The HVAC upgrade rebates make switching to power-efficient HVAC systems more affordable. As energy efficiency is a national priority, numerous federal, state, and utility-based rebates and incentives are available to homeowners. Federal programs like the Energy Efficient Home Improvement Credit can offer credits of up to $3,200 per year. Check out other federal, state-specific, and utility-based rebates to increase your savings.

Besides rebates, Energy Star heating and cooling system upgrades can slash monthly electric bills. Solar generators can be a crucial part of your essential home backup system if you want to save more. Jackery Solar Generators, with their highly efficient batteries, can power most of your HVAC appliances during peak hours. They also provide a reliable way to harness solar energy without complex installations.

Key Takeaways

- The Federal Tax Credits for HVAC upgrades include the Energy Efficient Home Improvement Credit, HEAR, and HOMES program.

- State or utility-based HVAC upgrade credits can range from a few hundred dollars to $10,000.

- Eligibility criteria for a rebate vary by type (federal, state, local, or utility). For example, the HEAR program is aimed at low to mid-income families. In contrast, appliances on par with the energy efficiency standard qualify for the HOMES program.

- The HVAC rebates and tax credits application process involves gathering necessary documents, filing the return, and claiming your credit.

Federal Tax Credits for HVAC Upgrades

The Inflation Reduction Act (IRA) 2022 offers attractive rebates to homeowners who opt for energy-efficient HVAC upgrades. This is primarily aimed towards promoting a shift towards greener energy alternatives. Here are some top federal tax credits for HVAC upgrades:

Energy Efficient Home Improvement Credit

The IRA Energy Efficient Home Improvement Credit allows homeowners to save up to $3,200 annually on taxes for Energy-Efficient Upgrades. The credit covers various home upgrades, with most deductions focusing on heating and cooling appliances.

That’s good news because, as per Energy.gov, 43% of a home utility bill comprises heating and cooling costs. As per the Internal Revenue Service, the maximum energy tax credits you can claim each year is:

- Up to 30% of HVAC upgrade costs or up to $2,000 for upgrading to qualified water heaters, heat pumps, or biomass boilers.

- Up to $1,200 can be spent on energy-efficient property upgrades or home improvements, with limits on exterior windows and skylights ($600), exterior doors ($250 per door and $500 total), and home improvement audits ($150).

Central Air Conditioners Tax Credit

As per Energy Star, this tax credit applies to products purchased between January 1, 2023, and December 31, 2032. A user can claim a maximum of 30% of the project cost or $600, whichever is less. To qualify for the tax credit, homeowners must install the air conditioner in a primary residence in the US.

Home Electrification and Appliances Rebate (HEAR) Program

As per Energy Star, the HEAR Program focuses on efficient electrification projects for households with income less than 150% of the area median. It offers rebates for installing qualifying appliances, and the maximum obtainable rebate for a single home is $14,000.

Home Efficiency Rebates (HOMES) Program

In the HOMES program, energy rebates reward homeowners for achieving a verifiable energy use reduction—the greater the energy savings, the higher the rebates. However, the amount cannot exceed $8,000 for a single/multifamily house.

State and Local HVAC Rebate Programs

Other than federal, loads of state or utility-wise HVAC upgrade programs are available. Depending on where you live, these range from a few hundred dollars to up to $10,000. Here’s a list of the top states with HVAC upgrade rebates:

California: The TECH Clean California Program in the states offers incentives of $3,100 to $4,185 per unit to switch from a traditional heating to a unitary heat pump.

Colorado: There’s a $1,500 tax rebate on anyone installing an Energy Star-certified air-source heat pump. Meanwhile, there is a maximum of $3,000 and $500 for other heat pumps and water heaters, respectively.

Besides, many utility companies, local governments, and their partner organizations offer extra rebates that can stack up. The one from Xcel Energy will apply to most Coloradans, which is the primary utility in most areas. The rebates on heat pumps can go up to $2,200, while a one-time $100 enrollment bill credit for joining the AC rewards program.

Florida: About a dozen utility companies around Florida offer rebates to customers who make HVAC upgrades. The savings can range from $25 to $1,630, depending on the company. For example, Duke Energy offers a rebate of $300 toward replacing the existing strip heat system.

Illinois: The rebates and discounts in Illinois come from electric companies. ComEd covers Chicagoland and most of northern Illinois and offers rebates of up to $6,000 on heat pumps and $250 on electric washers. Ameren Illinois covers the rest of the state and offers up to $700 rebates on HVAC upgrades.

Massachusetts: Mass Save runs the state's biggest heating and cooling incentive program. It’s a partnership between several electric and gas utilities and energy providers. Under this program, a rebate for a whole-home upgrade is up to $10,000, while a partial-home upgrade is $1,250 a ton. Considering the high average electric bill of Massachusetts, these rebates, paired with federal rebates, can help save a lot.

New York: With HVAC upgrade rebates under programs like NYSERDA's NYS Clean Heat and NYSEG's residential rebates, consumers can save between $700 and $9,000.

Idaho: The Idaho Residential Alternative Energy Tax Deduction deducts 40% of the cost of a heat or electricity production device from your taxable income. The maximum deduction is $5,000 annually or $20,000 for four years. Homeowners can also seek rebates from local utilities like Avista Utilities and Idaho Power.

Texas: Utility companies are the most likely source for rebates or discounts on HVAC upgrades in Texas. For instance, Oncor provides a discount of up to $3,300, while Southwestern Electrical Power Company offers up to $3,500 for a qualifying heat pump.

Virginia: Only a few utility companies, like TVA and Appalachian, offer rebates to customers who install heat pumps in Virginia. The savings can range between $50 and $1,625, depending on the company and system size.

Washington, D.C.: Residents can receive a rebate of up to $5,000 on qualifying heat pumps through the D.C. Sustainable Energy Utility (DCSEU).

In addition to these, Frontdoor Inc., the nation’s leading provider of home service plans, has a New HVAC program. The HVAC upgrades for Frontdoor Pro members come at a discount of up to 50% of the retail price. However, the service isn’t available in all areas, so check your eligibility first.

Eligibility Criteria for HVAC Rebates and Credits

Not everyone is eligible for HVAC rebates and credits. The eligibility varies because of a number of factors. For example, high-income families aren’t eligible for the HEAR program, while appliances must demonstrate a certain degree of energy efficiency to qualify for the HOMES program. Let’s explore these in detail:

Energy Efficient Home Improvement Credit

You can claim this HVAC upgrade credit to improve your primary residence. According to the IRS, the house must be in the United States. Appliances that meet energy efficiency standards of Energy Star certifications or the International Energy Conservation Code (IECC) qualify for the credit.

Central Air Conditioners Tax Credit

According to Energy Star, split system central air conditioners with SEER2 ≥ 17.0 and EER2 ≥12.0 are eligible for the rebate. Meanwhile, packaged air conditioners must have SEER2 ≥16.0 and EER2 ≥11.5. The credit is only applicable upon installation of the air conditioner in an existing home in the United States.

Home Electrification and Appliances Rebate (HEAR) Program

As per Energy Star, the program is primarily aimed at low and moderate-income homeowners, so households above 150% area median won’t be eligible for this rebate. Also, many states have paused or delayed their programs due to the lack of federal funding, so verify it first.

Home Efficiency Rebates (HOMES) Program

According to Energy Star, only ENERGY STAR-certified products with minimum energy efficiency are qualified for this rebate. The appliances must reduce energy usage by at least 20%; the more energy you save, the higher the rebate.

Barring the Federal Tax Credit, here’s a comparison table of rebate programs of the top ten US states alongside their eligibility criteria:

|

State |

Rebate Program |

Maximum Rebate Amount |

Eligibility Criteria |

|

California |

TECH Clean California Program |

$4,185 per unit |

Homeowner or renter with an active Southern California Edison (SCE) service account. |

|

Colorado |

Colorado Heat Pump Tax Credits |

$3,000 |

Residents must install an eligible appliance through a registered contractor. |

|

Florida |

Utility-based rebates |

$1,630 |

The homeowner must be a residential customer in the utility provider’s service area. |

|

Massachusetts |

Mass Save |

$10,000 |

Must be a full-time resident of Massachusetts. |

|

Illinois |

Utility-based rebates |

$6,000 |

The homeowner must be a utility customer and a resident of the state. |

|

New York |

NYSERDA's NYS Clean Heat and NYSEG's residential rebates |

$9,000 |

Must be a New York state resident and install HVAC equipment from a registered contractor. |

|

Idaho |

Idaho Residential Alternative Energy Tax Deduction |

$5,000/year |

Must be a primary resident of Idaho, and the deduction applies to both new and existing homes. |

|

Texas |

Utility-based rebates |

$3,500 |

The homeowner must be a residential customer in the utility provider’s service area. |

|

Washington D.C |

D.C. Sustainable Energy Utility (DCSEU) |

$5,000 |

A licensed contractor must install the equipment between October 1, 2024, and September 30, 2025. |

|

Virginia |

Utility-based rebates |

$1,625 |

The appliance must be Energy Star certified and meet specific utility-based requirements. |

Application Process for HVAC Rebates and Tax Credits

Now that you understand the HVAC upgrade tax credits, it is time to take advantage of one. Here is the process you must follow:

Step 1: Gather the Necessary Documentation

You must keep hold of certain documents to claim your HVAC upgrade credit. This includes your purchase and installation receipts and the certificate confirming the appliance’s efficiency ratings.

Step 2: Filing Your Tax Return

Now you have the required documents sorted, it’s time to file your tax return. Download IRS Form 5695 with your annual tax return and fill it out carefully. For example, if you’re applying for an energy-efficient air conditioner tax credit, input a maximum value of $300 in line 22a and the same in 23, 24, and 30.

Step 3: Claiming Your Credit

Proper paperwork filing before the tax day deadline is essential to ensuring you receive the HVAC upgrade tax credit. Late filings might lead to a loss of eligibility.

Maximizing Savings on HVAC Upgrades

Maximizing savings on HVAC upgrades isn’t just about claiming the available rebates but optimizing energy efficiency. Here’s how you can do that:

- Stack Tax Credits and Rebates: It’s encouraged as long as the amount doesn’t exceed the overall project cost. Research the available rebates in your states and which national rebates you’re eligible for to make a decision.

- Timely Upgrade: Consider upgrading your HVAC system when it breaks down or requires costly repairs. This indicates that the system is at the end of its lifespan, and an upgrade is more cost-effective in the long term.

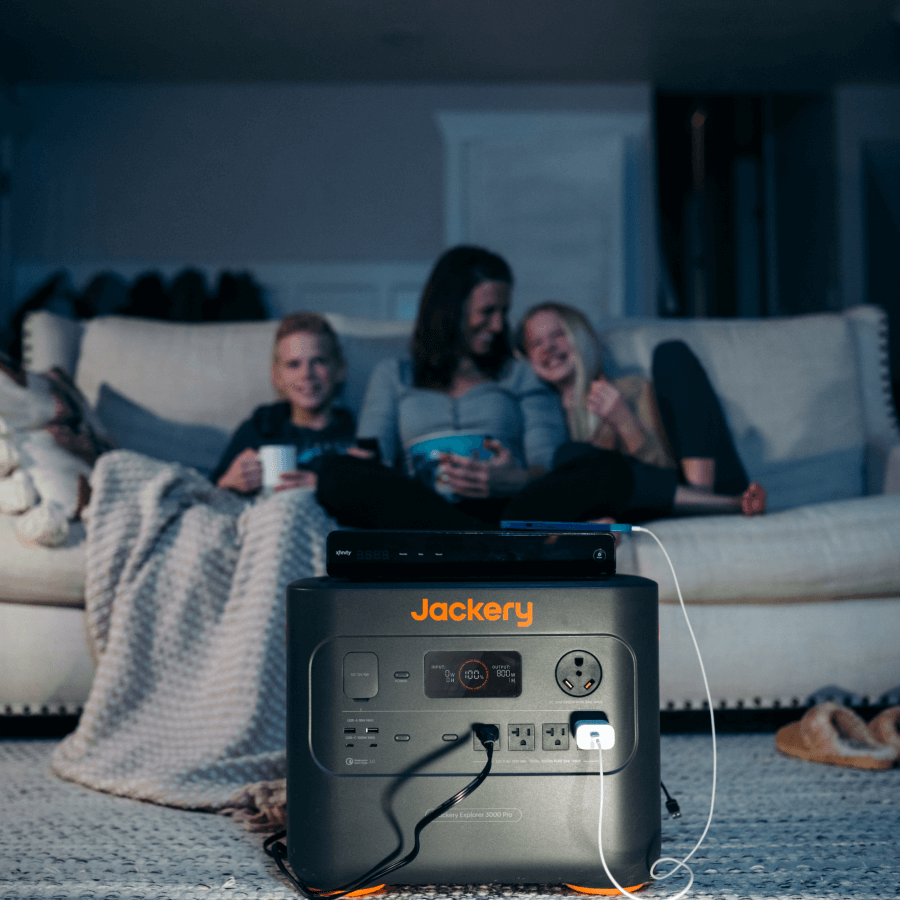

- Use a Battery-Backup Solution: You can use a battery backup solution like Jackery Solar Generator for HVAC systems during peak energy demand to help reduce energy costs. It is also reliable as part of your essential home backup system and can help maintain comfort during power outages.

- Smart Thermostats and Automation: Smart thermostats understand users’ preferences and adjust the system's temperature accordingly.

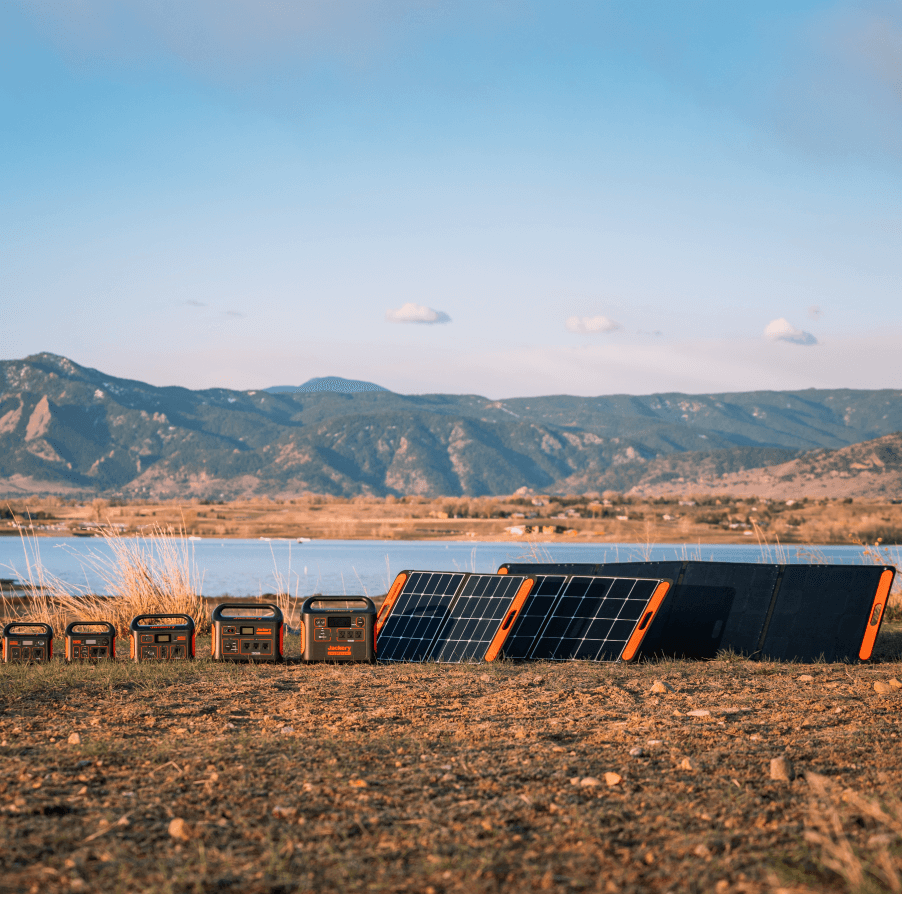

Jackery Solar Generator for HVAC

Jackery is a leading manufacturer of solar-powered products, such as solar generators, portable power stations, and foldable solar panels. A Jackery Solar Generator combines Jackery Portable Power Stations and compatible Jackery SolarSaga Solar Panels to convert sunlight into usable electricity.

Jackery Solar Generators can be an excellent investment in your essential home backup system if you’re preparing for power outages. You can use them to power your HVAC appliances and see a drop in your electric bills.

Jackery Solar Generator 5000 Plus

Jackery Solar Generator 5000 Plus is suited for large households with appliances like heat pumps, air conditioners, and other devices. It's ideal for families looking to cut down on their electricity bills or those living in areas prone to frequent rolling blackouts. With a Jackery Smart Transfer Switch, you can connect Jackery Solar Explorer 5000 Plus to the electric panel, which switches it to the backup power within 0ms, i.e., almost immediately. It ensures seamless switching to keep your HVAC appliances running during power outages and can be a crucial element of your essential home backup system.

Appliances Working Hours:

- Window AC (1800W): 2.3H

- Hair Dryer (1500W): 2.8H

- 120V Heat Pump (2500W): 1.7H

- Induction Cooktop (2000W): 2.0H

- Refrigerator (1200W): 3.3H

Customer Review:

“Awesome back-up unit. The wheels are pretty good. Three hours of home theater use (roughly 130 watts/hour) consumes about 10-15% of the inverter's charge.” - Telkwa.

FAQs for HVAC Upgrade

How much can I save by upgrading my HVAC?

Upgrading your HVAC system to an energy-star-rated system will lower your electricity bills by 20-40%. The federal, state, and utility-based rebates further enhance the savings.

What is the 2025 HVAC rebate in NJ?

In 2025, homeowners in New Jersey can receive up to $6,000 in cashback incentives and up to $25,000 in zero-interest financing for energy efficiency upgrades. This is per the 2025 Whole Home Energy Efficiency Program, but make sure you’re eligible for the incentives.

What are the benefits of upgrading HVAC?

Upgrading to an HVAC system has multiple benefits, including improved energy efficiency, enhanced comfort, lower energy bills, and potentially increased property value.

What is the New Jersey Energy Star program?

The New Jersey Energy Star Program incentivizes homeowners to help them make energy-efficient home upgrades. With incentives ranging between $2,000 and $6,000, the primary aim is to reduce overall energy consumption and financial savings.

How do I claim my tax rebate for a new HVAC system?

To claim your tax rebate, check your eligibility to determine whether your property meets the energy savings requirements and get documentation of your purchase. Then, file Form 5695, Residential Energy Credits, when you file your year's tax return.

Conclusion

An HVAC upgrade is a wise decision to maximize the comfort and savings of your home. Federal and state rebates and credits make it even more affordable. Determine the rebate you’re eligible for and fill out the tax form. Installing a smart thermostat is also a wise decision. You can also add a battery backup solution like Jackery Solar Generator to increase your savings. With the solar generator being a part of your essential home backup system, you can reduce reliance on the utility grid and lower electricity costs.

![[Add - on] Jackery Manual Transfer Switch for Explorer 5000 Plus - Jackery](http://www.jackery.com/cdn/shop/files/add-on-jackery-manual-transfer-switch-for-explorer-5000-plus-9017324.png?v=1754016782&width=170)

![HVAC Upgrade Rebates: Save up to $3,200 Annually [2025 Guide]](http://www.jackery.com/cdn/shop/articles/hvac-upgrade-rebates-save-up-to-3200-annually-2025-guide-8340213.png?v=1754019043)

Leave a comment