Do you want to save money while upgrading your HVAC system? Then, opt for the HVAC Energy Efficient Tax Credits under the Inflation Reduction Act of 2022. An energy-efficient HVAC home upgrade can make you eligible for 30% of the project cost, up to $3,200 in tax credits. Use and fill out IRS Form 5695 to determine your eligibility and calculate the total tax rebate amount.

Besides tax credits and rebates, energy-efficient HVAC upgrades can slash your monthly electric bills. To save more, you can switch to alternative ways to power appliances, such as solar generators. Jackery Solar Generators have highly efficient and reliable batteries to power most of your HVAC appliances during peak hours. They provide a reliable way to harness solar energy without any complex installations.

Key Takeaways

- Running an HVAC system might cost you between $1,500 and $2,000 annually on electric bills. The maintenance and repair charges are extra.

- The HVAC Energy Efficiency Tax Credit applies to Energy Star-rated systems that meet the SEER2, EER2, and HSPF2 ratings.

- An HVAC upgrade can save you 30% of the project cost, up to $3,200 on taxes.

How Much is Your Current HVAC System Really Costing You?

Running an HVAC system might cost between $1,500 and $2,500 annually on electric bills. The cost, however, varies with house size, power consumption, electricity cost, system efficiency rating, etc.

An HVAC system also requires regular maintenance and occasional repairs. On average, annual maintenance of an HVAC system costs between $75 and $200 per visit, depending on the contractor. If any substantial or complex repairs are involved, you might have to pay as much as $2,000 to $3,000.

Overall, your current HVAC system might cost you around $2,000 to $5,000 annually and more, depending on your location and the type of repair involved.

Should You Upgrade to a New HVAC System?

Yes, if the current HVAC system burdens you with high bills, maintenance, and repairs, it’s worth upgrading. A new HVAC system, on average, costs between $5,000 and $20,000 or more, depending on your house size and installation cost. However, you can save a lot if your system qualifies for the HVAC Energy Efficiency Tax Credit under the Inflation Reduction Act.

First, the IRS Energy Efficient Home Improvement Credit allows homeowners to save up to $3,200 annually on taxes for Energy-Efficient Upgrades. Besides, many state- or utility-wise programs, such as the TECH Clean California Program in California or Mass Save in Massachusetts, stack up. Also, these systems are energy-efficient, so they will help you save on your annual electric bills.

Which HVAC Systems Qualify for the 2025 Energy Tax Credit?

The 2025 HVAC Energy Efficiency Tax Credit under the government’s Inflation Reduction Act applies to Energy Star-certified HVAC systems. This includes meeting SEER2 and EER2 requirements for air conditioners and HSPF2 requirements for heat pumps.

What Are the SEER2, EER2, and HSPF2 Ratings You Need to Qualify?

As per Energy Star, the HVAC appliances must meet the following SEER2, EER2, and HSPF2 ratings to qualify for Energy Tax Credits:

|

Product Type |

Specification |

|

Heat Pump (Split Systems) |

≥ 7.8 HSPF2/ ≥ 15.2 SEER2/ ≥ 11.7 EER2 |

|

Heat Pump (Single Package Equipment)- Gas/Electric |

≥ 7.2 HSPF2 ≥ 15.2 SEER2/ ≥ 10.6 EER2 |

|

Central Air Conditioners (Split Systems) |

≥ 15.2 SEER2/ ≥ 12.0 EER2 |

|

Central Air Conditioners (Single Package Equipment)- Gas/Electric |

≥ 15.2 SEER2/ ≥ 11.5 EER2 |

The heat pumps must maintain efficiency in a cold climate, so their HSPF (Heating Seasonal Performance Factor) ratings are slightly higher.

|

Product Type |

Specification |

|

HP Split Systems (Non-Ducted) |

≥ 8.5 HSPF2/ ≥ 15.2 SEER2 |

|

HP Split Systems (Ducted) |

≥ 8.1 HSPF2/ ≥ 15.2 SEER2 |

|

HP Single Package Equipment |

≥ 8.1 HSPF2/ ≥ 15.2 SEER2 |

If your HVAC system meets the aforementioned criteria, you can claim the rebates by filling out IRS Form 5695.

Do Ductless Mini-Splits, Smart Thermostats, or Partial Upgrades Qualify?

No, as per Energy Star, only Energy Star-rated appliances that fulfill the set criteria are eligible for Energy Tax Rebates. However, many utilities provide rebates for partial home improvement upgrades. For example, customers of CenterPoint Energy in Minnesota can get a $50 rebate for a Smart WiFi-enabled thermostat with pressure-sensing or geo-fencing capabilities.

How Much Can You Claim for Each HVAC System Under IRS Guidelines?

As per the Energy Efficient Home Improvement Credit, homeowners can save up to $3,200 annually on taxes. The maximum Energy Tax Credits you can claim for each HVAC system under IRS guidelines are as follows:

|

Scenario |

Estimated System Cost |

Eligible Credit |

Net Tax Savings |

|

Central AC Installation |

$4,000 - $8,000 |

30% of costs- up to $600 |

$600 |

|

Energy-Efficient Furnace |

$3,000 - $7,000 |

30% of costs- up to $1,200 |

$900 - $1,200 |

|

Heat Pump Only (High-Efficiency) |

$2,000 - $12,000 |

30% of costs- up to $2,000 |

$600 - $2,000 |

|

Central AC + Furnace Combo |

$6,000 - $15,000 |

30% of costs- up to $1,200 |

$1,200 |

|

Full HVAC Upgrade (Heat Pump + AC) |

$6,000 - $20,000 |

30% of costs- up to $3,200 |

$2,000 - $3,200 |

|

Full System (Furnace + AC + Heat Pump) |

$8,000 - $25,000 |

30% of costs- up to $3,200 |

$2,400 - $3,200 |

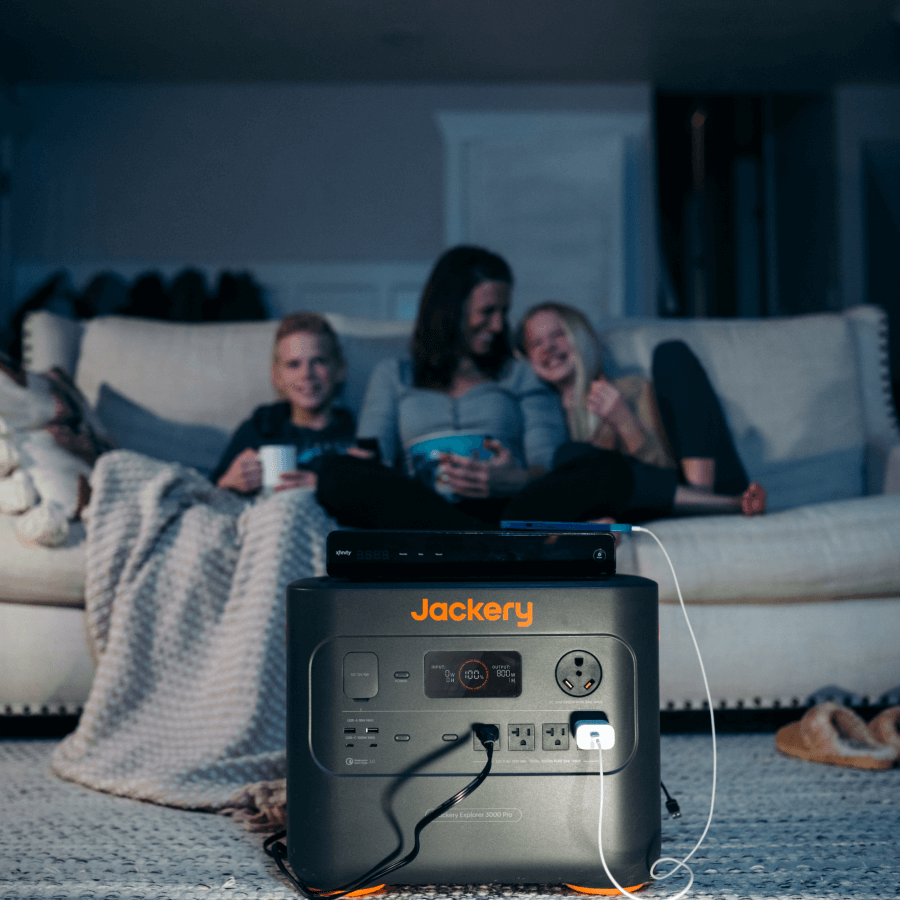

You can use a Jackery Solar Generator to run the HVAC systems during peak energy demand hours and reduce the electric bill. Considering you invest in eligible Jackery Solar Generator models, you can save up to $1,500 in solar tax rebates.

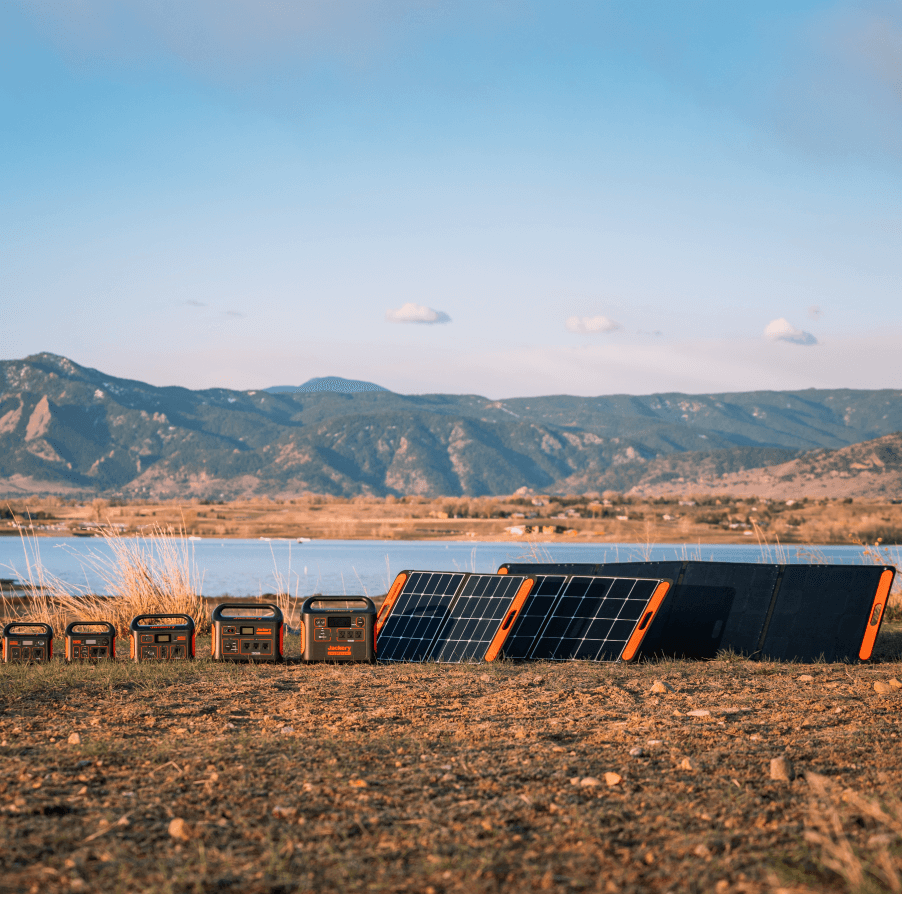

Rebates Available on Jackery Solar Generators

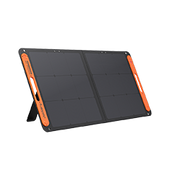

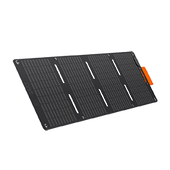

Jackery is a globally recognized solar brand that manufactures solar generators, portable power stations, and solar panels. Jackery Solar Generators combine Jackery SolarSaga Solar Panels and Jackery Portable Power Station to convert sunlight into usable AC electricity. This essential home backup solution can supply usable electricity to power your HVAC appliances for hours.

Some Jackey Solar Generators may qualify for an annual Residential Clean Energy Tax Credit. The amount is 30% of the clean energy property installed in primary homes between 2022 and 2032. If eligible, fill out IRS Form 5695 and get tax rebates between $839.7 and $1,589.7.

Jackery Solar Generator 5000 Plus

The Jackery Solar Generator 5000 Plus is an essential home backup power system with a large battery capacity to power HVAC appliances. It can be handy to offset your electric bills or as an emergency power backup for rolling blackouts. Its portable design with pull rods and double wheels lets you carry it anywhere during a power outage. Besides, it can help you save up to $1,049.7 in tax rebates.

Appliance Working Time:

- Water Heater (2000W): 2.1H

- Air Conditioner (2500W): 1.7H

- Space Heater (1500W): 2.8H

- Heat Gun (2000W): 2.1H

- Hair Dryer (900W): 4.5H

Customer Review:

“Awesome back-up unit. The wheels are pretty good. Three hours of home theater use (roughly 130 watts/hour) consumes about 10-15% of the inverter's charge.” - Telkwa.

Jackery Solar Generator 2000 Plus Kit (4kWh)

The Jackery Solar Generator 2000 Plus Kit (4kWh) can also be an essential home backup power system to run your HVAC system during extended power outages. It can also power other household appliances like refrigerators, CPAP machines, TVs, etc. The backup solution does not make much noise, so you can rest comfortably until the grid power is restored. Besides, you can receive up to $1,139.7 in tax rebates.

Appliance Working Time:

- Space Heater (1500W): 2.3H

- Induction Cooktop (1200W): 2.8H

- AC (1800W): 1.9H

- Refrigerator (900W): 3.8H

- Bench Grinder (1000W): 3.4H

Customer Review:

“Perfect for my purpose, which is to supply an oxygen generator.” - Janet.

Checklist Before You Upgrade or File a Tax Claim

Before you upgrade to an energy-efficient HVAC system or file a tax claim, as per the IRS, here’s a checklist to follow for maximum savings:

- Property or the connection you’re installing the residential energy property in an existing home in the United States.

- Appliances must qualify for the credit or meet the Consortium for Energy Efficiency's (CEE) highest efficiency tier.

-

Possess the following documents

- Purchase Receipts

- Energy Star Certification

- Proof of Heat Pump Installation

- Download and fill out IRS Form 5695.

FAQs

What documents do you need to claim the HVAC tax credit?

As per the IRS, while documents might not be needed to file your tax credit, you might need some if your tax return is audited. So, you must retain purchase receipts, installation records, and any Energy Star certifications.

Can you stack the HVAC tax credit with rebates and state incentives?

Yes, you can stack HVAC tax credits with rebates and state incentives if the total doesn’t exceed the project cost. Research relevant states and utility rebates from the Database of State Incentives for Renewables & Efficiency (DSIRE) to maximize your rebates.

How to claim the tax credit for your HVAC?

To claim tax credit for your HVAC system, ensure it meets specific efficiency requirements, such as SEER2, EER2, and HSPF2 ratings. Then, fill out the IRS Form 5695 to calculate and file the eligible credit amount.

What is the maximum solar tax credit?

The maximum solar tax credit under the Residential Clean Energy Tax Credit is 30% for new solar appliances installed on an existing property in the US. It applies to property installed between 2022 and 2032. However, the credit percentage drops to 26% and 22% for property installed in 2033 and 2034, respectively.

Can I roll over my unused solar tax credit in 2025?

Yes, you can carry over your solar tax credit for as many years as 2034, when the ITC (Investment Tax Credit) is scheduled to expire. However, the credit percentage drops to 26% in 2033, so if you want to take advantage of the 30% threshold, claim your solar tax credit before that.

Final Thoughts

Energy-efficient HVAC systems, if eligible, can save 30% up to $3,200 in HVAC Energy Efficient Tax Rebates. You must check if your system meets the set SEER2, EER2, or HSPA2 rating. Aside from rebates, you can add a battery backup solution like Jackery Solar Generators. With it, you can reduce your reliance on utility grids and lower your electric bills. It also lets you stay comfortable even during extended power outages.

![[Add-on] Jackery Manual Transfer Switch for Explorer 5000 Plus](http://www.jackery.com/cdn/shop/files/800x800-2_5b90d3ab-246e-4679-affe-e7c6949f9c27.png?v=1744356904&width=170)

Leave a comment