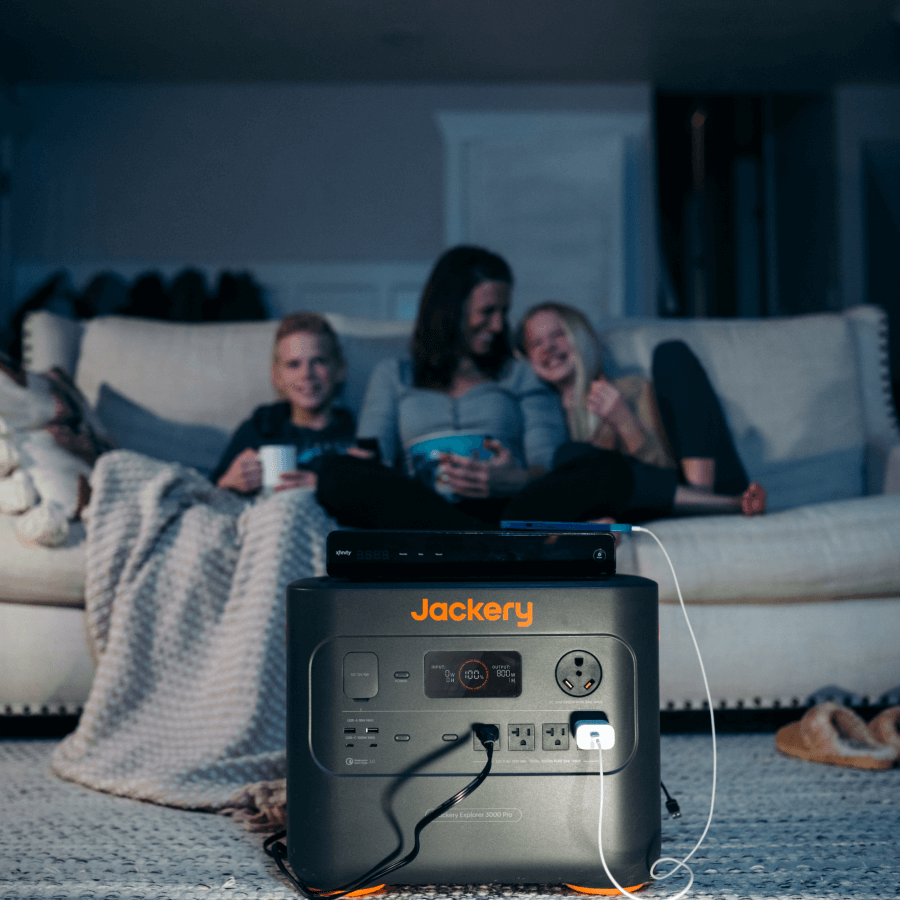

Jackery Solar Generator 3000 Pro

The Jackery Solar Generator 3000 Pro has a large NMC battery that can charge 99% of household appliances in Florida. You can get up to $839.7 in tax rebates if you invest in the powerful Jackery Solar Generator 3000 Pro. Despite being large in size, the battery-powered generator has built-in double wheels and pull rods for easy movement. The smart power master supports app control, making it ideal for home emergencies. It can also be integrated into the home circuits via the Jackery Manual Transfer Switch by choosing 6 circuits from the breaker panel and starting charging appliances in the blink of an eye.

Customer Review

"I just had this Jackery Solar Generator 3000 Pro for a month, and so far, so good. I was able to run every single appliance in my house without any problem—the 4-door refrigerator, the 85-inch TV, the 4-in-1 portable air conditioner, electric fans, and, of course, the smaller TVs and our laptops, tablets, and phones."—Jocarpo.

Jackery Solar Generator 2000 Plus Kit (4 kWh)

The Jackery Solar Generator 2000 Plus (4 kWh) is a sizeable battery-powered generator for large households and apartments. It features a stable LiFePO4 battery that can charge 99% of household appliances in Florida to reduce monthly electricity bills. You can charge small-sized appliances like mobile phones and large appliances like heavy-duty air conditioners. You can qualify for a tax rebate of up to $1139.7 to reduce the upfront cost of the system. Thus, it is a great charging solution for people looking for an emergency home backup solution or a large solar generator for an off-grid lifestyle.

Customer Review

"The Jackery Explorer 2000 Plus and Battery Pack with the 200W solar panels package is a great combination for home backup and RV usage. I like the idea that if I need more power in the future, I can purchase another battery pack." — Larry Gee.

|

|

Solar Generator 3000 Pro |

Solar Generator 2000 Plus Kit (4kWh) |

|

Capacity |

3024 Wh |

2-24 kWh |

|

Battery Cell |

NMC |

LiFePO4 |

|

Cycle Life |

2000 cycles to 70%+ capacity |

4000 cycles to 70%+ capacity |

|

Output Ports |

AC Output (x1) : 120 V~ 60 Hz 25 A Max AC Output (x3) : 120 V~ 60 Hz 20 A Maximum USB-C Output (x2) : 100 W Maximum, 5 V⎓3 A, 9 V⎓3 A, 12 V⎓3 A, 15 V⎓3 A, 20 V⎓5 A |

AC Output (×4) : 120 V~ 60 Hz, 20 A Maximum AC Output (×1) : 120 V~ 60 Hz, 25 A Maximum USB-A Output (x2) : Quick Charge 3.0, 18 W Maximum USB-C Output (x2) : 100 W Maximum, (5 V, 9 V, 12 V, 15 V, 20 V up to 5 A) |

|

Working Hours |

Pellet Stove (350 W) : 7.3 H Refrigerator (900 W) : 2.8 H Space Heater (1500 W) : 1.7 H Sump Pump (1200 W) : 2.1 H Deep Freezer (500 W) : 5.1 H |

Pellet Stove (350 W) : 9.9 H Refrigerator (900 W) : 3.8 H Space Heater (1500 W) : 2.3 H Sump Pump (1200 W) : 2.8 H Deep Freezer (500 W) : 6.9 H |

|

How Much It Can Save with Tax Rebates |

$839.7 (Though this is an estimated value) |

$1139.7 (Though this is an estimated value) |

Florida Solar Incentives FAQs

Does Florida have incentives for solar?

Yes, homeowners in Florida can take advantage of many solar incentives, such as property tax exemption, sales tax exemption, and Federal Solar Tax Credit. The favorable net metering also compensates homeowners when they send the excess generated by the panels back to the grid.

Is it worth getting solar panels in Florida?

Solar panels in Florida are worth it because of the abundant sunshine, favorable net metering policy, and many solar incentives.

How much should I pay for solar panels in Florida?

The average price of solar panel systems in Florida is nearly $2.60 per watt. If you install the standard residential solar panel system size of 5 - 6 kW, you will have to pay between $13,000 and $15,600.

How long do solar panels take to pay for themselves in Florida?

Solar panels in Florida take anywhere between 6 and 10 years to pay for themselves. However, the payback period depends on many factors, including the size of the solar system, the household's overall electric usage, the chosen electricity rate plan, and the amount of energy the solar system produces.

What is the average solar bill in Florida?

On average, solar systems in Florida cost around $11,700 after financial incentives. Homeowners pay between $1.95 and $2.65 per watt in solar bills.

Final Thoughts

Florida's year-round sunny weather makes it an excellent state for switching to solar energy to lower power grid dependency and electricity bills. In fact, according to the SEIA (Solar Energy Industries Association), Florida ranked third in the country for solar power. If you want to go solar and reduce the average electric bill in Florida, there are many solar loans and incentives available.

Florida solar incentives reduce the initial investment needed to install solar panels. Jackery Solar Generators are great for charging indoor and outdoor appliances during extended power outages, blackouts, RVing, camping, etc. If you invest in a Jackery Solar Generator 3000 Pro or Jackery Solar Generator 2000 Plus (4 kWh), you can avail of a tax rebate of $839.7 — $1139.7, making the setup more affordable.

References

Residential Clean Energy Credit | Internal Revenue Service

About Form 5695, Residential Energy Credits | Internal Revenue Service

Florida State Tax Guide: What You’ll Pay in 2024

Solar and CHP Sales Tax Exemption

Affordable Solar System Loan, Solar Panel Financing

About Us | Who Is the Florida PACE Funding Agency?

Energy Rebates & Loans | Clay Electric Cooperative, Inc. Keystone Heights, Florida

Energy Rebates | Beaches Energy Services

![[Add - on] Jackery Manual Transfer Switch for Explorer 5000 Plus - Jackery](http://www.jackery.com/cdn/shop/files/add-on-jackery-manual-transfer-switch-for-explorer-5000-plus-9017324.png?v=1754016782&width=170)

![Guide to Florida Solar Incentives, Rebates, & Tax Credits [2024]](http://www.jackery.com/cdn/shop/articles/guide-to-florida-solar-incentives-rebates-tax-credits-2024-7510598.jpg?v=1754018089)

Leave a comment