The Residential Clean Energy Credit makes switching to solar power more affordable by offering a 30% tax credit on eligible solar products and their respective installation fees. Jackery offers a range of solar generators that qualify for the Residential Clean Energy Credit. With the Residential Clean Energy Credit, you can reduce your federal income tax by a percentage (currently 30%) of the cost of installing eligible solar equipment, making it a practical option for home backup, off-grid power, and emergency preparedness. This guide explains which Jackery products qualify for the Residential Clean Energy Credit, how much you can save, and the steps to apply.

What is the Residential Clean Energy Credit

The Residential Clean Energy Credit is equal to 30% of the costs of new and qualified clean energy property for your home installed between 2022 and 2032. The credit percentage rate will reduce to 26% in 2033 and 22% in 2034. However, according to the IRS, no credit will be available for property placed in service after December 31, 2034.

Note: The solar tax credit is not a cash rebate. It reduces the amount of income tax you owe to the federal government.

Does the Installation Fee Qualify for a Solar Tax Credit?

Yes, you may get up to 30% of tax credit on the installation fee of the solar generator setup (if the bundle includes the Smart Transfer Switch), depending on the price of the model. For example, if you buy the Jackery Solar Generator 5000 Plus along with a Smart Transfer Switch, you may qualify for a 30% federal tax credit under the Solar Investment Tax Credit (ITC) on the solar product as well as the installation fees of the STS.

However, if you purchase the Smart Transfer Switch separately from the bundle, the installation will not qualify for the solar tax credit. Hence, if you are purchasing the Jackery product bundle, make sure to include the Smart Transfer Switch in the bundle to avail tax credit on the installation service.

Which Jackery Products Qualify for the Residential Clean Energy Credit

Some Jackery products are eligible for the Residential Clean Energy Credit. However, the exact amount of tax credits you can receive will depend on the product you buy.

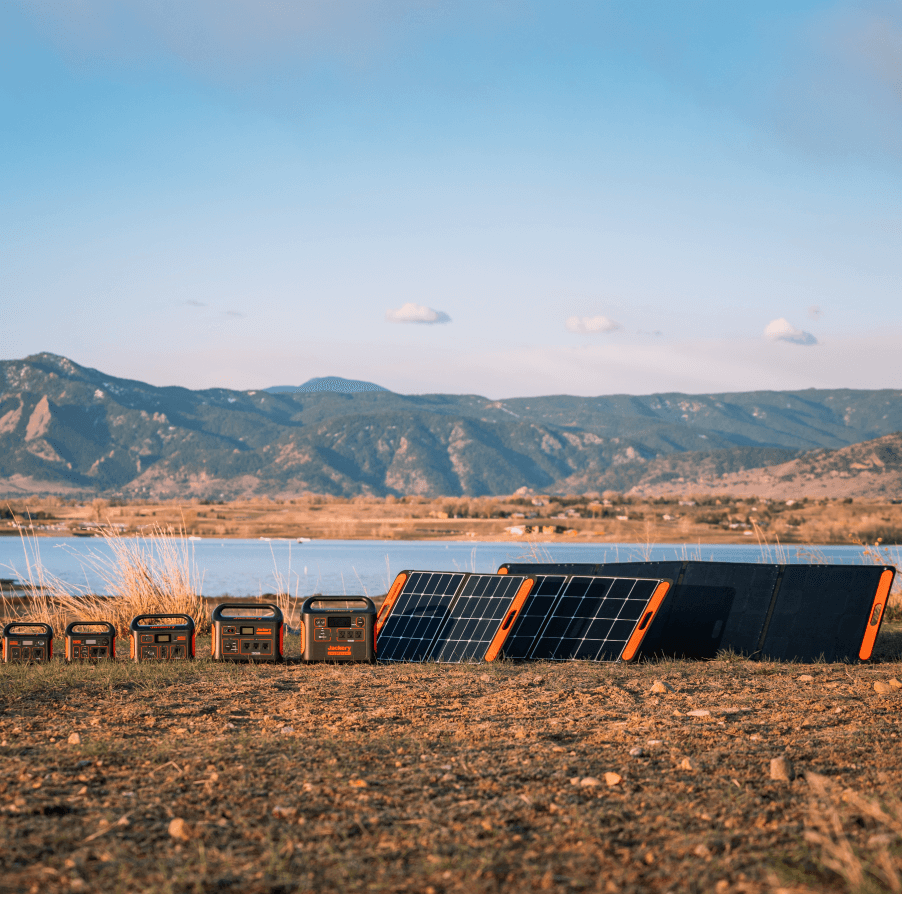

Jackery Solar Generators

Jackery Solar Generators combine Jackery Portable Power Stations and compatible Jackery SolarSaga Solar Panels that work together to power appliances using the sun's free energy. They can be used to power appliances during off-grid living, power outages, and outdoor adventures.

Here are some of the Jackery Solar Generators, along with how much you can save:

Jackery Solar Generator 2000 Plus Kit (4kWh)

Jackery Solar Generator 2000 Plus Kit (4kWh) can power most household appliances during outages and can also reduce high electricity bills. Whether you want to power a full-size refrigerator to keep food fresh during outages or high-power-consuming appliances like AC to lower the utility bill, the solar-powered generator has your back. While the standard price of the bundle is around $4,399, those who are eligible for the Residential Clean Energy Credit can save up to $1,139.70 in tax credits, i.e., 30%. However, if you are purchasing the solar generator during the promotions when the price is lower than the standard cost, the amount of tax credit you can claim may differ.

Note: The product prices mentioned may change. Kindly refer to the official product pages to learn about the recent costs.

Jackery Solar Generator 2000 Plus Kit (6kWh)

The Jackery Solar Generator 2000 Plus Kit (6kWh) is another solar-powered generator that can help you reduce high electricity bills. It is also ideal for off-grid living and can power appliances during extended blackouts. It can operate at 30dB of noise, which means you can enjoy a peaceful environment while working, sleeping, or simply relaxing. The standard bundle is priced at $6,599, and you may be eligible for up to $1,589.70 (up to 30%) as tax credits. However, as mentioned above, the tax credit amount can differ when you purchase the Jackery product at a lower price during promotions.

Jackery Solar Generator 3000 Pro

The Jackery Solar Generator 3000 Pro is a reliable home battery backup system that can power most indoor or outdoor appliances for long hours. It features a foldable handle, pull rod, and double wheels for easy transportation to different locations during an outage. While the solar generator bundle costs $3,999, you can get up to $839.70 in rebates, which will help you reduce the overall cost of the solar generator to $3,159.30.

Jackery Solar Generator HomePower 3000

The Jackery Solar Generator HomePower 3000 is the lightest and smallest 3kWh LFP essential home backup power solution. The large battery capacity ensures essential appliances such as fridges, fans, WiFi routers, lights, coffee machines, etc., remain powered. It is 47% smaller and 43% lighter than other mainstream products of a similar capacity, ensuring power doesn't limit portability. The early bird offer lets you purchase the new Jackery Solar Generator HomePower 3000 at just $1,999. You can receive a tax credit of up to $749 to reduce your federal income tax, though it may vary depending on the amount you paid while purchasing the product.

Jackery Solar Generator 5000 Plus

The Jackery Solar Generator 5000 Plus is one of the most trusted solar generators for homes. It can power almost all household appliances during extended power outages or off-grid living. It has 12 output ports to power multiple appliances, such as fridges, computers, home servers, routers, etc. With a standard price of $4,999, eligible customers can receive a tax credit of approximately $1,049.70, reducing the net cost to $3,949.30. But if you pay less than the standard price during the purchase, the tax credit amount may differ, as it is 30% of the total amount paid.

Kindly note that only the products mentioned above are eligible for the Residential Clean Energy Credit, and the exact amount you receive will be directly influenced by the purchase amount. It is best to refer to the Residential Clean Energy Credit page to learn what Jackery products qualify for tax credits.

Rules of the Residential Clean Energy Credit

If you invest in renewable energy for your home, such as wind, solar, geothermal, or battery storage technology, you may qualify for an annual Residential Clean Energy Credit. Here is who can qualify for Residential Clean Energy Credit:

- According to the IRS, you may claim the Residential Clean Energy Credit for improvements to your home where you live most of the time, regardless of whether you own or rent it.

- The credit will apply to both new and existing homes located in the US.

- You may also be able to claim the Residential Clean Energy Credit for improvements made to a second home located in the US. The second home will refer to the place where you live part-time and do not rent to others.

However, if you are a landlord or other property owner who does not live in the home, you cannot claim the Residential Clean Energy Credit. In addition, if you use the property only for business purposes, you cannot claim the credit.

Note: Always refer to the IRS Residential Clean Energy Credit page to check the latest guidelines as they are subject to change.

How Much Can You Save With Residential Clean Energy Credit

The Residential Clean Energy Credit helps you save up to 30% of the costs of new, qualified clean energy products installed at home between 2022 and 2032. Multiple Jackery products are eligible for Residential Clean Energy Credit programs. However, you should verify eligibility and requirements before applying.

Note: The savings and the cost mentioned in the table are just for reference, and may vary depending on the total amount you pay. Also, refer to the product page to check the latest costs and tax credits. This is because the Residential Clean Energy Credit rebates will vary depending on the cost of the solar generator or power station you are investing in.

You may also be eligible for solar incentives and tax credits in different states, such as Texas, Florida, Oregon, and California, which will further reduce the overall cost.

How to Apply for the Residential Clean Energy Credit When Buying Jackery Products

Now that you know the Residential Clean Energy Credit allows you to save 30% of the money you spend on qualified products, it's essential to understand how to apply it. Here is the step-by-step process to claim a Residential Clean Energy Credit on Jackery products.

Step 1: Buy a Qualifying Jackery Product

In order to be eligible for the tax credit, you need to buy a qualified solar generator from Jackery. You should check the available Residential Clean Energy Credit from Jackery to confirm your eligibility before making a purchase decision.

Step 2: Keep All Receipts and Documentation For Your Purchase

The IRS strongly recommends retaining all purchase receipts and installation records (if any). If you buy online, you should keep a digital copy of the order confirmation. These documents and receipts are essential to prove the purchase amount when filing the tax return.

Step 3: File IRS Form 5695 When Filing Your Tax Return

When you file your tax return for the year, you will need to file IRS Form 5695, which lets you calculate the tax credits based on the qualifying solar product.

Step 4: Claim the 30% Credit on Your Tax Return to Reduce Your Tax Bill

Once you've filled out IRS Form 5695, transfer the credit amount to your 1040 tax return. The 30% credit directly reduces your tax liability, meaning if you owe taxes, this amount will be subtracted from what you need to pay.

Step 5: Consult a Tax Professional If Needed for Additional State Rebates

Some states offer additional solar incentives, such as solar rebates or property tax exemptions, which can further reduce the overall cost of solar generators. A tax professional can help you identify extra savings opportunities and ensure proper documentation.

Disclaimer: The information provided in this blog is for educational purposes only. For the latest updates, please refer to the official IRS website or consult a qualified advisor.

FAQs for Residential Clean Energy Credit

Can I claim the tax credit if I only buy a Jackery power station?

Yes, if you purchase the qualified Jackery product, you may be eligible to claim a 30% tax credit. However, the amount of Residential Clean Energy Credit you can claim will depend on the model.

Does the tax credit apply to used or refurbished Jackery products?

No, the Residential Clean Energy Credit cannot be claimed on buying a used or refurbished Jackery product. You will need to purchase a new, qualified Jackery product to claim the tax credit.

Does Jackery qualify for the 2025 Residential Clean Energy Credit?

Yes, the Residential Clean Energy Credit can be claimed on a qualified Jackery product between January 1, 2023, and December 31, 2032.

How many times can I claim the Residential Clean Energy Credit?

You can claim the annual Residential Clean Energy Credit every year that you install eligible solar products until the credit begins to phase out in 2033. However, eligibility may vary depending on multiple factors, such as the type of product you purchased and its costs.

Conclusion

Jackery products provide reliable and sustainable power solutions for appliances, and the Residential Clean Energy Credit helps make them more affordable. When you purchase a qualifying Jackery product, you can claim a 30% tax credit, reducing your overall cost. The process is straightforward, and all you need to do is buy an eligible Jackery product, keep your receipts, and file IRS Form 5695 with your tax return. It allows you to lower your expenses while investing in renewable energy.

![[Add - on] Jackery Manual Transfer Switch for Explorer 5000 Plus - Jackery](http://www.jackery.com/cdn/shop/files/add-on-jackery-manual-transfer-switch-for-explorer-5000-plus-9017324.png?v=1754016782&width=170)

Leave a comment