Improvements to your home can enhance its look, functionality, and longevity. Are home improvements tax-deductible? Not all of them. As long as home improvements increase the value of your house, prolong its use, or adapt it to a new use, they are tax-deductible. If you are eligible for a tax deduction, you can claim it by filing Form 5695, 8829, or 4562.

Some potential tax deductions exist for self-employed, remote workers, and seniors to claim. You can use a solar generator as part of your essential home backup if you want to increase your savings beyond tax deductions. Jackery Solar Generator can bring in tax credits of up to $1,500, depending on the model. Read ahead to know what home improvements are tax-deductible.

Key Takeaways

- Home office, capital investment, medical, and energy-efficient home improvements are tax-deductible.

- Depending on the type of improvement and worker, you can file tax deductions using Form 8829, Form 5695, Form 4562, and Schedule A.

- Using solar generators to power your home appliances is another way to gain valuable rebates while saving energy costs.

- Jackery Solar Generators can help you earn a residential clean energy credit rebate of up to $1,500, depending on the chosen model.

When Are Home Improvements Tax-Deductible?

Ideally, not all home improvements are tax-deductible. However, changing your home to boost its functionality or value can reduce your taxable income.

Energy-Efficient Home Improvements

If you make any qualified energy-efficient home improvements to your home after January 1, 2023, you are eligible for an energy-efficient home improvement credit of up to $3,200. These home improvements can include HVAC upgrades, Energy Star-certified exterior doors, windows, or skylights. Besides, qualified heat pumps, water heaters, and biomass stoves also come under valid energy-efficient home improvements. The heat pumps must meet or exceed the CEE’s highest efficiency tier, and the biomass stoves and boilers must have a thermal efficiency rating of at least 75%.

Home Office Deductions

Are home improvements tax-deductible for a home office? Yes, they are under certain conditions. If you use your home or a part of it exclusively for business operations, you may be eligible for a tax deduction for depreciation and operating expenses. The IRS has specific tax deduction guidelines for the business use of your home in Publication 587.

Capital Improvements

Capital improvements are permanent changes made to your home that increase its value. There is no specific list of such improvements, but some, such as adding a swimming pool, a new roof, a new furnace, and an air conditioning system, can provide a tax deduction.

Any repairs made to the property are not counted as improvements. You are not eligible for a tax deduction if you receive subsidies or tax credits for energy-related enhancements. However, in the case of solar portable power stations, you can get rebates.

|

Type of Work |

Deductible? |

Example Use Case |

|

Cosmetic Paint Job |

No |

Home value neutral |

|

New Roof installation |

Yes |

Improves structural integrity |

|

Adding an Energy Star Certified Door or Skylight |

Yes |

Enhances the energy efficiency of the house |

|

Using Your Home as an Office |

Yes |

Depreciation and operating expenses |

|

Repairing a Leak |

No |

Home value neutral |

Are Home Improvements Deductible for Self-Employed Professionals?

Yes, home improvements are tax-deductible for self-employed professionals as long as these improvements are made to the home office used exclusively and regularly for office work. Whether related to interest, mortgage, insurance, rent, security system, or even utilities, they can be deducted from taxes.

|

Upgrade |

% Deductible |

IRS Form |

|

Office Solar Power System |

100% (if exclusive use) |

4562/8829 |

|

Room Renovation |

Partial (if mixed-use) |

8829 |

|

Depreciation on Office Equipment |

Fully deductible |

4562 |

|

Mortgage Interest and Real Estate Taxes |

Partial |

Schedule C (Form 1040) with 8829 |

|

Office Supplies |

Fully deductible |

8829 |

Are Home Improvements Deductible for Remote Workers?

Yes. But, when are home improvements tax-deductible if you work from home? There are certain conditions for that. Home improvements are not tax-deductible if you are a W-2 employee, working from home for a company.

On the other hand, if you are a 1099 freelancer or a self-employed contractor, you are eligible for home improvement deductions only if you use a dedicated space in your home for work purposes.

|

Worker Type |

Home Office Deduction |

Eligible Improvements |

Note |

|

W-2 Employee |

Not Allowed |

Only energy-efficient upgrades (Section 25D) |

|

|

1099 Freelancer |

Allowed |

Renovations, rent, utilities, depreciation, etc. |

These deductions are only allowed if the freelancer uses a space in their home for work. |

|

Remote W2 in CA |

Not Allowed |

Only if you are an independent contractor. |

TCJA suspended unreimbursed employee expenses |

Are home improvements tax-deductible in California? No, if you are a W-2 remote worker in California, you cannot get any tax deductions.

Are Home Improvements Tax-Deductible for Seniors?

The answer is yes, as long as there are medically necessary home improvements to care for the seniors. As per the IRS Publication 502, home improvements are tax-deductible for seniors if they are more than 7.5% of the adjusted gross income. You cannot claim any tax deductions if any insurance covers these expenses.

|

Upgrade |

Deductible |

Notes |

|

Stairlift |

Yes |

Comfort, not medical |

|

Installing Railings and Support Bars in the Bathrooms |

Yes |

Comfort |

|

Adding Handrails or Grab Bars Anywhere |

Yes |

Comfort |

|

Lowering or Modifying Kitchen Cabinets and Equipment |

Yes |

Comfort |

How to Apply for Tax Deductions on Home Upgrades

The IRS provides several forms that you can use to apply for tax deductions. These forms vary depending on the worker type, home improvement type, etc.

Form 5695

This form is used to apply for tax deductions if you have made any energy-efficient additions to your house, such as an exterior door, skylight, biomass stove, etc. You must specify all the details in part 2 of Form 5695.

Form 8829

This form is helpful if you have made improvements to your home office. With Form 8829, you can highlight home office expenses, including rent, insurance, utilities, mortgage interest, etc., to apply for tax deductions.

Form 4562

When you use a part of your home as your office, you can claim a deduction for depreciation of its assets using Form 4562. Business assets on which you can claim depreciation are furniture, property, office equipment, etc.

Schedule A (Form 1040)

If you have made any medical improvements to your home, you can itemize your deductions in this form. Schedule A has to be attached to Form 1040.

Necessary Receipts and Documentation

To ensure that you are eligible for the tax deduction, you have to keep certain documents ready, such as:

- Credit Card Statements

- Bank Statements

- Checks

- Itemized receipts

- Contracts

Note: You should secure these documents for at least three years after filing your tax return.

When to use Straight Deduction vs Depreciation?

To gain maximum tax deduction, you must check if you should go for straight deduction or depreciation. Ideally, if your home improvement expenses are small, you can go for the straight deduction (claim $5 per square foot). If your home improvement expenses are high, such as adding furniture or equipment to your home office, it is ideal to go for depreciation.

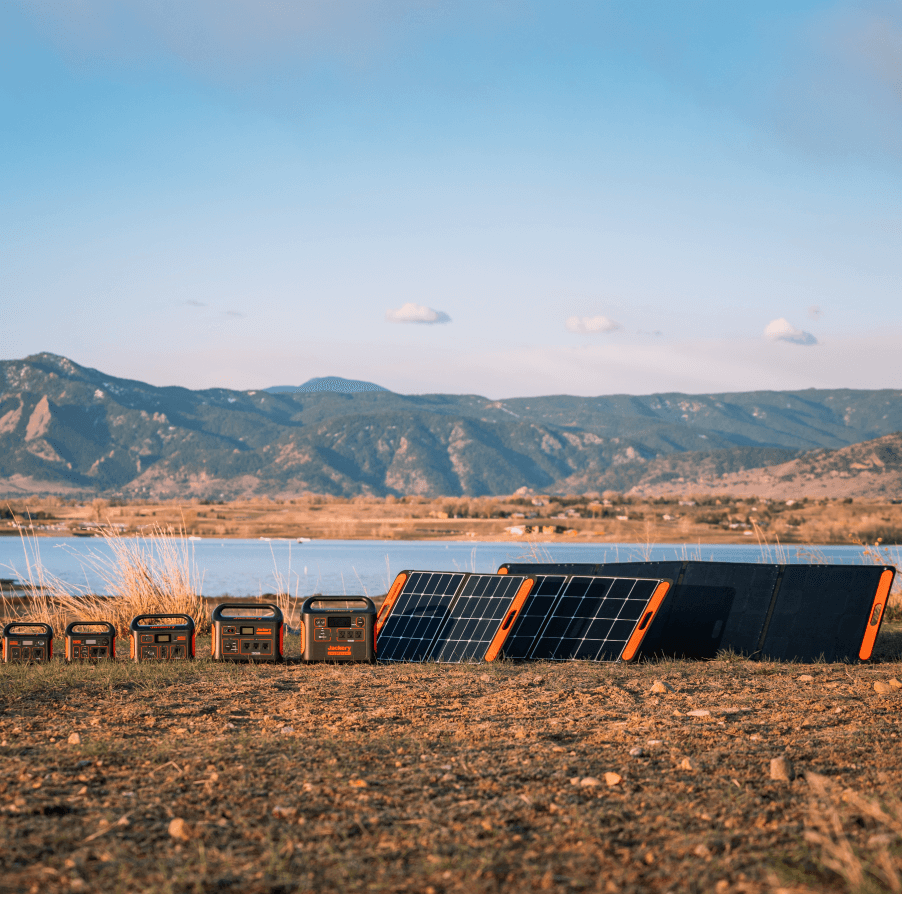

Jackery Solar Generators to Get Rebates

Solar generators are an ideal and eco-friendly choice to ensure an uninterrupted power supply to your home appliances. Your solar home backup generator has several daily uses, not just in emergencies. It can power devices while hosting a party, during an outing, at family reunions, etc.

Jackery is one of the leading manufacturers of cutting-edge solar power products. Its products include solar generators, portable power stations, and solar panels.

Jackery Solar Generator 5000 Plus

Jackery Solar Generator 5000 Plus is an essential home backup that can provide you with a residential clean energy credit of up to $1049.7. The generator has a high capacity, ensuring a consistent power supply to your home appliances. Its portable design ensures easy movement across your home to power devices in different areas.

Appliance Running Time

- Refrigerator (900W) = 4.5H

- AC (2000W) = 2.1H

- Dishwasher (1200W) = 3.4H

- Pressure Washer (2500W) = 1.7H

- Induction Cooktop (1500W) = 2.8H

Customer Review

“Love my Jackery 5000 Plus, it does everything I need it to do without any problems. Hopefully it will continue to operate without any problems,” - Michael Luan.

Jackery Solar Generator 2000 Plus Kit (4kWh)

Jackery Solar Generator 2000 Plus Kit (4kWh) is another ideal addition to your essential home backup that saves energy bills and attracts rebates. Its high capacity can power most home appliances, including AC, refrigerator, space heater, etc. The generator operates at a remarkable 30dB noise level, making it almost noise-free. It can earn you a rebate of up to $1,139.7.

Appliance Running Time

- Refrigerator (900W) = 3.8H

- Toaster (800W) = 4.2H

- Hair Dryer (900W) = 3.8H

- Portable AC (1000W) = 3.4H

- Dishwasher (1200W) = 2.8H

Customer Review

“Awesome product. Have a few of the smaller ones which are very handy. Sweet fit for house and car hauler to power lights and radio. Not as heavy as I thought and wheels with handle a plus” - William Grimes.

FAQs

Is there a tax deduction for home renovations?

Yes, there are tax deductions for home renovations. Suppose the home renovations increase the value of your house, such as adding a new roof, a swimming pool, or any energy efficiency improvement. In that case, you are eligible for a tax deduction.

What improvements can be offset against capital gains tax?

Once you purchase the property, you can make several improvements to offset capital gains tax, such as adding a new swimming pool, HVAC system, deck, energy-efficient roof, and windows and doors.

Is a house repair exempt from income tax?

Most repairs that do not contribute to the house's overall value are exempt from income tax. But you can claim a tax deduction if they increase the value of your house anyway.

Does California allow a home office deduction?

No, California does not allow a home office deduction for W-2 employees, but self-employed individuals are eligible for home office deductions.

What home improvements are tax-deductible, IRS?

According to the IRS, several home improvements, such as medical, home office, capital, and energy efficiency improvements, are tax-deductible.

Conclusion

Any home improvement that contributes to the overall value of your house is tax-deductible. However, if your question is, Are home improvements tax-deductible for self-employed? Yes, they are, but if you are a W-2 employee working for a company from home, you may not be eligible for a tax deduction. If you want add-on benefits by investing in an eco-friendly energy solution, the Jackery Solar Generator is ideal. It can power most of your home appliances while earning you rebates up to $1,500, depending on the model.

![[Add-on] Jackery Manual Transfer Switch for Explorer 5000 Plus](http://www.jackery.com/cdn/shop/files/800x800-2_5b90d3ab-246e-4679-affe-e7c6949f9c27.png?v=1744356904&width=170)

Leave a comment