Energy tax credits are government incentives for investing in energy-efficient products and services. If you ask, does a new roof qualify for an energy tax credit? Yes, it does, under certain conditions. You can check these conditions under the IRS guidelines and claim your tax credit using IRS Form 5695.

The Inflation Reduction Act of 2022 encourages citizens to invest in energy-efficient solutions for their homes by providing federal tax credits and deductions. These energy-efficient systems include solar, wind, geothermal, etc. On some Jackery Solar Generator models, you can get a tax credit of up to $1,500. Read ahead to learn how much tax credit a new roof gets you.

Key Takeaways

- A new roof made from materials that generate clean energy qualifies for an energy tax credit in 2025.

- According to IRS Fact Sheet 2025, roofs made from solar shingles or roofing tiles are eligible for a tax credit.

- Roofing material costs, labor costs, and assembly or original installation costs fall under the qualified expenses for the tax credit.

- Using essential home backup systems, such as Jackery Solar Generators, can get tax credits of $800 to $1,600. You can claim between January 1, 2023, and December 31, 2032.

Does a New Roof Qualify for the Energy Tax Credit in 2025?

Yes, a new energy-efficient home roof qualifies for a tax credit in 2025. The roof should be evaluated as an energy upgrade and made from materials that generate clean energy, not just serve a roofing or structural function. These materials can be solar shingles or solar roofing tiles.

The Federal Solar Tax Credit or Residential Clean Energy Credit can be up to 30% of the total cost of qualified, newly installed property. The 30% credit is only valid on installations between 2022 and 2032.

What Types of Roofs Are Eligible for Energy Tax Credit?

As of 2025, your house roof qualifies for an energy tax credit if it is made from materials that are solar electric collectors and provide structural support. If the roof is made from materials providing only structural support, such as the roof's decking or rafters, you cannot claim the residential energy-efficient property tax credit.

Solar Shingles

Solar shingles are roofing materials that act as solar panels. They can support roofing and generate electricity using solar energy, making them eligible for an energy tax credit under the updated Inflation Reduction Act of 2022. Solar shingles have a higher upfront cost than traditional asphalt roofing, but their benefits on your power bill can cover the cost.

|

Type of Roof |

IRS Eligibility Criteria |

|

Solar Shingles Roof |

As per the instructions for IRS Form 5695, “Some solar roofing tiles and solar roofing shingles serve the function of both traditional roofing and solar electric collectors, and thus serve functions of both solar electric generation and structural support. These solar roofing tiles and solar roofing shingles can qualify for the credit. ” |

Note: The Inflation Reduction Act of 2022 received an update. From the beginning of 2023, metal roofs with a pigmented coating and asphalt roofs with cooling granules no longer qualify for the energy-efficient home improvement credit. It was a correction to the 2023 instructions for Form 1040.

Does a Roof Qualify for Tax Credit If You Install Solar Panels?

Yes, installing solar panels on a roof can qualify for an energy tax credit under certain conditions:

- You can claim a tax credit if the roof's materials are solar energy generators and support the roof's structure. These materials can be solar shingles and solar roofing tiles.

- Even if the solar shingles are a part of the roof, you can claim an energy tax credit.

- If solar panels are installed on traditional roofing shingles or tiles, they do not qualify for a tax credit. This is because the roofing material does not generate any power.

As per the IRS, “Traditional building components that primarily serve a roofing or structural function generally don't qualify. For example, roof trusses and traditional shingles that support solar panels don't qualify, but solar roofing tiles and shingles do because they generate clean energy.”

What Roofing Costs Are Covered Under the Energy Tax Credit?

Now that you know whether a new roof qualifies for an energy tax credit, let’s find out the roofing costs covered under the energy tax credit. You can claim several roofing costs under the residential clean energy credit, such as

- Roofing material costs (if the material produces power using solar energy, such as solar roofing tiles or solar shingles)

- Labor costs for onsite preparation, assembly, or original installation of the roof.

- Wiring costs to connect the solar power roof to your home.

Note: The net energy tax credit is obtained after subtracting the public utility subsidies, rebates, and state energy efficiency incentives from the overall qualified expenses.

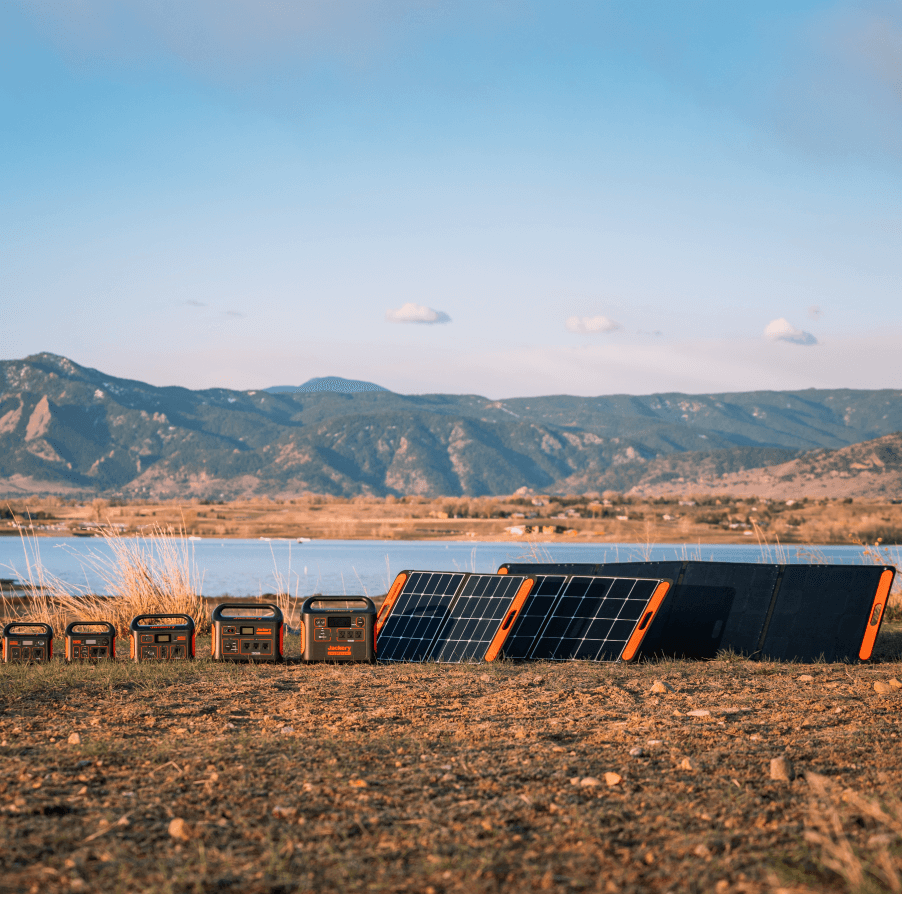

Tax Credits Available on Jackery Solar Generators

Jackery is a solar power brand that manufactures solar power products to bring green energy to all. Its product line includes solar generators, foldable solar panels, and portable power stations. The Jackery Solar Generator can be your ideal companion when installing a solar roof. It can power most of your tools, such as drills, saws, nail guns, etc.

As the Jackery Solar Generator produces clean, green energy without a carbon footprint, you can get a residential clean energy credit for using it at home. The tax credits vary from $800 to $1,600, depending on the product type.

|

Product |

Tax Credits |

|

Jackery Solar Generator 5000 Plus |

Up to $1049.7 |

|

Jackery Solar Generator 2000 Plus Kit (4kWh) |

Up to $1,139.7 |

Note: You can claim these tax credits using IRS Form 5695 between January 1, 2023, and December 31, 2032. Check with your utility to verify eligibility and requirements for residential rebate programs.

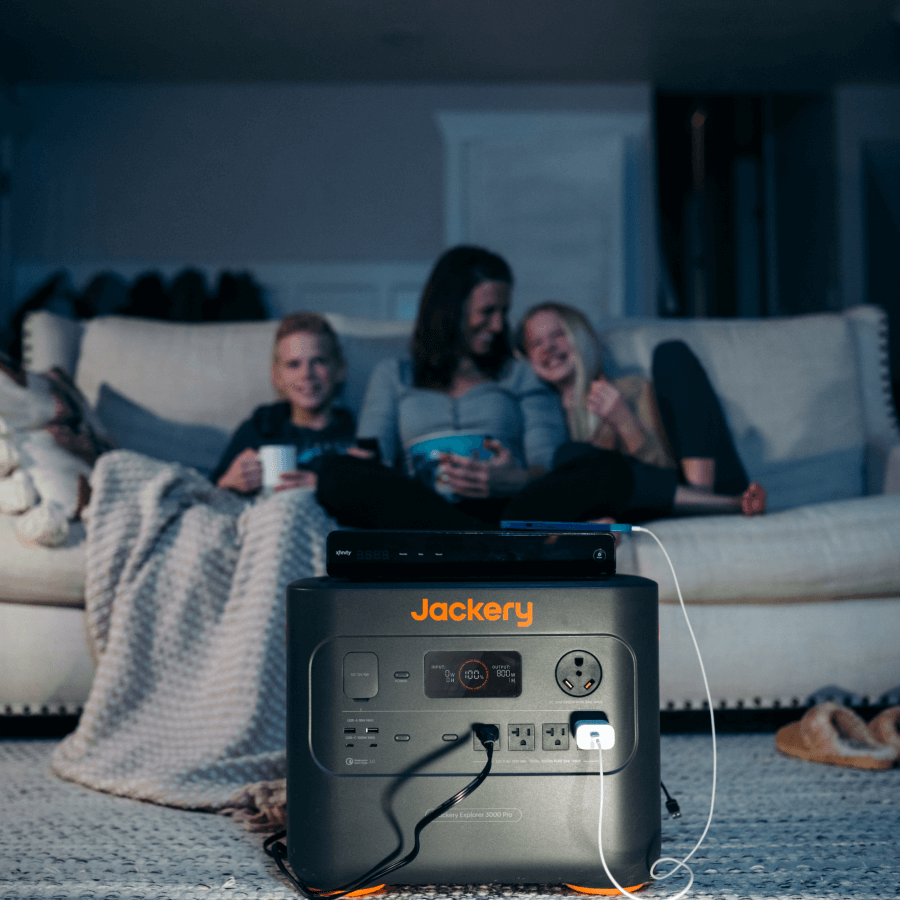

Jackery Solar Generator 5000 Plus

The Jackery Solar Generator 5000 Plus is an essential home backup that can get you maximum credits on your annual taxes. The generator is a high-capacity device ideal for emergencies like an outage or your power needs on a trip. The equipment operates without emissions and at a low sound of 30 dB. Its super portable design has wheels, making it easy to take anywhere around the house. It can provide you with up to $1049.7 in tax credits.

Appliances Running Time

- AC (2000W) = 2.1H

- Washing Machine (2000W) = 2.1H

- Refrigerator (900W) = 4.5H

- Drill Machine (1000W) = 4.1H

- Circular Saw (1200W) = 3.4H

Customer Review

“The entire 5000 plus bundle arrived within 3 days of ordering it. It is a high-quality product with amazing power generation capabilities. I will be purchasing a second bundle in order to increase our kWh to 60.” - S.M.

Jackery Solar Generator 2000 Plus Kit (4kWh)

The Jackery Solar Generator 2000 Plus Kit (4kWh) is an ideal pick if you are looking for an electricity generator for your home. The 4kWh power capacity of the generator can power a big house by running most of the electrical appliances. The solar generator kit comes with one battery pack that can easily extend the power availability for your home if required. It can provide you with up to $1,139.7 in tax credits.

Appliances Running Time

- Portable AC (1000W) = 3.4H

- Vacuum Cleaner (1200W) = 2.8H

- Refrigerator (900W) = 3.8H

- Drill Machine (1000W) = 3.4H

- Circular Saw (1200W) = 2.8H

Customer Review

“Plan is to use it at my home for emergency situations if/when power goes out - which is thankfully not typically very often. Have not had to use it during a power outage yet, but during a day of testing- it performed well running our kitchen refrigerator, home Wi-Fi, lamp and fan… plus separately an air fryer and coffee maker.” - Frederick R.

Common Mistakes People Make When Claiming Roof Tax Credit

When you have the answer to whether a new roof qualifies for the energy tax credit in 2024, you can file the claim. There are some mistakes that you need to avoid.

Don’t Overcommit

Just because a new roof qualifies for an energy tax credit, don’t overcommit to improvements you can’t afford. Check IRS Form 5695 for instructions on tax savings and credits before making the improvements.

Not Checking Eligibility

You can claim the tax credit if the house is your permanent residence. You are not eligible for a credit if your home is new and not an existing one on which the improvements were made.

Not Having the Right Documentation

If your tax return is audited, you must have all the necessary purchase receipts and installation records. The IRS will use these records to confirm your eligibility for a tax credit.

Claiming Non-Solar Materials

When claiming the energy tax credit, you can only claim for materials related to solar energy. The use of solar shingles and solar roofing tiles qualifies for a tax credit.

FAQs

Can I deduct my new roof as an energy-efficient improvement?

No, you cannot deduct your new roof as an energy-efficient improvement, but you can obtain a tax credit if it has solar energy features. Tax deductions and tax credits are different terms.

Can I claim tax credit on roof labor?

Yes, the qualified expenses include labor costs for onsite preparation, assembly, or original roof installation and piping or wiring to interconnect the roof to the home.

Does a new roof count for a 30% tax credit?

Yes, a new roof may qualify for a 30% tax credit if it is made from materials that can produce electricity using solar energy, such as solar shingles or roofing tiles.

Does my metal roof qualify for energy credit?

No, as per the correction to the 2023 Instructions for Form 1040, Instructions for Schedule 3, line 5b, metal roofs with a pigmented coating and asphalt roofs with cooling granules no longer qualify for the energy credit.

Can I get energy credit if I replaced my roof but didn’t install solar?

No, if you have replaced the roof and haven’t installed solar, you are not eligible for an energy tax credit. The roof material should be a solar power generator.

Conclusion

Does a new roof qualify for an energy tax credit? The answer to this question depends on specific parameters. If the roofing material is related to solar energy, such as solar shingles, the roof is eligible for a tax credit. Besides, you can get a tax credit if you use any other solar power equipment in your house. Jackery Solar Generator is an essential home backup that can attract significant tax credit for you, besides powering your critical devices in emergency scenarios.

![[Add-on] Jackery Manual Transfer Switch for Explorer 5000 Plus](http://www.jackery.com/cdn/shop/files/800x800-2_5b90d3ab-246e-4679-affe-e7c6949f9c27.png?v=1744356904&width=170)

Leave a comment