A heat pump water heater is a necessary and cost-effective investment for your home. It can reduce the water heating cost by 75% and enables you to get a significant tax credit. You can obtain a Heat Pump Water Heater Tax Credit of up to $2,000 annually. This tax credit applies to heat pump water heaters that have earned the Energy Star and have UEF ratings of ≥ 3.3.

A heat pump water heater is energy-efficient because it transfers heat instead of generating it. This is why it consumes less power and reduces energy bills. You can save more by investing in an essential home backup system like a solar generator. The Jackery Solar Generator is an ideal power backup alternative that can garner up to $1,500 in tax credits.

Key Takeaways

- A heat pump water heater is eligible for a tax credit if it is Energy Star certified and meets or exceeds the CEE’s highest efficiency tier.

- You can claim a Heat Pump Water Heater Tax Credit by filling out the IRS Form 5695, Residential Energy Credits, part 2.

- If it is Energy Star certified, a heat pump water heater, whether integrated, split-system, hybrid, or solar-assisted, is eligible for a tax credit.

- An essential home backup like Jackery Solar Generators can earn you tax credits of $839.7 to $1,589.7, depending on the model.

Understanding the Heat Pump Water Heater Tax Credit in 2025

A heat pump water heater transfers heat rather than generates it, making it 2 to 3 times more energy-efficient than conventional water heaters. Energy efficiency is the key factor that makes the water heater eligible for the Electric Heat Pump Water Heater Tax Credit.

You are only eligible for tax credit if the heat pump water heater has earned the Energy Star. As per the IRS Energy Efficient Home Improvement Credit, it must meet or exceed the CEE highest efficiency tier, not including any advanced tier, to qualify for the tax credit.

According to Energy Star reports, you can claim a tax credit of up to $2,000 or 30% of the overall project cost for heat pump water heaters that have earned the Energy Star. You must complete IRS Form 5695 to get the credit.

Note: It is also important to note that from the beginning of 2025, no tax credit will be allowed unless a qualified manufacturer produces the item and the taxpayer reports the PIN for the item on their tax return.

How to Check If a Heat Pump Water Heater Qualifies for Tax Credit?

To verify if the heat pump water heater qualifies for a tax credit, you must check if it satisfies the following conditions:

- You can claim the Heat Pump Water Heater Tax Credit if the appliance is Energy Star-certified. According to Energy Star, Energy Star-certified HPWHs have a UEF rating of 3.3 to 4.1.

- The HPWH should be installed in a U.S. property used as a residence. If the taxpayer makes eligible improvements, it can also be the taxpayer's second home or a rented one.

- To claim a Heat Pump Water Heater Tax Credit under the Inflation Reduction Act 2022, the heater should be installed after Jan. 1, 2023, and before Jan. 1, 2033.

If all these conditions are met, you can fill out part 2 of IRS Form 5695 and file it with your tax return to get the Energy Star Heat Pump Water Heater Tax Credit.

Types of Heat Pump Water Heaters That May Be Eligible

There are four types of heat pump water heater setups. If the water heater is Energy Star certified, it will be eligible for the Hybrid Heat Pump Water Heater Tax Credit.

Integrated Heat Pump Water Heater

This variant of the heat pump water heater has a heat pump system and a hot water storage tank in one cabinet, making it easy to install. As there are no refrigerant lines, it is a space-saving solution.

Split System Heat Pump Water Heater

The heat pump and hot water storage tank systems are separate. This system provides convenience, as you can install the heat pump outdoors and the storage tank indoors.

Hybrid Heat Pump Water Heater

This setup combines the heat pump and traditional electric heating elements in one unit. While the heat pump does most of the heating, the heating element is used when demand is high.

Solar Assisted Heat Pump Water Heater

A solar-assisted heat pump water heater has solar thermal collectors and a heat pump. The solar thermal collector preheats the water, and the heat pump heats it to a desired level.

All the described heat pump water heaters are eligible for a tax credit if they are Energy Star Certified. Energy Star Certified heat pump water heaters have a UEF value between 3.3 and 4.1, making them highly energy-efficient. Traditional water heaters have a UEF between 0.63 and 0.95.

How to Claim the Heat Pump Water Heater Tax Credit?

If you are wondering how to claim the Heat Pump Water Heater Tax Credit, you can use IRS Form 5695. Check if the heat pump water heater satisfies all the conditions for a tax credit. If it does, file part 2 of the Residential Energy Credits Form with your tax return. Ensure you claim the Energy Star Heat Pump Water Heater Tax Credit for the year when the equipment is installed and not purchased.

It is also crucial to ensure that a qualified manufacturer produces the installed heat pump water heater and that the taxpayer reports the PIN for the item on their tax return to claim the Electric Heat Pump Water Heater Tax Credit.

State Rebates and Utility Programs for Heat Pump Water Heater

Several rebates and utility programs are available for heat pump water heaters. The rebate amount, eligibility criteria, and application process vary by state and utility provider.

- Minnesota Power provides a rebate of $300 on Energy Star-certified heat pump water heaters.

- In Vermont, USA, households can get 100% of the equipment and installation costs (up to $5,000) for a new heat pump water heater as cashback.

- National Grid supplies New York and Massachusetts with electricity and offers a $1000 rebate or up to 50% of the equipment cost.

- Puget Sound Energy’s Efficiency Boost program offers a rebate of $850 for installing qualifying electric heat pump water heaters.

- The Home Electrification and Appliances Rebate (HEAR) Program, enabled by the Inflation Reduction Act, also provides a $1,750 rebate for installing an Energy Star-certified electric heat pump water heater.

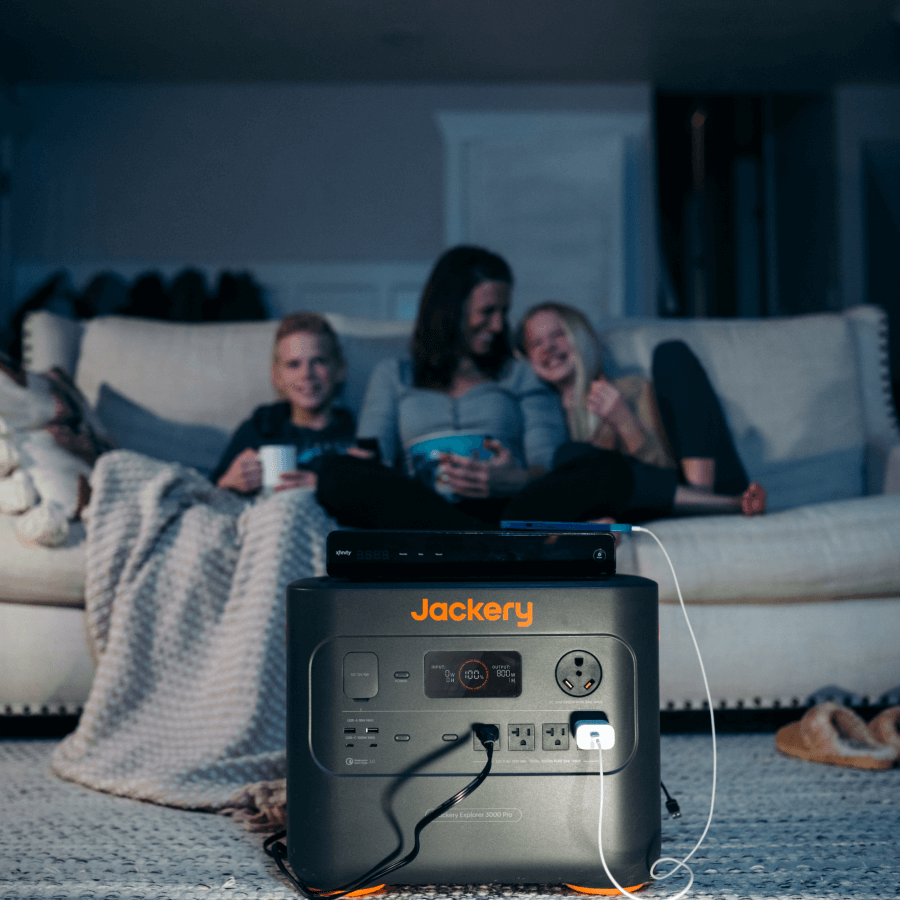

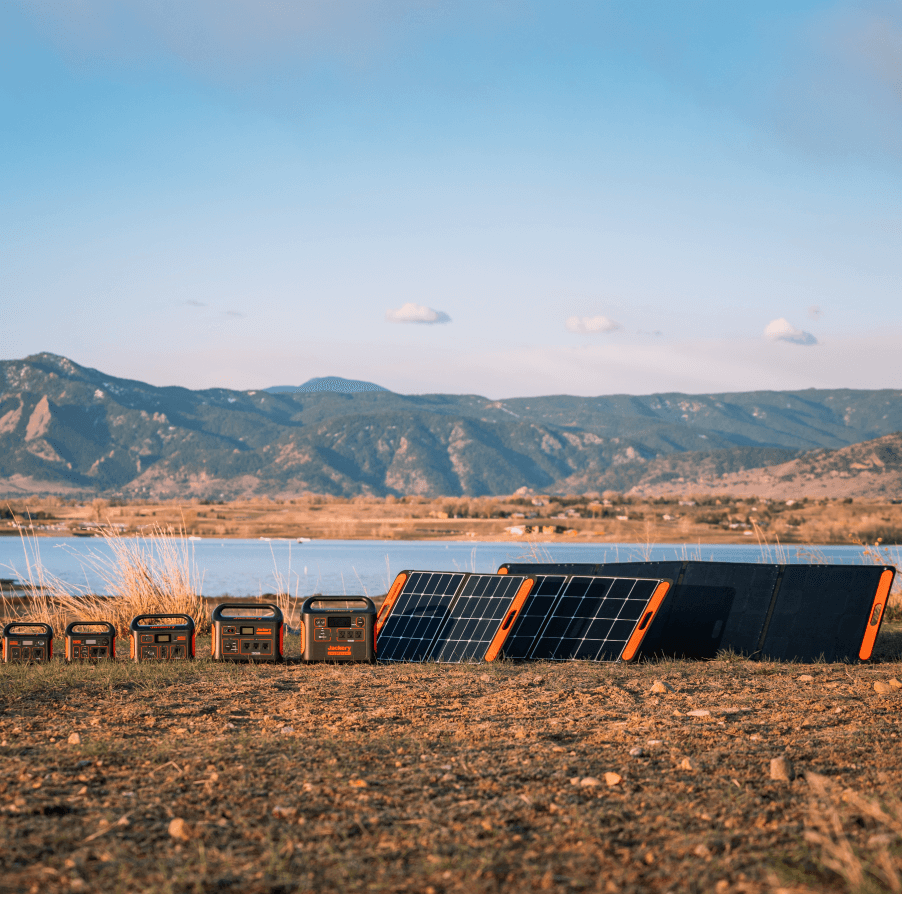

Tax Credits Available on Jackery Solar Generators

Jackery is a manufacturer of reliable solar power products. Its primary product line includes solar generators, foldable solar panels, and portable power stations. These products have a high capacity to support your house’s power needs in case of an outage. They are portable and operate while making minimal noise and zero emissions.

The essential home backup systems provide the required power to your heat pump water heater in case of an outage. With some Jackery Solar Generators, you are also eligible for a Residential Clean Energy Credit. The credit amount depends on the generator's model.

Jackery Solar Generator 5000 Plus

The Jackery Solar Generator 5000 Plus is an essential home backup that powers your heat pump water heater seamlessly. Its high capacity ensures hot water for your household tasks for an extended time. Whether you have an integrated system or a split-system water heater, the portable Jackery Solar Generator 5000 Plus can power it anywhere around your house. The use of the Jackery Solar Generator 5000 Plus also qualifies for tax credits of up to $1049.7.

Appliances Running Time

- AC (2000W) = 2.1H

- Washing Machine (2000W) = 2.1H

- Refrigerator (900W) = 4.5H

- Dishwasher (1200W) = 3.4H

- Water Heater (2000W) = 2.1H

Customer Review

“I received the Explorer 5000 Plus solar generator to use to run my home if the power goes out. It works great and will run my whole home if the power goes out.” - Dennis Carlson.

Jackery Solar Generator 2000 Plus Kit (4kWh)

The Jackery Solar Generator 2000 Plus Kit (4kWh) is a powerful 4kWh solar system that can support the power needs of a heat pump water heater. It can also power your other household devices, reducing reliance on grid power and saving your energy bill. With the Jackery Solar Generator 2000 Plus Kit (4kWh), you can earn solar tax credits of up to $1,139.7.

Appliances Running Time

- Portable AC (1000W) = 3.4H

- Bench Grinder (1000W) = 3.4H

- Refrigerator (900W) = 3.8H

- Vacuum Cleaner (1200W) = 2.8H

- Space Heater (1500W) = 2.3H

Customer Review

“The generator is a good generator. I did try to plug in a heater for that generator and that heater only about one hour on one charge. I can see that I’m going to try to plug in Solar panels and see how that works” - Robert.

FAQs

What are the appliances that do not qualify for the energy tax credit?

Several devices, such as refrigerators, dishwashers, LED lights, and ovens, do not qualify for the energy tax credit. The IRS does not mention anything about these devices, including the Energy Star refrigerator tax credit.

Is it worth getting a heat pump hot water system?

Yes, getting a heat pump hot water system is a worthy investment. It can be two to three times more energy efficient than conventional water heaters and qualify you for a Heat Pump Water Heater Tax Credit of up to $2,000.

What is the tax credit for heat pump water heaters?

Under the Inflation Reduction Act, homeowners can obtain a tax credit of 30% of the cost of their heat pump water heater, up to $2,000. This credit is only applicable to Energy Star-certified heat pump water heaters.

What is the income limit for the 30% tax credit on a heat pump water heater?

There is no Heat Pump Water Heater Tax Credit income limit. If you have an Energy Star-certified heat pump water heater at home, you are eligible for a Hybrid Heat Pump Water Heater Tax Credit.

Conclusion

While a heat pump water heater can be convenient for your home, it can also be a cost-effective investment. With its use, you can earn a Heat Pump Water Heater Tax Credit that reduces your overall taxes. Besides heat pump water heaters, a Jackery Solar Generator 5000 Plus can also provide you with tax credits of up to $1049.7, reducing the upfront cost. It can power your water heater in case of an outage, saving on energy bills.

![[Add-on] Jackery Manual Transfer Switch for Explorer 5000 Plus](http://www.jackery.com/cdn/shop/files/800x800-2_5b90d3ab-246e-4679-affe-e7c6949f9c27.png?v=1744356904&width=170)

Leave a comment