Can you claim home improvements on your taxes? This is a common question when someone makes improvements to their house. The answer is yes, you can claim home improvements on your taxes. Home improvements using renewable energy can earn you a tax credit of up to 30% of the new, qualified clean energy property costs. You can claim such home improvement by using Form 5695.

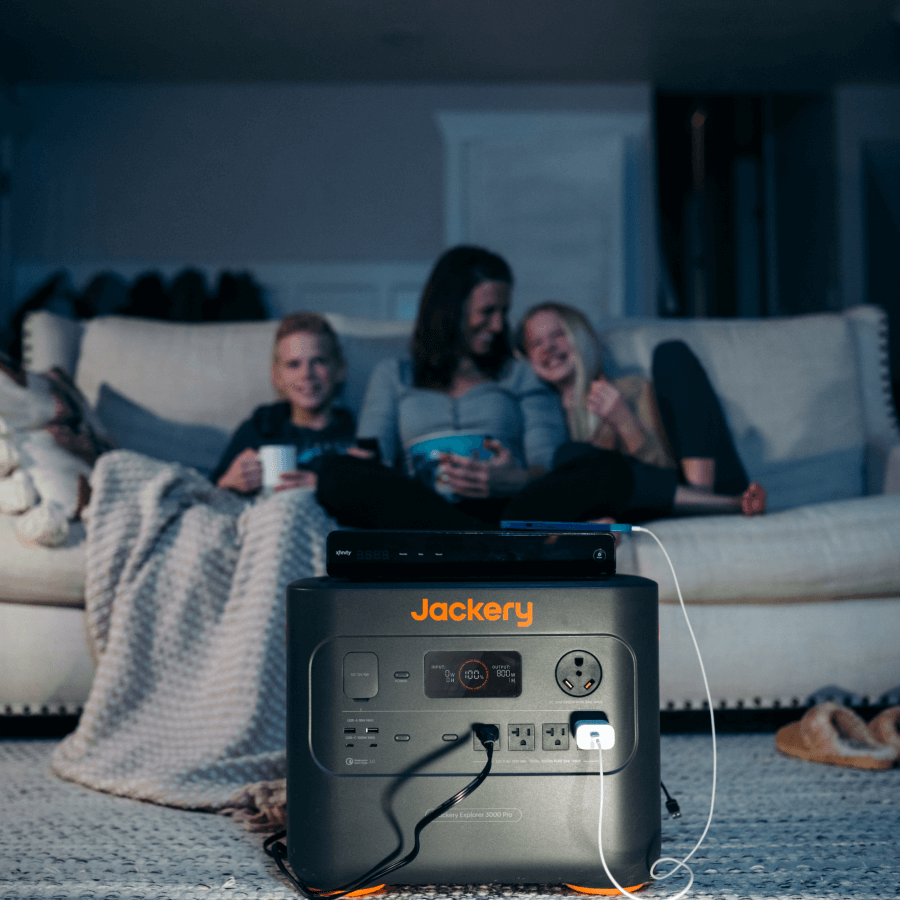

Home improvements can earn you a tax credit while reducing your power bill. If you invest in a solar generator for your home, you can earn extra benefits through rebates. You can invest in a Jackery Solar Generator to power your home appliances and earn rebates up to $1,500, based on the model of the generator. Read ahead to learn what home improvements can reduce your tax bill.

Key Takeaways

- Making energy-efficient home improvements, clean energy improvements, and capital improvements can reduce your tax bill.

- Homeowners and renters can claim a tax credit if they live in their principal residence in the United States and have paid for the energy property.

- You can avail yourself of a residential clean energy credit of up to 30% of the cost of the clean energy property added to your home.

- Jackery Solar Generator is an essential home backup that can power your home appliances to save energy bills and provide a rebate of up to $1,500, depending on the generator's model.

Home Improvements That Can Reduce Your Tax Bill

Reducing your tax bill by making home improvements is applicable when the improvements contribute to the value of your house or extend its life. Several home improvements can reduce your tax bill via credit or tax deduction.

Energy Efficient Home Improvement Credit

You can earn a maximum energy-efficient home improvement tax credit of up to $3,200 or 30% of the yearly qualified expenses. These qualified expenses include

- Home Energy Audits of up to $150.

- Residential Energy Property of $600 per item

- Qualified Energy Efficiency Improvements of up to $2000 per year.

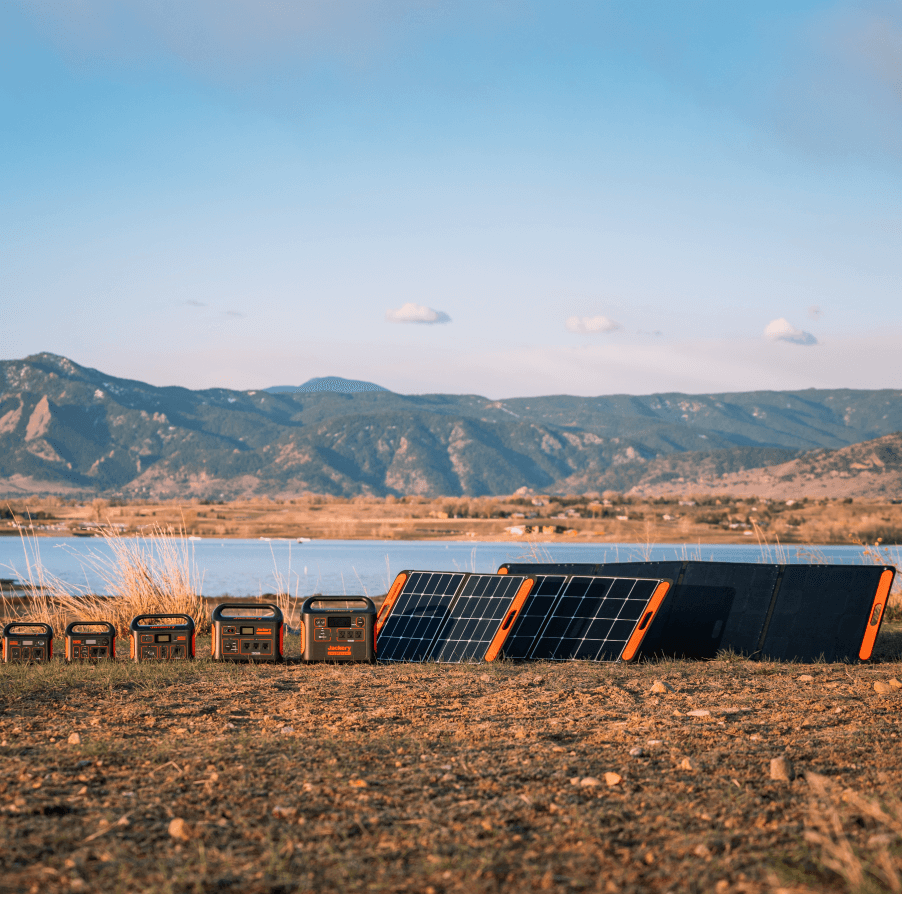

Clean Energy Improvements

You qualify for a residential clean energy credit if you invest in renewable energy for your home. These investments include solar electric panels, solar water heaters, wind turbines, geothermal heat pumps, fuel cells, etc. The credit limit here is 30% of the costs of a new, qualified clean energy property installed at your home between 2023 and 2032. For fuel cells, the limit is $500 for each half kW.

Capital Improvements

Besides tax credit, you can also decrease your tax liability by making capital improvements to your house. These deductions are not immediately available, but when you sell your home in the future, you can deduct these from your sale price. This reduces your capital gains and thus your tax bill. Some capital investments eligible for a tax deduction are installing a new swimming pool, roof, an air conditioning system, etc.

Who Can Claim Taxes on Home Improvements

Certain conditions apply to who can claim taxes on home improvements. Homeowners and renters who live in the home or use a part of it for business purposes can claim tax deductions.

Homeowners

Homeowners who live primarily in the United States can claim a residential clean energy credit and an energy-efficient home improvement credit. The residential clean energy credit applies to new and existing homes, whereas the energy-efficient home improvement credit applies only to existing homes.

If you use a part of your house solely for business purposes (self-employed or freelancer), you are eligible for a clean energy credit under these conditions.

- Business use up to 20%: Full credit.

- Business use more than 20%: Credit based on the share of expenses allocable to non-business use.

Note: Self-employed people can also claim tax deductions by showcasing their home office expenses in Form 8829.

Renters

If you are a renter living in a United States property that belongs to someone else, you are eligible for a tax credit. If the landlord does not live in the property, though they own it, they cannot claim tax credit, whether it is the residential clean energy or energy-efficient home improvement credit. If a homeowner has a second home in the United States that they don’t rent out but live in part-time, they may claim the tax credit.

Claiming Energy Tax Credits for Solar Systems

If you install solar energy systems at your home, you are eligible for a tax credit worth 30% of the cost of a new, qualified clean energy property. The eligible properties or products are solar water heaters and solar panels. Some conditions for claiming an energy tax credit for solar systems are as follows:

- Roof trusses and traditional shingles should not support solar panels, but a roof made from solar shingles qualifies for a tax credit. Solar shingles are one of the best alternatives to solar panels.

- The solar water heaters must be certified by the Solar Rating Certification Corporation (SRCC).

- Existing, newly constructed, primary, and second homes qualify.

- Rentals do not qualify.

- The home must be in the United States and used by the resident.

Home Improvement Deduction Vs Clean Energy Credit

When seeking answers to whether you can claim home improvements on your taxes, you must understand the difference between a home improvement deduction and a clean energy credit.

Home Improvement Deduction: Depending on your home improvements, these deductions are made from your overall taxable income. For example, if you added a new roof for $50,000, you can deduct $50,000 from the profit value or capital gains to reduce the overall taxes owed when you sell the house at a profit.

Clean Energy Credit: Clean energy credits are tax credits that you can earn by investing in renewable energy for your home. Unlike tax deductions that reduce your taxable income, these credits directly reduce your tax bill. Tax credits are better than tax deductions.

How Solar Systems Lower Your Taxable Income?

According to the IRS, if you invest in renewable energy for your home, you are eligible for a tax credit of up to 30% of the cost. For example, investing $15,000 into a solar system makes you eligible for a $4,500 tax credit.

This credit amount will be directly deducted from your overall tax bill. In the case of tax deduction, the amount is deducted from the tax liability before calculating the final tax bill.

What Happens if Your Tax Liability is Lower Than the Credit?

If the tax credit exceeds the tax liability, the balance amount can be rolled over to cover future years' tax liability. This is possible only in the residential clean energy credit; the energy-efficient home improvement credit cannot be rolled over.

How Much Credit Can be Rolled Over?

There is no specific limit on the credit that can be rolled over. As long as your credit balance stands, you can roll it over for future years.

Jackery Solar Generators to Save on Taxes

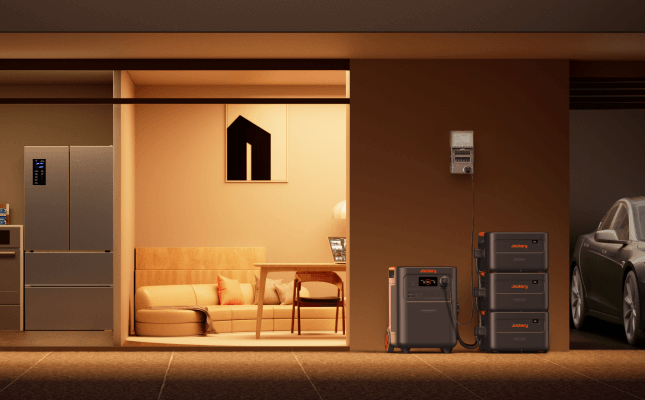

Making solar additions to your house can be cost-effective in terms of power usage. You can use a solar generator with solar panels to provide an uninterrupted power supply to your home appliances, such as the AC, refrigerator, dishwasher, space heater, etc. This will not just save energy bills but also save you taxes.

Jackery manufactures reliable, portable, noiseless, and environmentally friendly solar power products. Its solar generators, foldable solar panels, and portable power stations are ideal for use in case of an outage, on a trip, for a house party, etc. All you have to do is plug your devices in, and you are good to go.

Jackery Solar Generator 5000 Plus

Jackery Solar Generator 5000 Plus is an essential home backup that can earn you handsome tax rebates. The generator can power most home appliances while operating at a 30dB noise level. It has roller wheels and a handle that makes it easy to move around. The tax rebate on the generator can be up to $1049.7.

Appliance Running Time

- Washing Machine (2000W) = 2.1H

- Water Heater (2000W) = 2.1H

- Refrigerator (900W) = 4.5H

- Electric Kettle (900W) = 4.5H

- Pressure Washer (2500W) = 1.7H

Customer Review

“This product is awesome, purchased after the northern Michigan 2025 ice storm and has helped so much in times of need.” - A.H.

Jackery Solar Generator 2000 Plus Kit (4kWh)

If you want to earn higher solar rebates, the Jackery Solar Generator 2000 Plus Kit (4kWh) is the ideal product. Using this generator, you can earn a residential clean energy credit rebate of up to $1,139.7. It is also a reliable option that easily suffices your house’s power needs. The sleek and portable solar generator powers many appliances without harmful emissions.

Appliance Running Time

- Toaster (800W) = 4.2H

- Circular Saw (1200W) = 2.8H

- Bench Grinder (1000W) = 3.4H

- Vacuum Cleaner (1200W) = 2.8H

- Electric Chainsaw (1500W) = 2.3H

Customer Review

“I previously had purchased a 2000 Pro & the new 2000 Plus with its battery packs for expansion is excellent! With the Jackery solar panels (Saga 200), I am able to lower my utility bill & we are ready for hurricane season with possible loss of power.” - Billy Ray.

Common Tax Mistakes When Claiming Solar Credits

You might run into avoidable errors while claiming solar tax credits. Check for these mistakes:

- Not considering the local and state tax rebates and incentives. If you are getting local and state tax incentives, you must subtract these from the solar system's overall cost before adding them to the tax return.

- Applying for credit for a leased solar system. The owner of the system gets the credit.

- Forgetting the rollover rules. If your tax liability exceeds the tax credit, the balance is rolled over for future years.

FAQs

Can I get tax benefits on home renovation?

Yes, as long as your home renovation increases the value or life of your house, you can get tax benefits. You can file a tax deduction after making a valuable upgrade to your home, such as adding a new roof.

How to claim house maintenance in income tax?

Ideally, you cannot claim maintenance as a deduction, but if you are using a part of your home for business purposes, you can claim maintenance as a deduction using Form 8829.

What home improvements are tax-deductible according to the IRS?

Several home improvements, such as capital, medical, energy-efficient, and home office improvements, are tax-deductible.

Can I claim the solar tax credit on a portable generator?

Yes, you can claim a solar tax credit of up to 30% on the cost of an eligible portable solar generator. You need to check eligibility and requirements in the Instructions for Form 5695.

Do I need professional installation to qualify for the solar tax credit?

To qualify for a solar tax credit, it is best to have a professional installation, as these installation costs are covered under the qualified expenses of the clean energy property.

Conclusion

So, can you claim home improvements on your taxes? Well, yes, you can claim home improvements on your taxes if they contribute to your home's overall value or age. The residential clean energy credit is available for any renewable energy source in your home. If you invest in a solar generator, you can also earn handsome rebates. Getting an essential home backup like a Jackery Solar Generator can earn you rebates up to $1,500, depending on the model of the generator.

![[Add - on] Jackery Manual Transfer Switch for Explorer 5000 Plus - Jackery](http://www.jackery.com/cdn/shop/files/add-on-jackery-manual-transfer-switch-for-explorer-5000-plus-9017324.png?v=1754016782&width=170)

Leave a comment