If you're looking to invest in solar systems, there are two ways: lease or buy solar panels. One big difference between leasing vs. buying solar panels is how much you spend. For example, when you purchase solar panels, you pay a high upfront cost. On the other hand, leasing solar panels means you pay a fixed monthly fee to a third-party company.

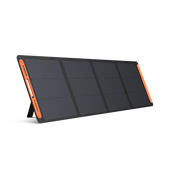

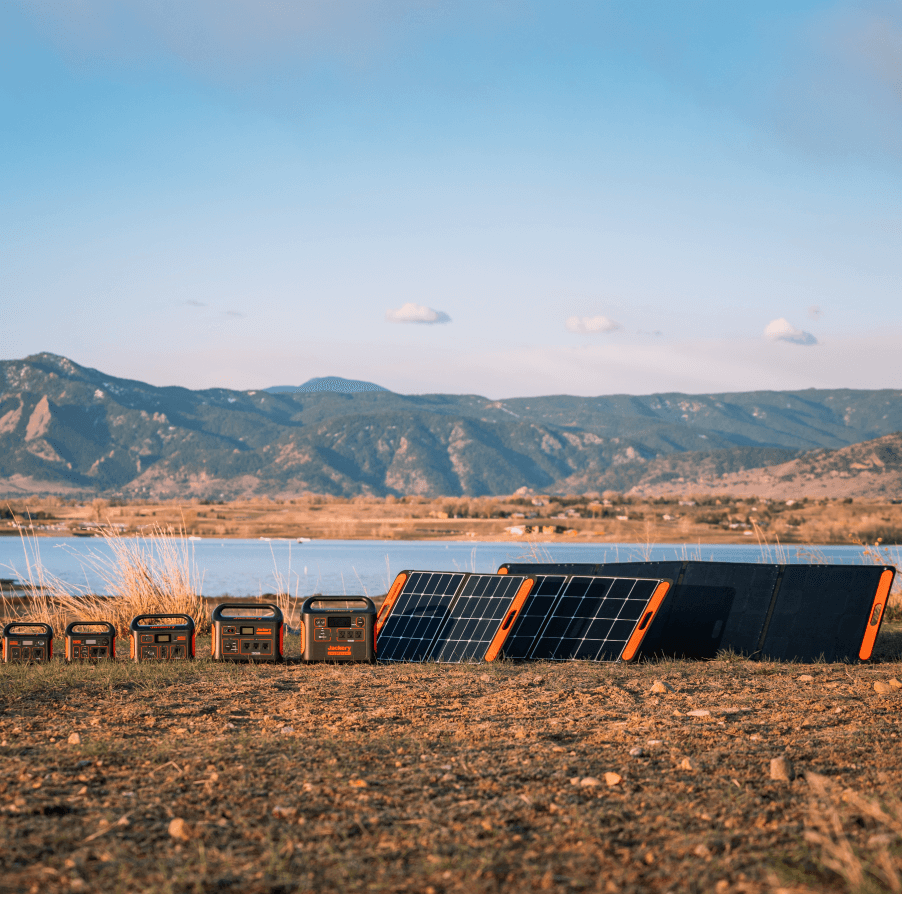

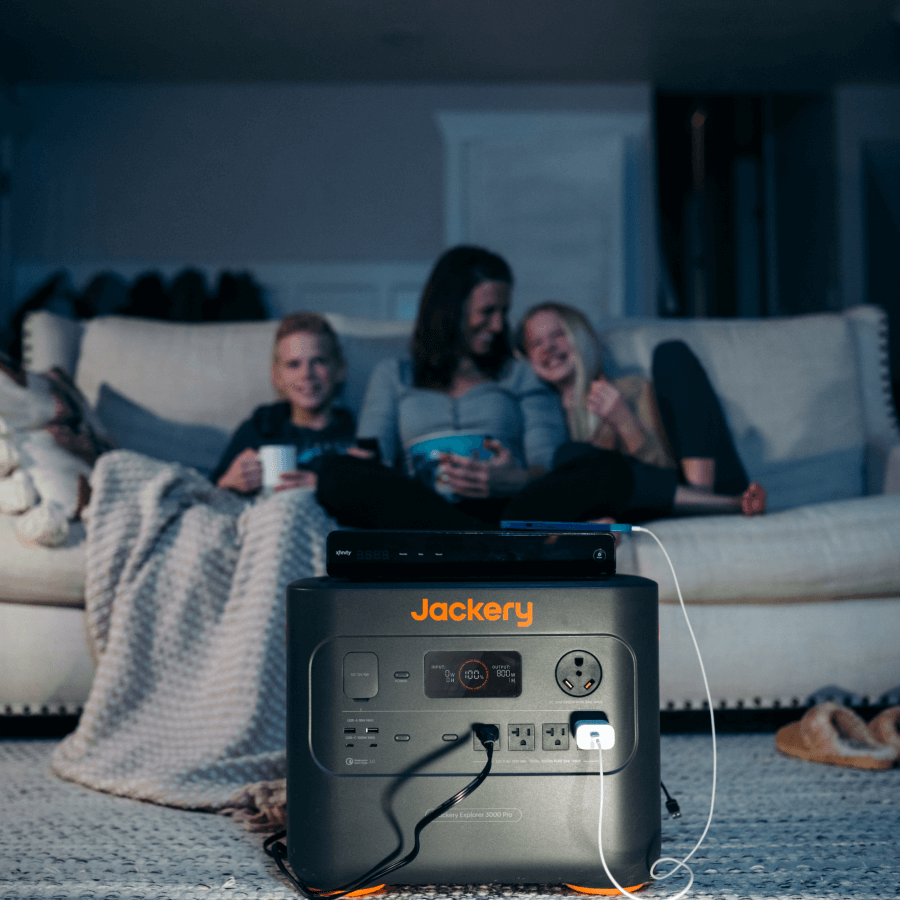

Jackery SolarSaga Solar Panels are foldable and portable, so you don't have to worry about paying extra for installation or high upfront costs. They are also easier to maintain and much more cost-effective than rooftop solar panel systems. Read the guide to learn the key differences between buying and leasing solar panels and what you should choose.

Key Takeaways

- Buying solar panels means you've to pay all the upfront costs of the system, whereas you pay a monthly fee (fixed) to a third party when leasing.

- Purchasing solar panels is a much smarter option if you want long-term savings, a cleaner energy footprint, and a higher home value.

- You'll qualify for solar incentives and tax rebates when buying the panels.

- Purchasing solar panels means you'll own the system, whereas leasing means the company receives all the benefits as they're the owner.

Leasing Vs. Buying Solar Panels

The key difference between leasing and buying solar panels is who owns the entire system. For example, if you buy solar panels with cash or solar loans that might be available in your area, you own the panels.

On the other hand, a solar lease means you don't have to pay any upfront costs. Instead, the solar company installs and owns the solar panels. You can use the electricity produced by the leased solar power panels but are entitled to provide a monthly lease payment.

Here's a table covering how leasing vs. buying solar panel options stack up.

|

|

Leasing |

Buying |

|

Ownership |

No |

Yes |

|

Upfront Cost |

No |

Yes |

|

Long-Term Savings |

No |

Yes |

|

Tax Credits & Incentives |

No (Leasing party is not eligible for tax credits) |

Yes |

|

Property Resale |

No (Does not add value to property) |

Yes |

|

Payments |

Monthly fixed lease |

Upfront payment or solar loan |

|

Maintenance |

No |

Yes |

Leasing Vs. Buying Solar Panels: Ownership

When you buy solar power panels, you become the ultimate solar system owner. You pay the entire system installation cost, and the panels and all other equipment belong to you.

On the other hand, if you lease solar panels, the third party owns the solar system. If you want to start with solar without paying a large amount, you may consider renting the system.

Leasing Vs. Buying Solar Panels: Long-Term Savings

Whether you buy or lease solar panels, you'll surely save money by reducing high electricity bills. However, the long-term savings will depend on whether you lease or buy the system.

For example, if you're purchasing solar panels, you pay off the solar system in around 10-15 years and then have no more monthly payments. As a result, you're entitled to receive considerable long-term savings.

On the other hand, solar leasing means you're locked into a monthly lease payment for up to 20 years, depending on the lease terms. Hence, you end up saving less and paying more on leased solar panels.

Leasing Vs. Buying Solar Panels: Property Resale

If you plan to resell your home anytime after installation, it's essential to understand how leasing and buying solar panels work differently. In simple words, owning solar panels can increase the home value, whereas leasing makes it harder to sell your house.

For example, if you're financing solar panels, you can either pay for the system before selling your house or simply transfer the remaining loan to the new homeowner. Solar panels are designed to increase the home value, so the increased value can help you quickly pay off the remaining loan.

On the other hand, leasing solar panels might not be favorable when selling your property. This is because not all new owners would like to take on a lease agreement. Additionally, leases do not provide the same financial upside to buyers as buying solar panels.

Leasing Vs. Buying Solar Panels: Solar Credits & Incentives

Under the federal tax credit for solar panels scheme, you are entitled to receive up to 30% back on installing the solar panel system between 2022 - 2032. One important thing to note is that the solar incentives, rebates, and tax credits will differ depending on the state you live in.

For example, Florida solar incentives will be different from those offered in Texas, Illinois, California, or Oregon. However, the tax credits are available only if you are buying the solar panel system. On the other hand, if you are only leasing solar panels and do not own them, you don't get benefits from solar credits and incentives.

The table shows a quick breakdown of solar leases and purchases, highlighting the differences in upfront costs and time savings.

|

|

Lease |

Cash Purchase |

Loan |

|

Leads to Panel Ownership |

No |

Yes |

Yes |

|

Good Credit Required |

No |

No |

Yes |

|

Average Initial Cost Before Federal Tax Credit |

$0 |

$13000 - $26000 |

Often $0 |

|

Average Federal Tax Credit Available |

N/A |

Up to 30% of the total cost of solar installation |

Up to 30% of the total cost of solar installation |

|

Average Initial Cost After Federal Tax Credit |

$0 |

$9000 - $18000 |

Often $0 |

Leasing Vs. Buying Solar Panels: Maintenance

Purchasing the solar panels means you're the one responsible for maintaining and monitoring the system. That means if there's an issue in the solar panel system, it is your responsibility to spot the problems and pay for it. But here's the good news: Solar panels are pretty low maintenance.

On the other hand, if you are leasing solar panels, you don't have to worry about the maintenance and upkeep costs. Instead, the solar panel company will be responsible for maintaining the system. They'll cover all the costs as long as the required repairs are covered in the contract.

How Much Does It Cost to Lease or Buy Solar Panels?

The average cost of leasing solar panels might range from $50 to $250 per month. However, the actual amount will depend on the system size, credit score, regional cost of living, and leasing company. Generally, the solar leasing term ranges between 20 - 25 years.

At the end of the solar lease, you can expect to pay anywhere between $10,000 and $75,000. According to SEIA (Solar Energy Industries Association), solar installation costs have typically dropped by over 40% over the last decade, decreasing from $40,000 to $25,000.

The average cost of buying solar panels ranges between $13,000 and $26,000. After the 30% federal solar tax credit, you can expect to pay between $9000 and $18000. Buying solar panels is affordable in the long run, though the initial upfront cost is higher.

Here's a table that reveals the expenses related to purchasing solar panels via cash, solar loan, and lease.

|

|

Cash Purchase |

Loan Purchase |

Lease |

|

No Cash Out of Pocket |

Yes |

No |

No |

|

Receive Tax Credits |

Yes |

No |

No |

|

First Year Savings |

Yes |

Yes |

No |

|

Lifetime Savings |

Yes |

Yes |

No |

|

Add Home Value |

Yes |

Yes |

No |

Ways to Lease Solar Panels

There are two types of solar lease agreements for solar panels: Fixed monthly leases and Power Purchase Agreements (PPA).

- Fixed Monthly Solar Lease

The fixed monthly solar leases are pretty straightforward. In this type of solar lease, the solar company installs the system on your roof. You don't have to pay your utility bills. Instead, you'll make a lower lease payment on the solar system per month.

Let's take an example to understand better:

If the monthly electricity bill is $140, the monthly solar lease payment might be $99 in the first year. This will help you save around $41 per month and nearly $492 in the first year. They will typically last for 20 - 25 years with an annual escalator of 3% per year. If the monthly payment is $99 in the first year, they would be around - $102 per month in the second year and - $105 in the third year.

Here's an example of a 20-year solar lease with a 3% annual escalator:

|

Lease Year |

Monthly Lease Payment |

Annual Cost |

|

1 |

$99 |

$1188 |

|

5 |

$111.43 |

$1337.10 |

|

10 |

$129.17 |

$1550.07 |

|

15 |

$149.75 |

$1796.96 |

|

20 |

$173.60 |

$2083.17 |

While solar leases offer immediate energy savings, the escalator makes them more expensive in the long run.

- Power Purchase Agreement (PPA)

The primary difference between a fixed monthly solar lease and a PPA is that in a PPA, the homeowner only pays for the power generated from the solar panel system rather than a flat monthly rate. The core idea is that homeowners pay a lower rate for solar electricity than grid electricity. A PPA provider might offer 12 cents per kWh, whereas the utility charges might be around 16.6 cents per kWh. Similar to fixed monthly solar leases, PPAs include escalators to increase the payment amount each year.

Ways to Buy Solar Panels

There are two ways to buy the solar panel system — with cash or a loan. Let's explain them briefly below.

- Buying With Cash

Cash is one of the simple ways to buy a solar system, and it opens the door to more energy savings. This helps you avoid the interest payments on the loan. Some solar installation companies also offer discounts for paying in cash to increase overall savings. You'll usually pay in four intervals, and the exact payment amount will vary depending on the installer. Here's what the four payments might look like:

- Deposit or down payment:$1000 - $1200 after the site visit.

- Design approval: $1800 - $2000 after the approval of final system design.

- Materials deposit:60% of the remaining balance will be used to purchase the installation.

- Building inspection: The remaining amount is due after the solar panel installation passes the city building inspection.

After you've paid for the solar system, you can claim 30% of the federal solar tax credit. If you are investing in portable solar panels, you can save more by eliminating the cost of design approval, material deposit, and building inspection.

- Buying With Solar Loans

If you don't have full upfront money, homeowners can use loans to purchase solar panels. Solar loans will help you reduce the upfront cash and receive long-term energy savings. However, there are a few qualifications you might keep in mind while applying for solar loans:

- The borrower should be the homeowner getting the solar panels.

- The home where you're installing the solar panels should be your primary residence.

- Your minimum credit score should be 650, though it might vary depending on the company offering solar loans.

- The debt-to-income ratio should not exceed 50%.

Solar loans involve zero-down payment options and 20-year-long terms, making them quite flexible.

The Pros & Cons of Leasing Vs. Buying Solar Panels

Homeowners planning to invest in solar panels have multiple buying options, including a solar loan, purchase with cash, or leasing solar panels. If you have available funds, a single cash purchase is a viable option. On the other hand, if you want to go solar without a high upfront cost, you may consider a solar lease. Here, we will highlight the key pros and cons of buying vs. leasing solar panels:

Leasing Solar Panels

Instead of buying and owning the solar power panels, you are allowing a third party to install panels with little or no upfront cost. Then, you pay a monthly rent or lease amount for those panels. It might be a good alternative for those who cannot purchase the system in cash or secure a low-interest solar loan. While you can expect modest energy bill savings with solar panel leasing, there are higher savings if you buy the solar system directly. Here are the pros and cons of solar panels that are leased:

Pros

- There is little to no upfront cost associated with leasing the solar panels.

- The solar company maintains the panels.

- You can lower the monthly electricity bills.

- If the monthly cost of panels is less than your energy savings, you can also expect some net savings.

Cons

- There is no boost in the property value.

- It can become a logistical headache when selling a home.

- Your lease portion may consume a lot of your electric bill savings.

- Most solar providers do not allow you to end the lease early without paying a hefty fee or complete amount.

Buying Solar Panels

Although there is an upfront cost linked with buying solar panels, the panels eventually pay for themselves — typically less than 10 - 15 years. After that, you can continue to get energy savings. When you pay for solar panels, you don't have to worry about paying a monthly lease to the solar company. Instead, you can enjoy the monthly savings. Here are the pros and cons of buying solar panels:

Pros

- You're entitled to claim federal and state tax credits to reduce the overall installation costs.

- You get long-term savings over the life of panels.

- You're also eligible for net metering, which allows you to return excess energy to the electricity grid and save more money.

- Buying solar panels will help you get stable monthly payments.

- Solar panels eventually pay for themselves over time.

Cons

- There's a higher upfront cost associated with buying solar panels.

- You are responsible for maintaining the panels.

How Do You Decide to Lease or Buy Solar Panels

If you own the house and are financially stable, buying solar panels is probably the right option. On the other hand, leasing solar panels seems an attractive option as it can drastically reduce the upfront money needed. If you're still unsure, here's what to consider when deciding between leasing and buying solar panels.

Budget: The first thing to do is consider the kind of payment you can afford upfront for the installation costs. If you have enough money to cover the entire cost of the solar system, then you may consider a cash purchase.

Solar Incentives: Some states provide incentives and tax rebates to homeowners who are going solar. If your state offers federal tax credit, you can check the rebate programs and see how much you can save after solar panel installation.

Priorities: Finally, you'll need to check your priorities. For example, buying solar panels would be a better choice if you care more about long-term savings. On the other hand, if you want an easy way to reduce your carbon footprint, solar panel leasing would be a good option.

Who Should Lease Solar Panels?

Solar panel leases might be a good option for people who cannot afford an upfront purchase or cannot qualify for a solar loan. They are also a decent option for customers who want to contribute to the renewable energy movement and do not care much about savings.

When to Lease Solar Panels?

You should only consider leasing solar panels when you're ineligible for a solar loan or have insufficient funds. Leasing solar panels drastically reduces the long-term value.

Who Should Buy Solar Panels?

Everyone with cash should consider buying solar panels rather than leasing or renting. You can purchase solar panels with cash or a solar loan and get ownership. Most importantly, purchasing solar panels involves financial savings and improved property value. With so many solar incentives and tax rebates, purchasing panels has become more affordable than ever.

When to Buy Solar Panels?

If purchasing solar panels won't put you under financial stress, buying panels instead of leasing will offer larger monthly savings. You'll also have access to net metering, where you can send the excess energy generated by panels back to the grid and earn money. If you can afford a down payment, it might not take longer to pay off, and you can take full advantage of the utility bill savings.

Which Option Is Better: Leasing or Buying Solar Panels

When solar technology came into the market, leasing was the primary way to go. But today, buying solar panels offers more benefits and energy savings than leasing. This is because the average home solar system has dropped from $40,000 to $20,000. The fast-falling cost of solar panel systems and the 30% federal solar tax credit help you earn more potential energy savings, much more significant than a solar lease.

Here's a graph showing the cumulative cost of investing in solar through three financing methods:

- Purchasing the solar panels with cash and claiming up to 30% federal solar tax credit.

- Anyone can consider a 12-year solar loan with zero down, re-amortized with up to 30% federal solar tax credit in the second year.

- You can get a 25-year fixed monthly solar lease with a 3% escalator.

In this graph, the dotted line represents the cost of paying the national average price for utility grid electricity through the utility company.

It's worth noting that going solar is far more affordable than sticking with the utility for 25 years. While purchasing costs more upfront, it can lead to significant savings than leasing. You will have the greatest lifetime savings if you choose cash purchase over other options.

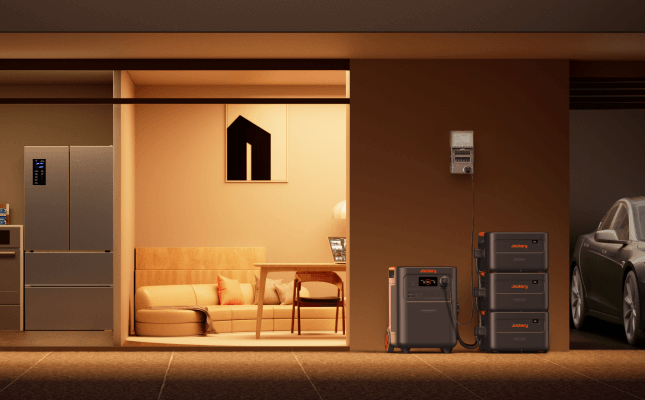

Jackery Solar Panels Explained

Jackery is the global leader in manufacturing solar panels, solar generators, and portable power stations. The Jackery SolarSaga Solar Panels are built with monocrystalline silicon solar cells and work by absorbing sunlight and converting it into DC electricity. Then, the Jackery Portable Power Stations have a built-in pure sine wave inverter to convert the DC to AC electricity. You can simply plug the appliances into the Jackery Portable Power Stations to charge outdoor or indoor appliances. They are compact and robust, so anyone can carry the solar generators anywhere.

Jackery SolarSaga 200W Solar Panels

The Jackery SolarSaga 200W Solar Panels are built with monocrystalline silicon solar cells and are IP68 waterproof rated. The ETFE-laminated case makes the solar panels last long, making them the perfect power source for outdoor travel and home backup. They are foldable and portable and can be hooked up to the Jackery Portable Power Stations, making them an ideal solar power system.

Customer Review

"These are very efficient panels. I tested them out with my 2000 Pro and 1000 Pro, and I was getting around 362 watts ( probably more if I positioned them perfectly) with my two panels. I will be purchasing two extension cables so I can charge my batteries safely in the shade." — Christian V.

Jackery SolarSaga 100W Solar Panels

The Jackery SolarSaga 100W Solar Panels have a solar conversion efficiency of around 24.3% and are IP65 waterproof rated. The adjustable kickstands help you place the solar panels anywhere and connect them with the Jackery Portable Power Stations. The panel also has two USB output ports to directly charge two small appliances, such as mobile phones. The solar panels do not require installation or heavy maintenance to make them cost-effective.

Customer Review

"This portable solar panel is easy to use and has great performance when charging our Jackery power generator." — Michael P.

Leasing Vs. Buying Solar Panels FAQs

What is the downside of leasing solar panels?

If you lease solar panels, your lease payments will consume a large portion of your monthly savings. This means long-term savings are much lower than solar loans or cash purchases. Additionally, the lease company owns the solar panels, meaning only they are entitled to take advantage of tax incentives and solar rebates.

Is leasing solar panels tax deductible?

If you lease solar panels, you're not eligible to claim any tax credit. This is because the 30% federal solar tax credit will go to the leasing company that owns the solar panels instead of the person leasing them.

How long does it take solar panels to pay for themselves?

Solar power panels eventually pay for themselves in the US for 10 - 15 years. You can also earn money from the ongoing solar incentives programs and save on electricity bills.

What happens to solar panels after lease?

When a solar lease ends, the solar company that owns the panels is responsible for removing them and decommissioning the equipment and materials without damaging the roof. This includes the panels, racking materials, wiring, inverters, and fencing. The solar company must restore the property to its original condition before the lease.

Is a 25-year solar lease worth it?

A solar power system financed through a solar loan or cash will help you save around $30,000 – $35,000 on electricity over 25 years. On the other hand, if you're leasing the solar panels, you'll only save nearly $10,000 – $12,000 over the same period.

Conclusion

Installing a solar power system with a zero-down payment approach, such as a solar lease, can seem very tempting. However, it's worth noting that you won't save as much money as you would when buying solar panels. If you are still confused between leasing vs. buying solar panels, consider investing in portable solar panels with a battery backup.

Jackery offers reliable Jackery Portable Power Stations and Jackery SolarSaga Solar Panels, which are powerful and portable by nature. Instead of installing solar power panels on the roof, you can invest in these portable battery backups to reduce overall costs and increase the chances of savings. You can also carry these solar generators to outdoor locations to charge appliances anywhere.

![[Add - on] Jackery Manual Transfer Switch for Explorer 5000 Plus - Jackery](http://www.jackery.com/cdn/shop/files/add-on-jackery-manual-transfer-switch-for-explorer-5000-plus-9017324.png?v=1754016782&width=170)

Leave a comment