SERC, or Solar Renewable Energy Credit (Solar Renewable Energy Certificates), is a specific credit that is used whenever you have extra energy from your solar power plant. The primary aim of this program is to motivate homeowners to get their electricity generated from the solar plant and reduce dependence on the electrical grid. However, unlike popular solar incentives like federal solar tax credit, SRECs aren’t available to everyone and vary from one state to another. The extra income you get from SRECs is one of the many financial benefits of going solar.

With Jackery Solar Generators, you’re eligible to get up to 30% tax rebates to save a chunk from its upfront cost, and you can save a lot on electric bills. Besides, its high-capacity battery makes it a viable companion for home emergencies and off-grid living.

Key Takeaways

- SERC is a way to compensate homeowners for generating electricity from solar energy.

- It exists to motivate more people to use electricity produced from solar energy.

- You can sell these SERCs to utilities and any other organizations under the mandate of renewable energy.

- Only eight states in the US have SRECs in place.

- SERC markets are volatile and subject to supply and demand, so it’s important to keep track of them and sell at the right time to make maximum earnings.

- You must select a broker and its contract depending on the risk quotient.

What Is A Solar Renewable Energy Credit (SREC)?

To define what SREC is, it’s an incentive paid to homeowners to generate electricity from solar energy. For each MWh (1000 kWh) of electricity, the utilities pay you 1 SREC. For example, a 7kW solar generator producing around 10MWh of electricity per year would give you 10 SRECs. An SREC is just a solar-specific version of REC that accounts for overall renewable energy.

Important Terms:

Renewable Portfolio Standards (RPS): Every year, utilities must account for some portion of their electricity to generate from renewable sources.

Solar carve-out: It is an RPS requirement that sets the amount of electricity utilities must generate annually from solar energy. It often dictates the SREC market or price of each SREC, as the utilities must purchase a specific amount to comply with the requirement.

Renewable Energy Credits (RECs): Credits utilities purchase from renewable energy producers to meet their renewable portfolio standards.

Solar Renewable Energy Credit (SREC): A type of renewable energy credit that utilities issue on producing 1000 kWh of electricity from solar energy.

Why Do SRECs Exist?

RPS regulations require utilities to generate a certain portion of electricity from renewable resources. In addition to generating energy themselves, utilities can purchase SRECs to comply with the regulations and avoid paying penalties. RPS exists in multiple states, but SRECs exist in a handful of states with solar carve-outs. In other words, only these states generate a certain amount of electricity from solar energy. Utilities can purchase and sell SRECs in only these states.

The primary aim of having SRECs is to create an incentive and demand for solar growth. In other words, more people would use solar energy to produce electricity to earn SREC, thereby reducing the potential dependence on the electrical grid and alleviating the negative impacts of climate change. Now, although the motive of these SRECs seems very noble and can potentially drive the adoption of solar energy, it has many drawbacks. Following are the pros and cons of SREC:

Pros

Financial Incentives: SRECs provide an additional revenue stream for homeowners who produce solar energy, so the more they generate, the more they earn. This way, utilities can also stay on par with the requirements set by RPS.

Environmental Benefits: More production of clean energy means less reliance on the electrical grid and fossil fuels and lower emissions of greenhouse gases.

Market-Driven Approach: Based on the set target and solar energy produced within the time, utilities can decide to purchase the number of SRECs. They can also choose to divide the equation between purchasing SRECs and generating solar energy based on their needs and capabilities.

Cons

Market Volatility: When utilities have the option to produce solar energy or purchase SRECs, it potentially makes it difficult for homeowners to predict the price of SRECs in the future. Also, too many people producing solar energy hoping to make extra bucks might end up cutting down the demand for SRECs and, in turn, the financial benefits.

Complexity: Purchasing and selling SRECs can be time-consuming and complex, as utilities must maintain accurate production data and monitor market rules. Besides, SREC programs vary from state to state, so understanding market conditions and regulatory compliance can be challenging.

Policy-Dependent: Purchasing and selling SRECs completely depends on state policies, and any changes potentially affect the market and intent of producing solar energy.

How Does SREC Work?

Solar Renewable Energy Credits (SRECs) are a market-based, tradable instrument that represents legal property rights to the “renewable-ness” of energy generation—in other words, the amount of solar energy used to generate electricity. The process starts with Renewable Portfolio Standards (RPS) setting up a solar carve-out, followed by enforcing it to all utilities in the area. SRECs are then used as proof of compliance with these standards.

Now, these are sold separately from actual electricity, and the owner can claim that they are “being powered with” or “using” the solar energy associated with the REC. If you have an SREC associated with your renewable energy project, you can sell it to another party, irrespective of who they are: homeowners or utilities.

An SREC owner can work with a buyer or aggregator to make a direct purchase or use an auction to sell them. The most common way, however, is through brokers, who take a percentage from it to facilitate the transactions. And once sold, you can no longer claim it as your own and rather generate additional revenue.

System hosts or utilities can also choose to sell the SRECs associated with their on-site solar generators or purchase cheaper ones from other geographically eligible green power resources to make claims about clean power generation. This is called “REC arbitrage,” where the host gets the financial benefits of solar REC while making environmental claims and remaining compliant with RPS standards.

Which States Have SRECs Market?

While 38 states in the country have RECs in place, only 8 of them have SREC programs in place, where individuals can sell and purchase solar credits. These include:

- Delaware

- Maryland

- Massachusetts

- New Jersey

- Ohio

- Pennsylvania

- Washington DC

- Virginia

In addition to these, individuals from Indiana, Kentucky, Michigan, and West Virginia can sell their SRECs in Ohio’s SREC market despite not having their own market.

SREC trading is a pretty new thing, and the markets came into existence when solar targets were first set up in Pennsylvania and New Jersey in 2005, followed by Washington D.C. and Delaware in 2007. Things began to ramp up when New Jersey shifted greater reliance on SREC markets from just a rebate program to support solar projects. Since then, the rest of the states have implemented their solar carve-outs, and every state has a separate target for the usage of solar energy, with New Jersey being the highest.

By taking advantage of this program, individuals and businesses not only cut down their carbon footprint but save on energy costs in the long run. The individuals get extra money by selling them at the right time.

How Much Are SRECs Worth?

Renewable Portfolio Standards (RPS) regulate the market demand, and depending on it, the prices of SRECs vary between $3.50 to $400. Just like stock prices or even the price of a commodity, the prices of SRECs increase when there’s an increased demand and reduced supply, and prices fall when there’s an oversupply. Over a year, your revenue for generating 8.5MWh of electricity can get as high as $3145 in Massachusetts.

The following table outlines how much SRECs were selling as of April 2024:

|

State |

SREC Price |

Annual Earnings** |

|

Maryland |

$58.00 |

$580.00-754.00 |

|

New Jersey |

$206.00 |

$2060-2678 |

|

Ohio |

$3.00 |

$30-39 |

|

Pennsylvania |

$34.50 |

$345.00-448.5 |

|

Washington DC |

$442 |

$4420-5746 |

|

Delaware |

$8 |

$80-104 |

|

Massachusetts |

$300 |

$3000-3900 |

Source: SRECTrade and SOLSystems

**Annual credits assumed 10-13 per year

As mentioned, the values are subject to change and depend on how you sell it. For example, SOLSystems has four ways to pay for the credits:

Upfront: The broker pays a one-time lump sum payment for your expected production (typically for 15 years). For example, their current rate in Washington, DC, is $1510 per kW for 15 years, while there’s no such contract option in Delaware.

Profit Share: Guaranteed base price credit and a potential to earn more if the market price increases.

Annuity: Guaranteed an amount, typically for 3-5 years.

Brokerage: Sell your SRECs at the highest market price.

While you have a contract for guaranteed or fixed payments, you risk losing money when the market credit price per kWh is high, or you’re at a profit if the price declines. Irrespective of the contract type and market price, getting an SREC is always an added bonus, which you get alongside the costs you save on going solar.

Aside from these, the prices you get for your SRECs depend on the penalties utilities pay for not meeting the targets. Also known as Alternate Compliance Payments (ACPs), some utilities choose to take the penalties rather than purchase SRECs because of the higher price ceiling of the latter. This, in turn, cuts down the demand in the next quarter and lowers prices.

How to Earn & Sell SRECs?

Selling SRECs seems a smart way to go renewable and earn some money with it as well, but it all goes without saying that you must do it right. SRECTrade and Sol Systems are the two largest brokers whom you must look to sell, but there are a few things you must do before and after, which are as follows:

Step 1: Register Your System

SREC registration is fairly straightforward, and you can do it on your own or let the companies do it for you. Irrespective of the way, your system is registered with the Public Service Commission and then submitted to the GATS or Generation Attribute Tracking System managed by PJM. You should get the approval within 5-7 business days and start earning credits.

Step 2: Choose Who You Want to Sell

Now that you’re registered, it’s time to choose who you choose to sell your SRECs, and SRECTrade and Sol Systems are the two largest brokers out there. There are Flett Exchange, SubTribe, and Carbon Solutions Group, amongst other options available. Go through their offerings and pricing trends, and opt for one accordingly.

Step 3: Create an Account

Whichever broker you select, you must provide your email ID and set up a profile with them by providing relevant details. You also might need to provide relevant details of your solar system, so make sure to keep them alongside.

Step 4: Select the Contract Type

Once you’ve registered and chosen the broker, you typically will get four options: Annuity, Profit Share, Upfront, and Brokerage. As mentioned in the previous section, the type of contract you opt for depends on whether you’re willing to take a risk in this volatile market or get a lump sum amount for a fixed number of years (typically 15).

Step 5: Give Permission

As you create the account and finalize the contract type, they’ll send the contract via DocuSign. It contains all the terms and conditions of the contract, so ensure that you fully go through it.

Once you’re content with the terms, provide your signature. Then, provide access to your Enphase account, where you’ll receive the SREC credits. If you don’t have an account on Enphase, then create one, provide the broker with its access, and cross-check the details before submission. Typically, it takes around 40-80 days to get the permission, but any misleading information affects your chances, so try to be careful.

Step 6: Sell your SRECs

When an aggregator comes in, they sell your SRECs to the utilities in exchange for a small fee, and the rest of the earnings are sent through your Enphase account.

Now that you’re ready to sell your SRECs, here are a few extra tips to help you do better:

Understand the Market: Each state has its own SREC-related programs and regulations, so it’s important to understand the specifics, like any upcoming policy changes, supply and demand dynamics, and others. Also, keep track of the prices on websites like Sol Systems and SRECTrade to decide the best time to sell.

Choose the Right Broker: The next important thing is to select the right broker. For that, compare the fees, services, and reputation of the brokers available in your area, such as Sol Systems and SRECTrade. But here, brokers might keep a percentage of the sales, so if you can, sell it directly to buyers to yield better prices.

Timing Your Sales: As mentioned earlier, the SREC market is pretty volatile, so it’s important to keep track of the prices and sell the credits when demand is high or supply is low. This will ensure that you get the maximum value for your sales.

Leverage Incentive Programs: Many state governments offer lucrative incentives and/or grants that offset your cost of installing and maintaining solar generators. So, stay informed about them to enhance your financial returns from your investment in solar energy.

Optimize Your Solar System: Most importantly, invest in a solar system that’s powerful and reliable enough to generate ample energy and maximize your earnings. But you must spend loads to build such a system and meet the threshold needed to generate SRECs.

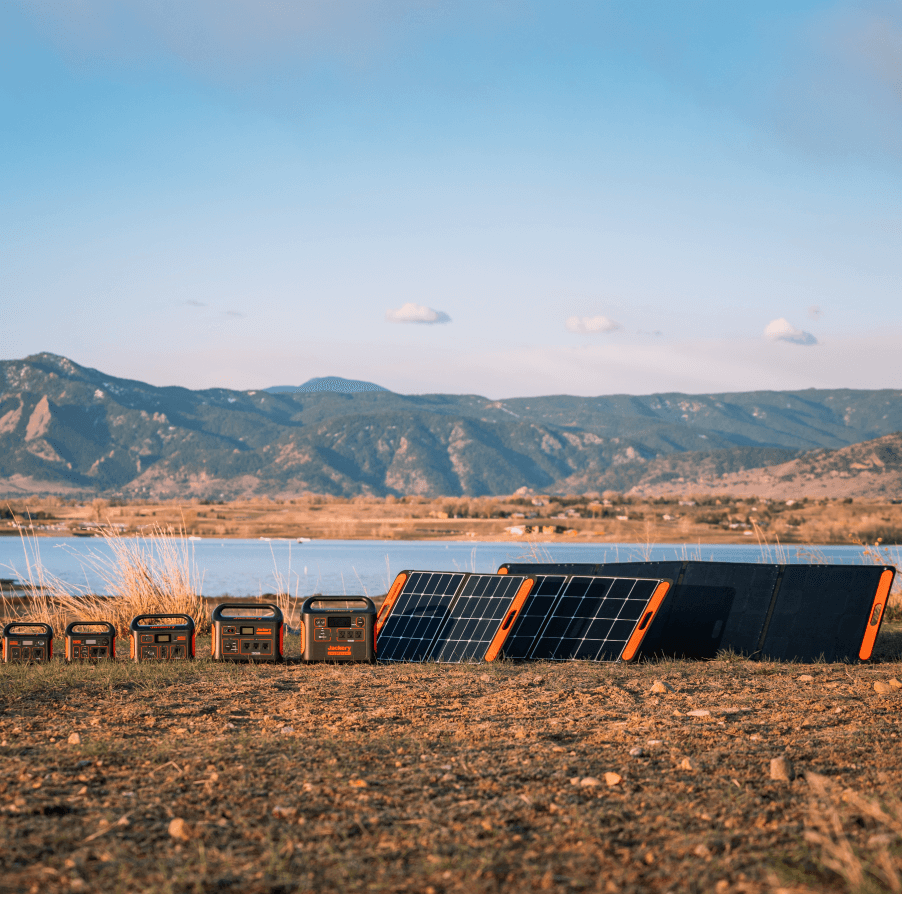

If you’re on a budget and need a portable solar generator to save on bills and use clean energy, Jackery Solar Generators are one of the best in the market. These produce ample solar energy to power 99% of your household and outdoor appliances and come at a price that doesn’t burn a hole in your wallet. Also, these are available in multiple sizes, so you can choose one that goes best with your setup.

Jackery Solar Generators Explained

Jackery is a renowned solar brand that manufactures solar generators, solar panels, and portable power stations. The Jackery Solar Generators encase portable Jackery SolarSaga Solar Panels that collect sun rays, convert them to DC current, and send them to Jackery Explorer Portable Power Stations, which further convert them into usable AC current to power up most of your available appliances.

Jackery Solar Generators provided their reliability, efficiency, and use of solar energy to generate electricity, qualify for an annual residential clean energy tax credit. The rebate is equal to 30% of the costs of a new solar panel system. For example, purchasing Jackery Solar Generators might earn you a tax rebate of up to $839.7-$1139.7.

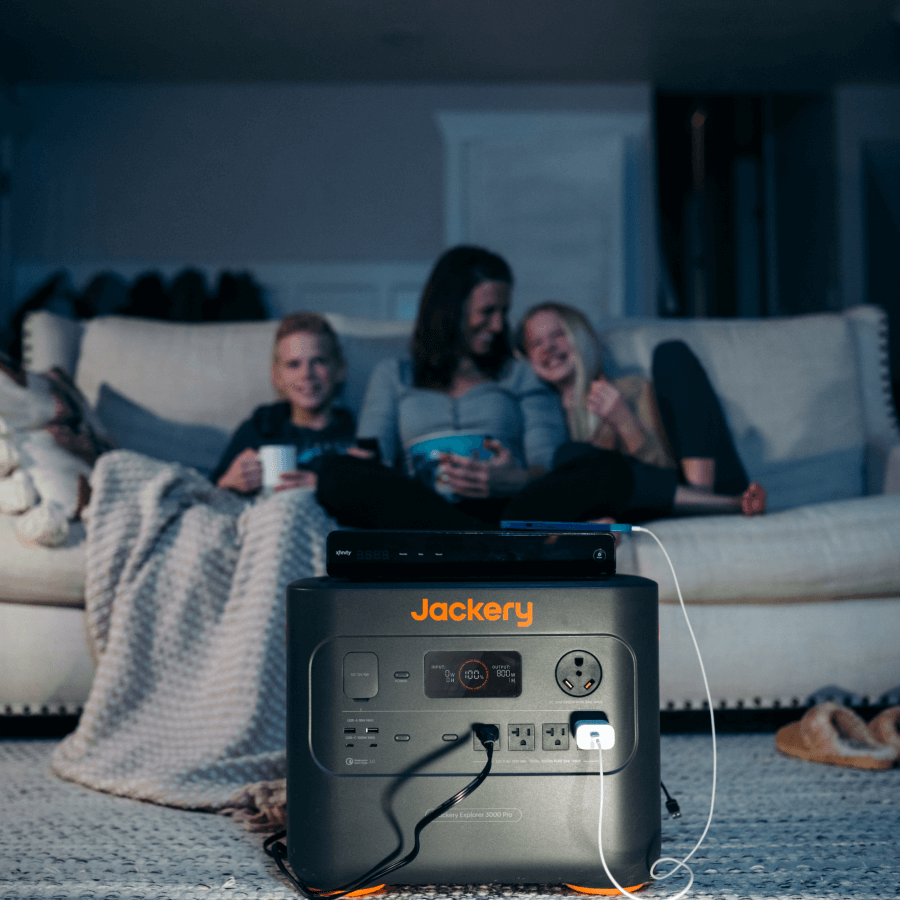

Jackery Solar Generator 3000 Pro

Jackery Solar Generator 3000 Pro, with its large NMC battery, can charge up to 99% of your household and outdoor appliances. Investing in it will earn you a refund or tax rebate of up to $839.7 from the upfront cost. Despite its large size, its pull rods and double wheels make for easy movement, and unlike those oil and gas generators, it doesn’t make any noise. Besides, its smart power master supports app control, making it an ideal choice during home emergencies.

Here are some common household appliances and their average runtime:

- Refrigerators (1000W): 2.5H

- Microwave (1300W): 1.9H

- Window AC (1800W): 1.4H

- Dishwasher (250W): 10H

- Sump Pump (800W): 3.2H

Customer Review

“Sent right away. Works great so far with home charge and solar charge. Will be hooking it up to my pop-up camper next week. Great size, quiet and good app so far.”- James Matthews.

Jackery Solar Generator 2000 Plus

Jackery Solar Generator 2000 Plus is a sizeable battery-powered generator with a stable LiFePO4 battery that can charge up to 99% of household appliances. Whether charging large appliances like power tools and air conditioners or small-sized appliances like laptops and smartphones, it turns out to be an excellent companion. It’s a great charging solution for those looking for an emergency home backup solution, a solar generator for their off-grid lifestyle, or saving a chunk from their electric bills.

Here are some common household appliances and their average runtime:

- Refrigerators (1000W): 1.7H

- Microwave (1300W): 1.3H

- Sump Pump (800W): 2.1H

- Window AC (1800W): 58 min

- Dishwasher (250W): 7H

Customer Review

“Very good quality, the battery lasts a very long time. Very easy to move around with the built-in tires. Love the upgradeability. The best solar generator I have ever had.”- Marc.

SREC FAQs

How do SRECs work in VA?

Virginia is one of the states with SRECs. One gains one SREC for every 1,000 kWh of energy generated by solar panels, which you can sell to your utilities and other organizations subject to renewable energy mandates. As of 2023, each SREC was sold at around $45-70.

What is the downside to SREC?

Although SREC seems like a profitable deal, the market is extremely volatile and susceptible to supply and demand. Besides, purchasing and selling SRECs can be time-consuming and complex, as they involve state and federal mandates.

Are SRECs paid monthly?

Yes, SERCs are paid monthly through Brokerage and Annuity systems, and payments are processed on the last day of every month.

How long do SREC credits last?

The lifespan of SRECs varies from one state to another, as well as their specific regulations. These typically have a lifespan of 1-5 years and must be used or sold within the period.

Can I sell my own SRECs?

Yes, you can sell your own SRECs, but the investment in solar energy generation plants can be heavy.

SERCs Improve Your ROI

Renewable energy is currently a hot topic, with people becoming aware of the increasing pollution and the potential benefits of clean energy. Various state governments have mandates about SERC to motivate people to access solar energy from the grid or produce their own. However, the latter is unequivocally expensive, and the alternate way is to invest in Jackery Solar Generators. These are qualified to access tax rebates and refunds, saving thousands on annual electric bills.